Should you become an investment expert?

DEMANDING ATTENTION

I recently read Oliver Burkeman’s latest book “Four Thousand Weeks”. I thoroughly recommend it. One of the things he reminded me of is that your life is sum of the things you pay attention to.

Whether that’s a deliberate focus or a haphazard collection of experiences. What you pay attention to will define you.

You can choose to spend your time looking after your own investments. There is something about this that seems perfectly reasonable and “grown up” after all, who is more trustworthy with your own money?….

Or perhaps you can let go of the notion that you need to be fully competent in many aspects of adult life. Perhaps the plethora or choices and complexity is nothing like those your parents actually had. When money was generally a lot easier and investment choices were simple. Heck, it’s much more complicated than 10 years ago, let alone your parents generation.

Now we have that time saving device and access to the internet, all possible answers can be considered. But is this how you really want to spend your precious time?

THINGS I PUT DOWN

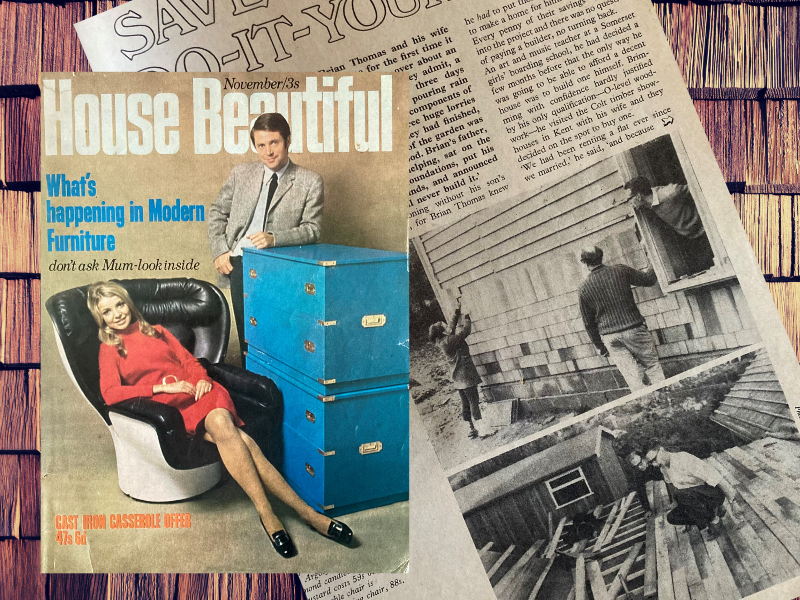

My parents built our first family home when they were just 25, the house itself is still standing and probably faring better than the faded magazine that reported their story (House Beautiful) from the time. Meanwhile I’m over twice that age and can barely achieve most rudimentary DIY tasks. In truth, they had limited options as a couple of new teachers back in the 60s. They built a house because for them, it got them a home they could afford. A decade later they sold it for five times what it cost them.

I’m not daft enough to attempt a house build, it is an aspiration to do so one day, but what I really mean is have a house built, one that I have “designed” not to actually lay all the bricks!

Perhaps I will never get to “build my own house” it can be added to the very long list of things that I will never get to do, that isn’t going to deflate me, it’s reality and the fact that my choices are always compromises.

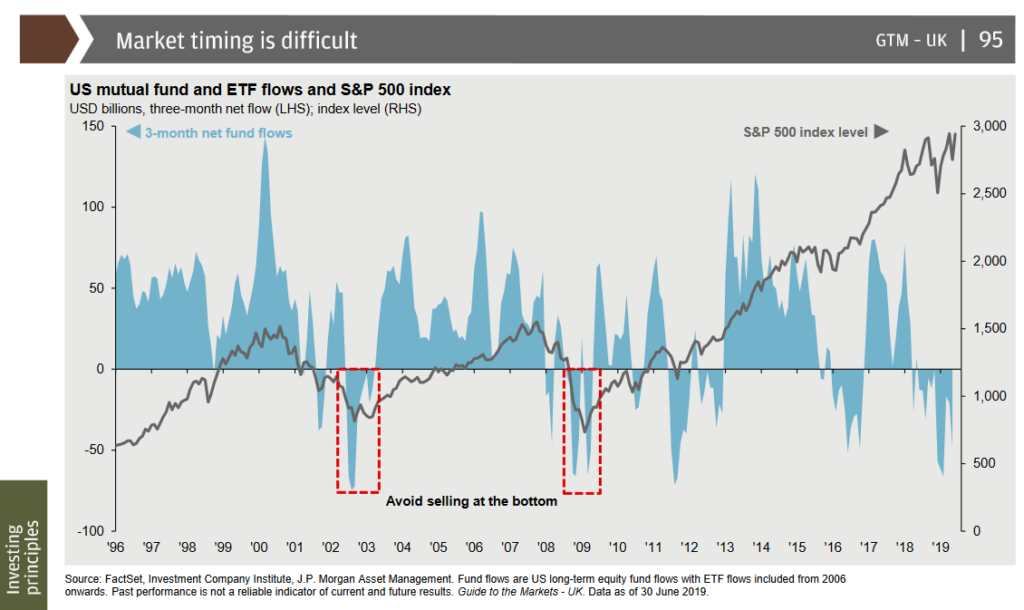

If you want to do your own investing, fine, go for it. I can promise it’s not a part-time occupation and experience can be expensive to acquire. I’m serious – go for it. You will have a world of choices and “experts” bombarding you with information. My one tip would be to have an evidence-based Investment philosophy and stick with it for life…. Or at least 2 decades.

Alternatively, why don’t you go out and do something less boring instead…

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk