YOUR ‘UMBLE SERVANT..

TODAY’S BLOG

YOUR ‘UMBLE SERVANT…

We are regularly looking for new clients that are looking for the services that we provide. I often forget just how daunting an experience this can be for people. Invariably they have had a poor service from someone else, or worse. Some, though relatively few, have never had financial advice of any form.

I was with a new potential client this week, it was a familiar scene. There were lots of statements from various investment companies, lots of bank accounts and a significant amount of confusion. This was no fault of theirs, keeping track of all of your arrangements is made rather difficult by the constant corporate name changes and jargon.

Revealing your story

Every good adviser needs to understand your financial situation and what you hope to achieve. Gathering information from people is painful, because it’s a really tedious task and for many it involves trawling through a mass of paperwork and a sinking feeling that things may not be as good as hoped and unclear about which investment and savings still exist. It is far easier to give the lot to us to sort out and check through, but this requires a high degree of trust. I would generally discourage anyone from sharing or handing over their financial information, but of course to us it is “bread and butter”. Generally, I believe that trust is increased by earning it, by which I mean keeping promises – not by ripping people off.

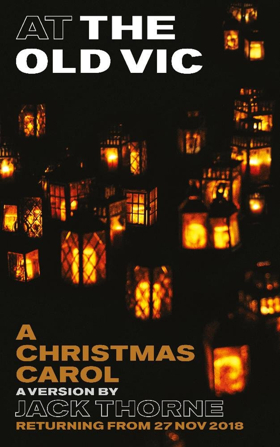

Pariah Uriah

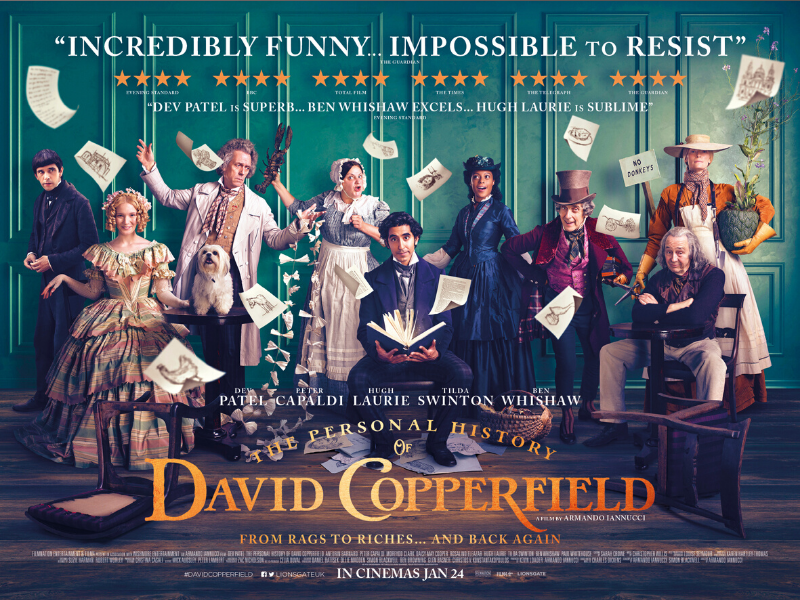

I was intrigued to see how one of literature’s financial fraudsters, Uriah Heep would fair under the retelling of “David Copperfield”. If you know the Dickens story, Uriah Heep is a man obsessed with class, attempting to ascend the slippery social pole through manipulation and deceit. He is a miserable creature, as legal clerk to Mr Wickfield he enables Wickfield’s struggle with alcoholism, encouraging ever more intoxication and thus more dependency on him. Gradually Heep’s ambitious plan forms into action, he forges signatures and loans and embezzles money from Wickfield and his clients. This leads both Wickfield and his clients to believe they are ruined through poor investments.

