Getting enough state pension?

Dominic Thomas

Dec 2022 • 12 min read

Are you getting enough state pension?

This item is relevant to women aged at least 69 and men 71 or older.

The State Pension is regularly in the news, yet it is widely misunderstood. It has not helped that Government policy over the decades has altered it considerably as society has changed, both in terms of equality and longevity. As a result there are layers to the State Pension, not everyone gets the same amount.

In recent years it came to light that some pensioners had not been receiving what they were due. According to the DWP this dates back at least as far as 1985. Initially in March last year the DWP estimated that about 134,000 pensioners had been underpaid, but by July this year the figure rose to 237,000 with underpayments worth about £1.4bn.

The main challenge is accurately assessing all the data and making recompense and in practice the DWP have flagged a possible 400,000 cases that require a review. To complete the review process alone along the original timescales is by the end pf 2024 (which will be too late for many) means reviewing 19,000 cases a month, at the last count only 4,000 cases were being reviewed each month. The DWP is hoping that increasing staff from 500 to 1500 and better automated systems will help them get on track… errm, good luck with that. Let’s remember that the problem is one of poor data in the first place with errors going unspotted for many years, there is already concern that even the solutions will contain errors.

At the time of writing around £200m has been paid of the estimated £1.46bn and many suggest the process may well take 5 years to complete.

According to the DWP, those impacted are people that claimed their pension before April 2016 and do not have a full National Insurance record, largely impacting married (or widowed) women. Tracing people is problematic but around 118,000 that could be traced were underpaid by an average £8,900 each. Some payments are much larger.

The DWP advise that they will be in touch, frankly I would not wait for them to contact you if you think you may be affected. You can and should check your State Pension here: www.gov.uk/state-pension. Please note this problem really relates to the older State pension, not the one that superseded it in 2016. In reality that means if you are a man and born before 6 April 1951 or a woman born before 6 April 1953. Today (December 2022) you would therefore be at least 69 if a woman 71 if a man. If it helps, Liverpool football legend Kenny Dalglish and pop veteran Chris Rea (On The Beach and Driving Home for Christmas) were both born 4th March 1951 or American Mary Steenburgen (of Back to the Future) in February 1953 or our own Jenny Agutter (The Railway Children and Logan’s Run) who was born in December 1952.

THOSE PROBABLY SHORT-CHANGED

The DWP focus on these main categories

- Someone already getting State Pension who got divorced or had their civil partnership dissolved.

- A married woman whose husband reached State Pension age after them and who became entitled to his State Pension before 17 March 2008

- A husband, wife or civil partner in a couple where both had reached State Pension age and the other person has died and not yet claimed their State Pension, or

- Someone aged 80 and over who has either no State Pension or Graduated Retirement Benefit, as they need to make a claim to get any Category D State Pension.

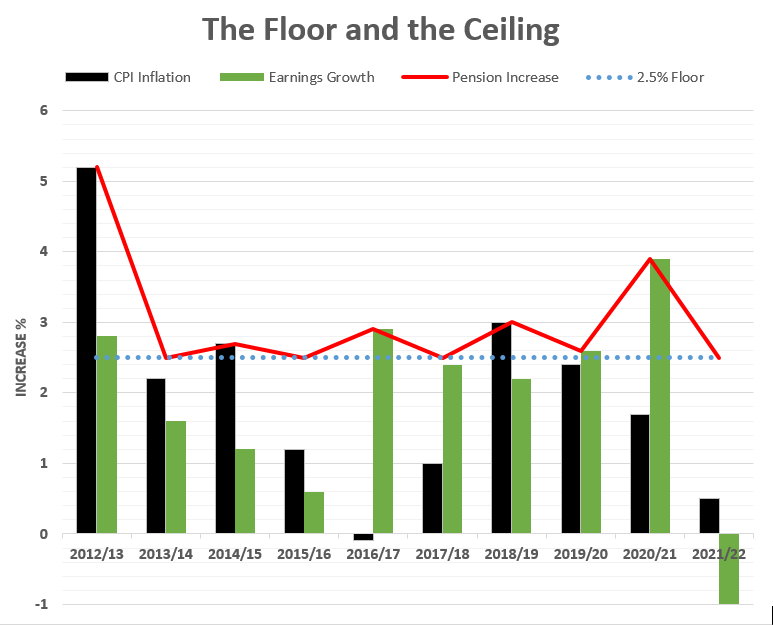

APRIL 2023 – THE INCREASE for 2023/24

I was asked recently if everyone’s State Pension will be increased by the inflation rate of 10.1% announced in the November Budget. I can confirm that according to all the Government website information this is the case. I have used this link as the source: https://www.gov.uk/government/publications/benefit-and-pension-rates-2023-to-2024/benefit-and-pension-rates-2023-to-2024 but to save you the trouble, the salient information is shown below. The new State Pension has a much later retirement age and this is likely to be extended further. A small footnote in the Budget showed that the Government would set out its intention in 2023.

THE “OLD” STATE PENSION

| Category | Rates for 2022/23 | Rates for 2023/24 |

|---|---|---|

| Category A or B basic pension | £141.85 / £7,376.20 | £156.20 / £8,122.40 |

| Category B (lower) basic pension – spouse or civil partner’s insurance | £85.00 / £4,420 | £93.60 / £4,867.20 |

| Category C or D – non-contributory | £85.00 / £4,420 | £93.60 / £4,867.20 |

THE NEW STATE PENSION

| New State Pension | Rates for 2022/23 | Rates for 2023/24 |

|---|---|---|

| Full State Pension | £185.15 per week / £9,627.80 per year | £203.85 per week / £10,600.20 per year |

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk