ARE YOU MISUSING YOUR CASH ISA?

TODAY’S BLOG

ARE YOU MISUSING YOUR CASH ISA?

You may have gathered that I am not a fan of the Cash ISA. If you really must have one, then you need to be clear that you are getting a top rate of interest (less than 1% at the moment) and that you are not locked in for too long. If you expect rates to rise, why on earth would you lock in to one?

We all have a personal savings allowance. That’s £1000, £500 or nothing depending on your highest rate of tax. Basic rate (20%) taxpayers have a £1000 savings allowance (interest from savings) and those that are higher rate (40%) have a £500 allowance. Therefore, majority of people will have at least £500 of interest that they can earn tax free. Today that means holding around £50,000 of cash, which is a little under twice the average national income. According to ONS data to the end of the 2019/20 tax year, that’s £29,900 (median household income).

As I have said before, I am a great believer in holding cash. It provides for projects and emergency. Good planning – which is something that you already do better than most because you are here today, means getting a realistic estimate for something you intend to do and setting that aside prior to starting the project. This is therefore based on your research, quotes, and prudence to allow a sensible margin for error, or builder maths.

CASH FOR EMERGENCIES

Then there is your emergency fund. This is entirely subjective. It is an amount that enables you to sleep at night knowing that if something disastrous happened by the time you woke, you and your family would be able to cope financially. Things like loss of your job, the boiler breaking down, your car being vandalised or stolen, perhaps even a quick getaway fund from an abusive relationship. You might relate this number to how much you normally spend each month and hold a multiple of that.

RISKS CHANGE AS YOU AGE

Those that have a guaranteed income (people that are retired and living on State Pensions, annuities, or final salary pension benefits) arguably don’t need to worry about the loss of a job or their income. Its more likely that, if that’s you, you think of the extra income sources – from your investments or perhaps a holiday home that is let during a pandemic.

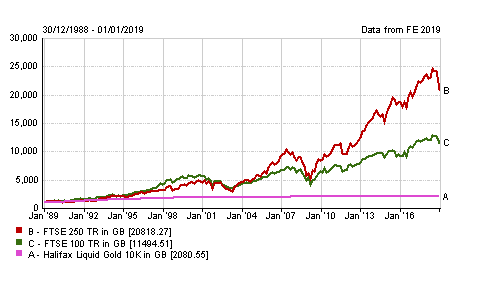

Most people will probably not need more than £50,000 (in 2021) but I did say it was subjective and personal to you. Cash doesn’t really work for you; it works for a bank who lend your money out at a rate that makes them rather more than they offer you to “store” it with them. If this drags on for months and years, you will undoubtedly see the spending power of your money reduce due to inflation. It needs to do some heavy lifting, which means investment. This comes at the price of market volatility in the short term, but if done properly, will deliver greater yields.

PARABLES ABOUT BARNS AND GRAIN

To my mind, it’s like an arable farmer keeping all their seed (cash crop) in a barn and not sowing enough. At some point, the barn will run out as its consumed or rots, missing out on all that multiplication and future harvests.

Anyway, given that most people don’t need to hold much more that £50,000 and would get the interest on it tax free anyway, there is no point using your valuable ISA allowance to give you something you already have.

Of course, this is what a plan will help determine and why understanding what the money is for and the reasons for your anxieties about money. Do get in touch.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084