Working fiction

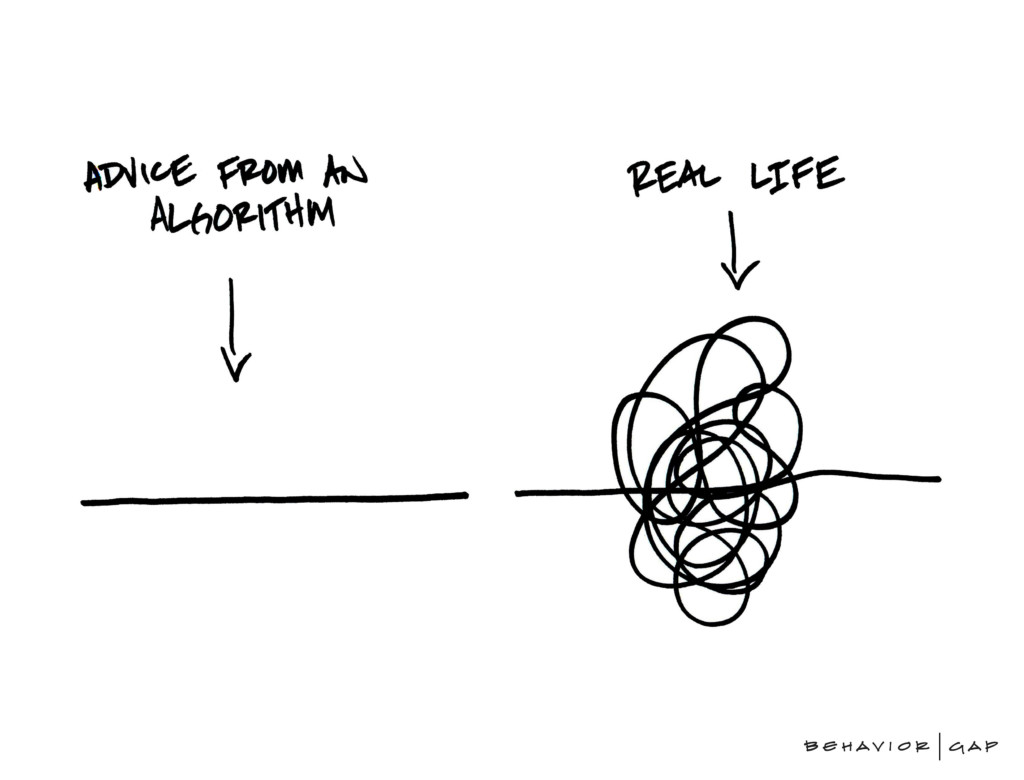

One would like to believe that this is a rather pertinent financial lesson – beware of the pressures on your adviser and his or her vices. Today it is both harder and easier to misrepresent the truth. Online portals that link up your arrangements (such as ours) show valuations, every day. These are from the providers themselves, so it would be very difficult for us to alter them. However, I have no doubt that with the advantages of a decent bit of editing software, things could be misrepresented by those that wish to do so. Whilst I might wish to believe our portal is your first port of call, it also acts as confirmation of other documentation sent directly from investment companies (further reassurance).

Who knows what Uriah Heep would have done with the available technology today. Thankfully character and processes and decent regulation all help limit the impact of such fraud.

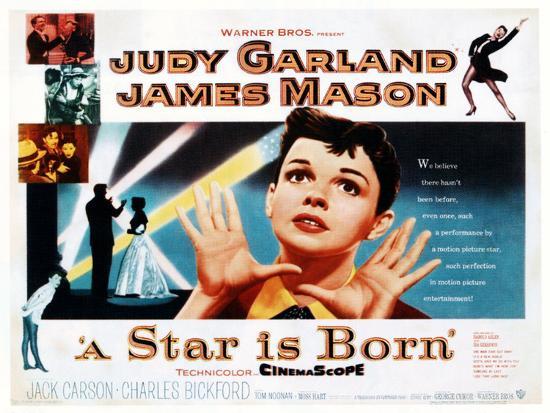

A Story is not set in stone

As for the film, well I loved it. It isn’t the book. The timeline is a little different but it is a charming and very warm re-imagining of the story. Of course, the way we might discuss your future, we tend to jump around from present, past and future and re-imagine different versions of your future if you make different decisions. So messing around with a timeline if frankly very normal for a planner. I was surprised to learn that some feel it is very “unlike the book” and are particularly vexed by the multi-ethnic cast. It seems a more than a little silly to want historical accuracy about a fictional piece when it comes to skin tone. In any event, much of our understanding of multiculturalism is rather blinkered by the retelling of history from a particular perspective. I fail to see what the fuss is about and find many of the comments rather thoughtless. In any event, the essence of the story is about different types of people from the different classes. There are merits and flaws in each.

DIVERSE-I-FIC(A)TION

As for your portfolio, well its diverse – globally diverse. Its available to view within our secure portal and you ought to check it occasionally just to know that what I have told you is fair, accurate and true – that we have kept our promises.

That’s said, I would actively discourage too much focus on investments, there is no need to obsess over performance when the portfolio has been established to stand the test of time, apply disciplined, evidenced theory to seek appropriate returns for the degree of investment risk you wish to endure. The portfolio is low cost, globally diverse and set up to last a lifetime. You simply require patience and perseverance.

As for Uriah Heep, he is found in most bookshops and of course in the current film by Armando Iannucci and starring Dev Patel (who is excellent) leads the rather good good. Here is the trailer. I enjoyed the movie – pushing 9/10.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084