YOUR STATE PENSION – TIME IS RUNNING OUT

TODAY’S BLOG

YOUR STATE PENSION – TIME IS RUNNING OUT…

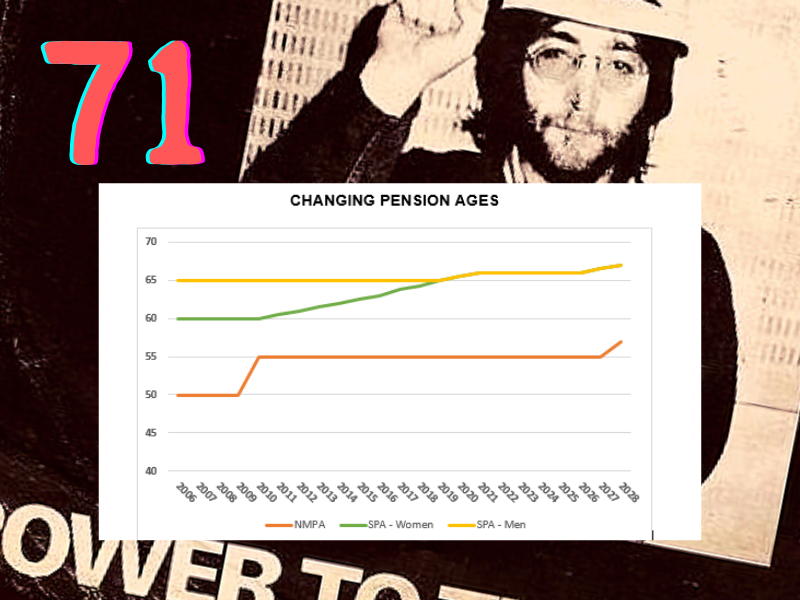

When the new State Pension was introduced from 6 April 2016, the Government also provided an easement to the normal six-year window which allows individuals to pay Voluntary (Class 2 or Class 3) National Insurance Contributions (NICs) to fill in gaps as far back as 6 April 2006. However, this easement is coming to an end on 5 April 2023 meaning individuals have a little over nine months to take advantage of this easement. I repeat…

THE EASEMENT TO BACK FILL YOUR NI CONTRIBUTIONS ENDS ON 5 APRIL 2023.

This was picked up in the press:

- Telegraph (18 June 2022): How to boost your state pension by £55,000.

- Express (25 June 2022): Pensioners could boost their state pension by up to £55,000 – how you could do it.

The headline grabbing figure of £55,000 is based upon the increase in State Pension following backfilling ten qualifying years, increasing an individual’s State Pension by £52.90 per week and paid for an assumed 20 years from State Pension Age (SPA).

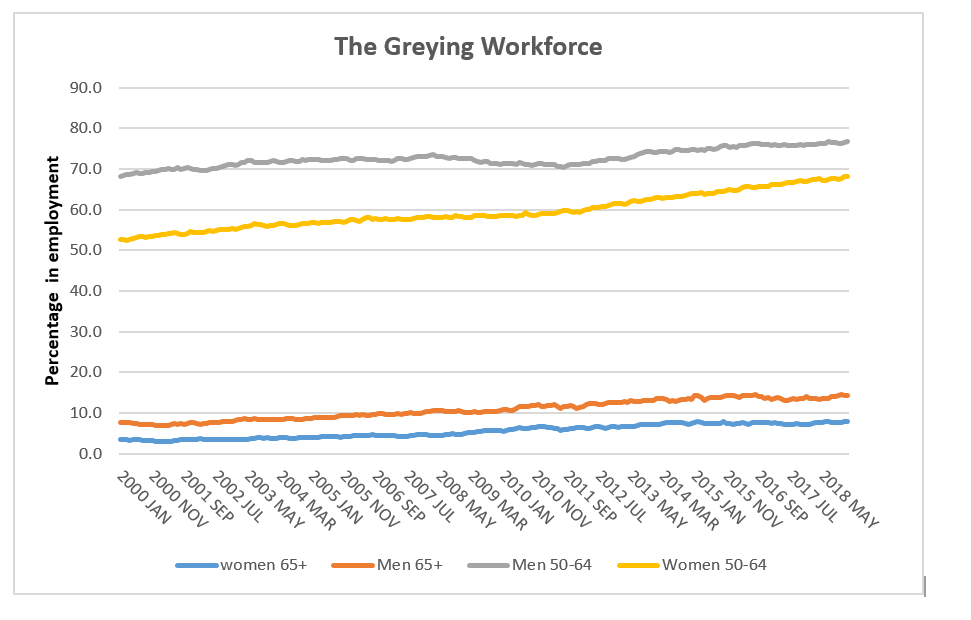

For those of you not yet drawing your State Pension, I regularly remind you to check both your National Insurance record and obtain a proper State Pension forecast. To say that politics has been mucking around with your State Pension would be a significant understatement. You can also do this via your Personal tax account.

BEFORE TOPPING UP

However, people considering topping up need to take a range of factors into account. For example:

- Some years can be ‘cheaper’ to top up than others; for example, people who have worked part-year and have paid some NICs may be able to complete that year more cheaply than buying a completely blank year;

- Filling blanks for certain years (particularly those before 2016/17) can sometimes have no impact on your State Pension. This is particularly relevant for people who have already paid in 30 years by April 2016 and who were long-term members of a ‘contracted out’ pension arrangement;

- People who expect to be on benefits in retirement may find that some or all of any improvement in their State Pension may be clawed back in reduced pension credit or housing benefit;

- People who were self-employed can save money by paying voluntary Class 2 contributions (currently £163.80 per year) rather than Class 3 contributions (£824.20 per year);

- Before paying voluntary NICs, individuals should see if they can claim NICs credits for a particular year. For example, those looking after grandchildren may be able to claim credits transferred from the child’s parent, and this could be a cost-free way of boosting their State Pension.

THREE KEY GROUPS

There are three groups for whom top-ups may be of particular interest:

- Early-retired public servants, or private sector individuals who have been members of a ‘contracted out’ occupational pension scheme; the period of contracting out is likely to reduce their State Pension below the maximum amount, and their early retirement is likely to mean they have ‘gaps’ in their NICs record which can be filled;

- The self-employed, who may have gaps in their NICs record and may be able to go back to any year since 2006/07 to top it up; this group is less likely to be affected by complications around ‘contracting out’.

- Anyone that took a career break to look after children.

TAKE ACTION:

If YOU haven’t started to receive your State Pension, please do take this as an urgent reminder to check your pension. The State Pension is now roughly £9,660 a year each – which is a guaranteed income for the remainder of your life. Whether you think this is a lot or a little isn’t of concern here – just that you receive what you are entitled to.

For the record, no I don’t think its enough… which is why I do what I do and you pay me to do it.

LINKS:

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084