TOMORROW’S WORLD

TODAY’S BLOG

PLANNING A FUTURE

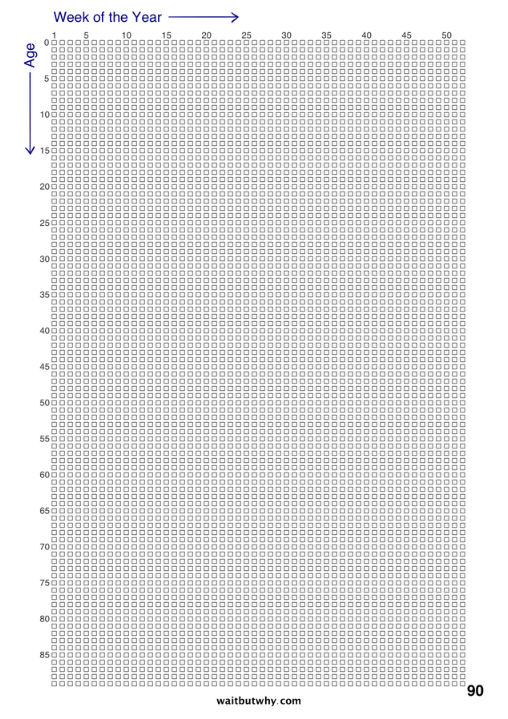

The more I read or hear about the impact of the pandemic on real people I am reminded of how important it is to have a sense of the future. There is little doubt that many of us have been struggling with the practicalities of living detached from friends and family, or frankly anyone that we may not know, but form a part of our ordinary lives.

Monty Don made the point that having something to look forward to is ever so important, which is part of the reason why so many people love and enjoy gardening. Those of us with gardens have benefitted this year from fairly good weather and the ability to take more time to enjoy our open spaces. Many have remarked that during the Spring when were in the full lockdown phase, they observed the natural world in way that seemed to be a glimpse into a bygone time, of no cars or aeroplanes – to see and hear nature, as may have been observed centuries ago.

TOMORROW’S WORLD

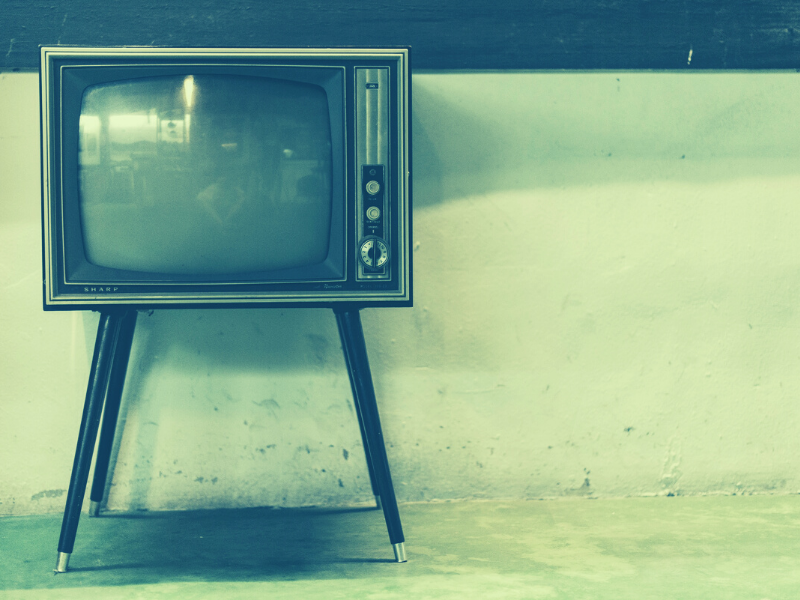

You will probably remember the BBC1 programme “Tomorrow’s World”. It was something of a TV fixture for many people, irrespective of age. When I grew up there were only three TV channels and “Children’s television” officially ended just before the news, but programmes really didn’t stop appealing to children. Perhaps you will remember James Burke, Michael Rodd, William Woollard, Judith Hann and Maggie Philbin all explaining various inventions which would perhaps become commonplace lifestyle improving solutions. Many of the “predictions” turned out to be some way off the reality, others were quite clearly an early prototype.

Anyhow, it got me wondering about the importance of having a vision for the future. We have seen some welcome reassessment of the past, we cannot change it, but we can at least learn to understand it differently, specifically its impact on the present.

A PLACE IN TIME

Without a grasp of history and a hope for the future, I would argue that it is easier to become overwhelmed by the present. Today I could probably find shows like Tomorrow’s World, but I’d really have to hunt them down from not simply hundreds of channels but different media sources and they certainly would not be what the majority watched, all experiencing the occasion at the same time, which I also believe to be pertinent to our sense of time.

THE IMPORTANCE OF HOPE

The book of Proverbs has an interesting phrase “without vision the people perish”. That’s a pretty bold statement and of course, has been interpreted in all sorts of ways and probably used to justify all sorts of ideas. If I may, can I simply offer it as an acknowledgement of the value of having a sense of tomorrow. Having hope.

Many of us, (perhaps all of us) have had moments of despair at the current circumstances. Whether that is concern about health, family, friends, loneliness, financial pressure, worrying if your business (or your friend’s) will survive, if you will ever get to enjoy the things you did before… Then there is a very deep despair that overwhelms and leads to some believing that they have no future and so end the pain.

DON’T UNDERVALUE YOUR FUTURE

The future is something I discuss all the time with clients, but I have to admit that simply having a sense of a future itself (whatever that looks like) is rather more important than having no vision at all. Please get in touch if you need to talk or simply want me to listen. Perhaps your plans have altered, maybe some priorities have changed. Alternatively, maybe you know someone that I may be able to help to get their plan for their future into shape.

And for your amusement… here’s the team at Tomorrow’s World looking back at the 1970s as the new decade was about to begin from roughly 4 decades ago – which is typically how long people “work” for a living and increasingly how long retirement may last…

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084