TODAY’S BLOG

HOW TO STOP TIME

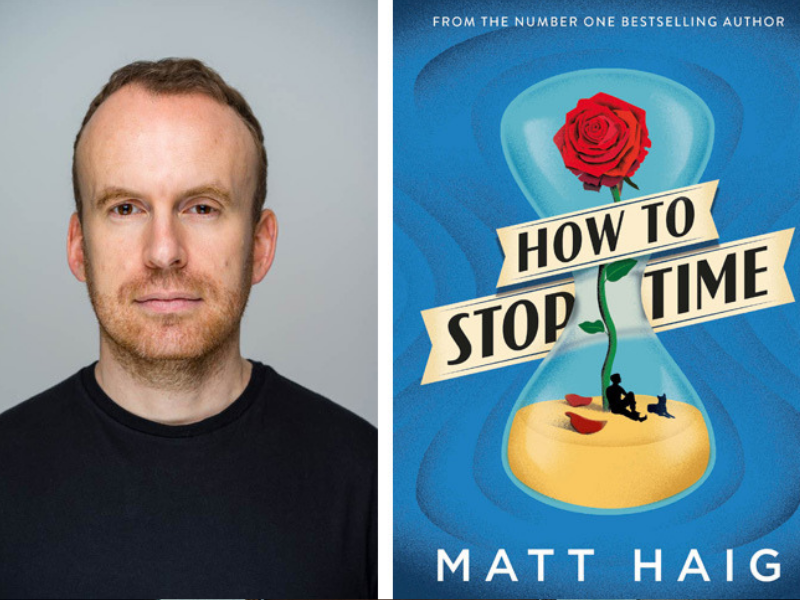

I have recently enjoyed a rather good book “How To Stop Time” by Matt Haig. The basic outline is that some people age much more slowly than the rest of us. This provides for some fascinating encounters in history, walking the streets of London from the time of Shakespeare to the present.

Matt Haig has already assembled an impressive body of work and this novel, which was published a little over a year ago is a really worthwhile investment. It is the story of Tom Hazard who at 41 has a secret that must be maintained and kept from the witch hunters of the time. Tom ages slowly – about 15 times more slowly, so whilst Tom moves from 15 to 20 years of age, his contemporaries have become 90. This makes for good fiction and a hugely enjoyable walk through history from the late 1580’s.

Short-term obsessions

There are some wonderful insights about time, fear of the future and relationships. It prompted me to reflect on the main problem that we all have – being somewhat obsessed by the short-term and immediacy of “news”. There is a great line that I shall probably use – “your nose is pressed against the canvas, you need to stand back to see the whole picture”.

Predicting the future?

As a financial planner that uses cashflow modelling, there is a danger of giving the impression that the future is predictable. There’s something of the mystic meg with her crystal ball, seeing the future… The truth is rather different – it is only predictable in its unpredictability. However, we can look to history as a great teacher. We use historical data to help shape our assumptions about the future. We get to play with the future, to alter it and reinvent scenarios, time and time again.

A client recently confessed that “the penny had dropped” for him. He was suddenly gripped by the reality that his retirement is now not so much theoretical, but all too real and getting closer by the day. Time marches on and it eventually forces us all to pay close attention. We now adapt the possible scenarios with far greater awareness of time. His experience is very normal and in practice it really doesn’t make that much difference how many times I or anyone else says – start investing early, there are always other calls for your money and the future, is… well, it’s the future, not the present.

In many respects Haig concludes that to know thyself and live a life without fear of the future is the logical conclusion for all us “mayflies”. Relationships are temporary and to be treasured. Loss of loved ones is a far harder path than the loss even of identity, let alone wealth. My job is to help you preserve yours, to start with the end in mind and to underscore your values – the people, places, things that make your life’s work worthwhile.

Time marches on, thankfully.

I enjoyed the book, here is a link to help you find it. Matt has been wonderfully honest about his struggles with depression and its also worth having a listen to his videos on the topic – reasons to stay alive. Here isn’t a bad place to start…

Oh and if you are interested, Matt Haig is currently touring the country promoting “Notes on a Nervous Planet”. Brighton at the weekend then blazing a trail up to Edinburgh for 28th April.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084