THE INVENTION CONVENTION OF CHRISTMAS

THE INVENTION CONVENTION OF CHRISTMAS

Christmas is nearly here and despite all of the preparation and expense, most of us will probably forget most of it, save a few carefully selected memories (good or bad). For some I imagine it will a story of how their Christmas was delayed or ruined by drones at Gatwick, for others it will be a particular gift, meeting with a friend or family member, or perhaps an event. Our memory, as we all know, is wonderfully selective.

Any good financial plan has to begin with understanding where money has been going. This is the account of “now” and can be a fairly depressing experience. Most people spend much more than they realise on things that in hindsight seem rather unnecessary. One of the categories of spending we ask clients to assess is their giving, both in terms of charitable giving (for tax planning) and money spent on gifts. There is invariably a link between the size of your circle of friends and family and how much this is.

Christmas – past, present and future…

I do not intend to turn you into some Dickensian character, like Mr Scrooge. However, as you enjoy Christmas this year, be mindful of how much the experience of celebrating this day has cost. The “day” of course tends to be rather more than 24 hours and likely begins when you buy (or rent) your tree. I enjoy the theatre and seeing friends and family. We tend to have a family trip to a show (perhaps more than one). In fact, there is a lot of “stuff” that we do that is an extra expense, precisely because… well… it’s Christmas.

The warm glow of honesty

All I ask is that you reflect on how much you really spend. This is not a value judgement, simply a call to be honest with your finances. If we are unable to accurately account for a day in the year, ok perhaps the “season” then we may well be fudging other numbers. It is tempting to say this is unique, but behaviours tend to be patterns. We all have limited resources and when earning money is no longer happening, for whatever reason, the harsh reality of living within budget or running out of money is the cold shower that will wake us from the warm haze of denial.

If we really want a good financial plan, we need to begin with honesty about where, when and how we spend money.

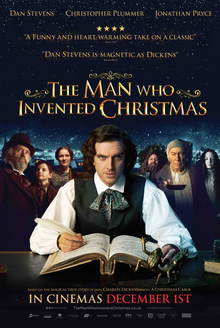

We know that many of the things we do today to celebrate Christmas have less to do with the birth of Jesus. The movie “The Man Who Invented Christmas” may help identify how much our Christmas celebrations have altered. Here is the trailer. I wish you a very happy Christmas.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk