Dominic Thomas

Jan 2023 • 8 min read

THE TAX DEADLINE – 31 JAN 2023

As I write the 31 January 2023 tax deadline is fast approaching. Hopefully if you are self employed or have some taxes to pay, you have set aside the funds to pay your dues to HMRC. Few of us like paying taxes, yet we all know how vital they are. Some people brag about how little tax they pay, even scoffing as they “stick it to the system” including the male that managed to convince Americans in the United States to elect him as President.

We have our own politicians with tax problems of course. This is nothing new. The complexity of international taxes and in particular offshore tax havens makes it all rather fuzzy, let alone some of the nefarious companies in which investments are held.

I suspect that you are affluent enough to be concerned about the custodial penalty if you fail to pay your taxes, not poor enough to dismiss it and not rich enough to presume you will be able to pay for the legal representation to keep you safely excluded.

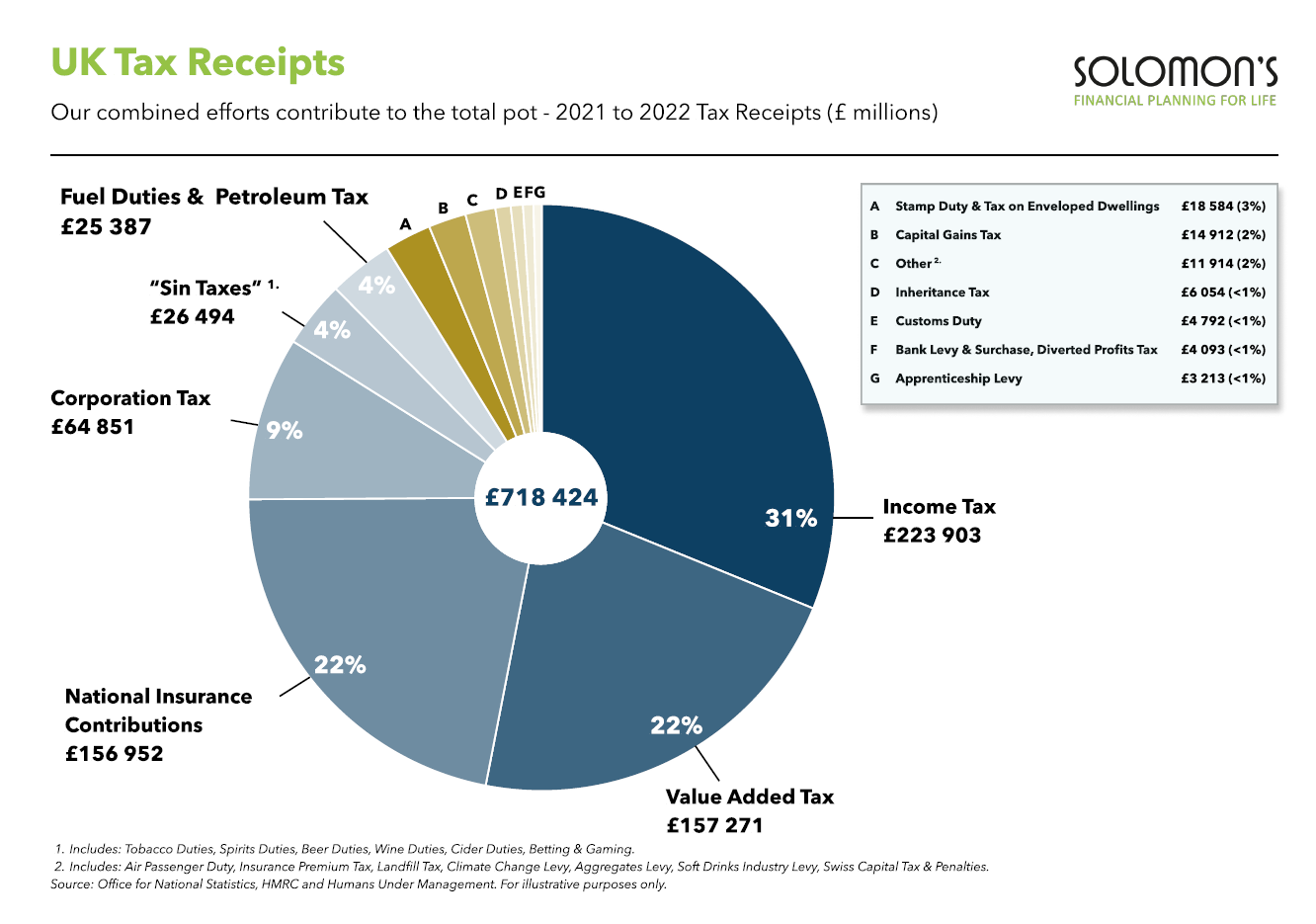

Whether we like them or not, and I do appreciate that sometimes it feels as though we are simply working for HMRC, but tax pays for lots of our societal benefits. Roads to justice, welfare to pensions, care and healthcare, education and defence. Certainly there is a lot wasted and we seem set to remain locked in a battle of ideologies about how to make the system fairer and popular.

Our role is to ensure that you don’t pay tax unnecessarily. For example, consider wanting to withdraw £10,000 to spend from your investments.

Whilst we live in an imperfect world where Chancellors, Prime Ministers and Governments are quickly replaced, much like the rules and policies that they introduce we do our best to minimise taxes, which have an enormous impact on your investments.

Tax had a bigger impact on returns

Whilst journalists get very vexed by charges on investments, in the 2022/23 tax year there are lots of different rates of tax, these get altered regularly. Currently tax rates include 0%, 8.75%, 10%, 18%, 20%, 25%, 28%, 33.75%, 39.35%, 40%, 45%, 55% or 60% tax to draw money from your investment, this rather puts things into perspective. We attempt to minimise tax so that you do not pay it needlessly.

The table below shows the enormous difference in the amount you would actually have to withdraw in order to end up with £10,000 post taxes. Irrespective of how you vote, these are accurate tax rates for 2022/23.

| TAX RATE | GROSS WITHDRAWAL | TAX PAID | NET YOU KEEP |

|---|---|---|---|

| 0% | £10,000.00 | £0 | £10,000 |

| 8.75% | £10,958.90 | £958.90 | £10,000 |

| 10% | £11,111.11 | £1,111.11 | £10,000 |

| 18% | £12,195.12 | £2,195.12 | £10,000 |

| 20% | £12,500.00 | £2,500.00 | £10,000 |

| 25% | £13,333.33 | £3,333.33 | £10,000 |

| 28% | £13,888.89 | £3,888.89 | £10,000 |

| 33.75% | £15,094.34 | £5,094.34 | £10,000 |

| 39.35% | £16,488.05 | £6,488.05 | £10,000 |

| 40% | £16,666.66 | £6,666.66 | £10,000 |

| 45% | £18,181.82 | £8,181.82 | £10,000 |

| 55% | £22,222.22 | £12,222.22 | £10,000 |

| 60% | £25,000.00 | £15,000.00 | £10,000 |

The above table ought to indicate how important it is to have the right advice and a good understanding of the UK tax system of allowances, reliefs and exemptions. Sadly we cannot rely on Government to simplify taxes or even maintain levels predictably.

Clearly using investment products and solutions that prevent tax or enable you to minimise it through careful management makes a lot of sense.

As the new tax year 2023/23 approaches (6th April) many of us will likely find ourselves paying rather more tax.