Klopp it

Dominic Thomas

April 2024 • 4 min read

Klopp it

Klopp’s kids beat a Chelsea team that cost a billion to win the League Cup final, confirming belief that Jurgen Klopp is a marvellous manager, one that Liverpool should not let go. I think you would agree that this probably fairly reflects the sentiment across most media platforms following Liverpool’s 1-0 victory over Chelsea.

If you don’t like football, like Ted Lasso, this is not really about football. Stay with me.

Any manager has to select players from his/her squad from those available (not injured). Jurgen Klopp selected a team based on his own criteria, but suffice to say not all the regular stars were available due to injury. As a result, he had to look beyond the familiar, to the rising stars, untested for a big occasion. By the end of the match which predictably went into extra time, there were five Liverpool players under the age of 20 on the pitch bringing the average age of the 11 on the pitch to under 22.

There has been much praise for this bold approach and the legacy that the departing manager will have provided, a future that looks exceedingly bright. Credit where it is due, it was indeed an impressive result, though I think it fair to say that Chelsea are not at their best. However, the ages of players, cost and who won are not the issues here.

The tendency of the media is to move towards extremes, failing to retain a level head, seemingly stuck in an adolescent state of black or white. Much is being made of the success of Liverpool’s youngsters with euphoric sentiments about the future.

It is perfectly possible that Liverpool’s young players go on to have very successful (trophy winning) careers, but it also depends on undeniable luck. Skill as an athlete is the entry price, but luck will often feature. I mean luck in avoiding injury, having sufficient stability, opportunity to play. Typically players retire at around 35. James Milner is currently 38 and playing for Brighton, having moved from Liverpool at the end of the last season. He is one of the oldest and most successful premier league players. He was born in 1986 and his six minute Boxing Day debut for Leeds made him the second youngest premier league debutant, just nine days before his 17th birthday. Milner has won lots and has the second highest number of Premier League appearances and is closing in on the record of 653.

Milner, like most athletes, does what he can to ensure he stays fit and skilled, but he has also been lucky with his fitness that has enabled him to continue playing and moving between teams that have a real prospect of winning (Manchester City and Liverpool since 2010).

Football pundits and commentators tend to forget luck, they forget survivor bias and often make statements with such a degree of certainty as a voice of authority, that many or perhaps most assume them correct. In the end they may be, but it’s unknown and bluntly, unlikely.

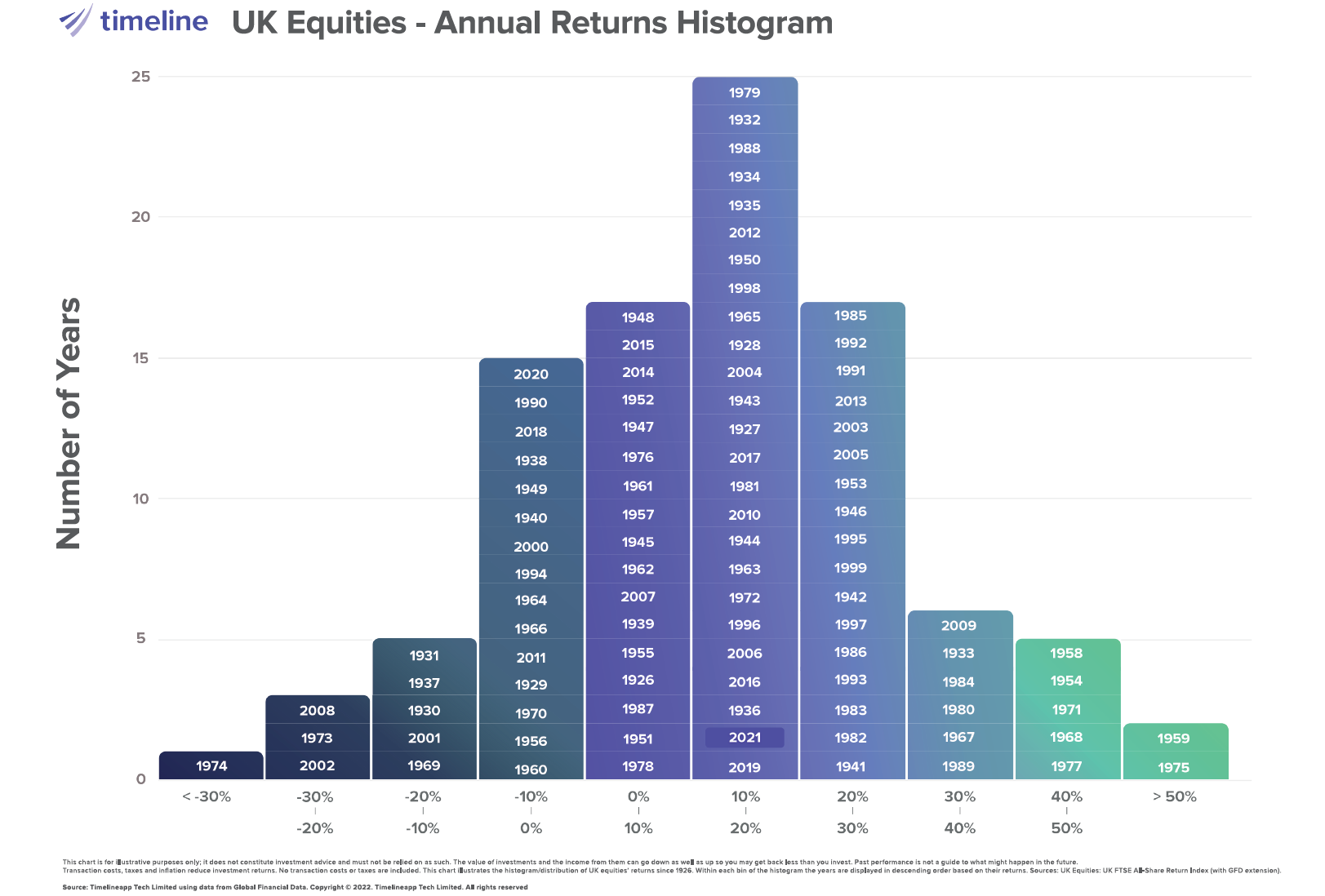

Investing is the same. We all see charts on billboards, newspapers or the internet showing how wonderful a particular investor is. There is no guarantee at all that this will continue or be repeated. Certainly they may have a good succession program in place, or assistants making the results more collaborative, but the truth is that we simply don’t know how much was luck and good health (investment managers also get ill, cancer, stroke, mental health issues and so on). Many or most investors elect for the belief that it is possible to consistently beat the market … denial of reality is a thing.

When James Milner made his debut at Leeds in 2002, Liverpool’s most successful period was already in decline, indeed they had never won the Premier League in his entire career until he helped them do so in 2020 some 30 years since their last League win (a record that their arch rivals Manchester United hope they do not match, but are now approaching halfway).

Sport is fickle, so is investing. As much as we would prefer not to acknowledge it, preferring to believe that we make our own luck – or where opportunity meets preparedness. Luck is part of the reality.

That’s why we avoid costly investment strategies that rely on the luck of a Manager. Over a reasonable time, one that is the real experience of investors like you, only about 5% of managers beat the market. So are you willing to bet your family’s wealth in 2024 on who they will be by 2044?… and pay a hefty premium for the privilege?

No, neither are we. At this point I cannot even tell you who will win this season’s Premier League which is over halfway through and concluding this Summer …