2015 has been a bad year…. for investors too

2015 has been a bad year… for investors too

It has not been a good year for investors, frankly it has not been a good year for lots of people – we are all aware of the disasters and atrocities that have occurred around the world. So as you review your investments which have not performed as anyone would have hoped, a sense of perspective is probably wise.

The problem with stock market or traditional investing is that we see good years a bad years. 2015 has been a bad year, with the FTSE100 opening the year at 6,556 rising to a high in April of 7,103 (up 8.3%) but currently lagging at around 6,050 (down 7.7% over the year to date).

It is natural to feel annoyed and fed up, particularly as it is easy to get the impression that somewhere, somehow others are doing better. The truth is perhaps rather different. A fall of 7.7% is what the market provided via the FTSE100 (the UKs 100 largest companies). To have a smaller fall (or even a gain) you would have had to take more investment risk (essentially attempting to beat the market return based on belief, information or frankly luck). The market return is literally the market average return. This assumes that you were invested at the start of the year. If you invested towards the end of April your “loss” would be worse.

Realisation about Loss

However what is a loss? In essence a loss is only realised when you sell your investment for less than the price you paid for it, which might happen due to changing circumstances, but should not happen within a financial plan.

Part of my role is to help clients minimise their mistakes. One would be to sell at the bottom – to panic and “get out” once markets have fallen (this would be called “realising a loss” – ie making it real). It is tempting to do so, but unwise unless your circumstances have genuinely changed.

Risk and Diversification

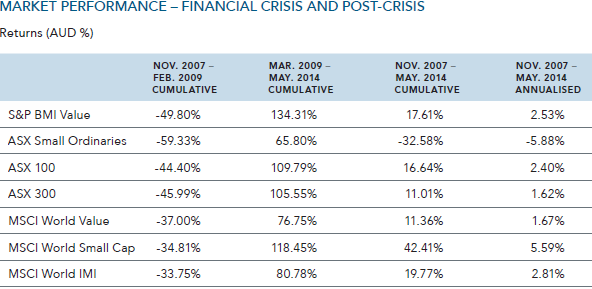

However all portfolios are diversified across a range of assets, so you aren’t purely in the FTSE100. Portfolios have a global nature and hold cash, commodities and Bonds. The mix (asset allocation) is the important tool we use to devise a suitable portfolio for you, given your ability to cope with investment risk and also have a context (your financial plan) for your money. This is what we call diversification of risk, but might be better understood as “not holding all your eggs in one basket”.

Yes, the year has been poor for investors, but do not be tempted to seek higher returns, and yes even cash with its dreadful returns was a better option in hindsight. The returns will “feel” and appear worse as statements at 5th April would have exposed the comparative high point in the year. However in the long-term investing rewards those that stick with the plan. There is ample and readily available evidence for this.

Noisy “genuises”

Be mindful that most people will never (or very rarely) talk about their investment losses, but invariably shout from the rooftops about their investment successes. The truth is rather different and much better hidden. This applies to private investors and professionals alike.

Tomorrow I will highlight another mistake that you can avoid and frankly, one that you need to encourage anyone you know to read the piece.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk