Moneybox and Platforms

Moneybox and Platforms

This week BBC Radio 4 Moneybox featured the running spat that seems to be developing in the investment platform market. Platforms are online administrative services that both advisers and clients can use to buy, sell and value investments. To say that they vary considerably in price and functionality would be an understatement. There’s an entire market for helping advisers assess what platform is best for their clients (which I pay for and use for no small sum of money). In essence there is a price war or what I might call a race to the bottom. Cheap is not always good, but then neither is expensive. Moneybox kicked the tyres on the new Hargreaves Lansdown (HL) platform, which is really aimed at DIY investors. As far as I’m aware (which means from the latest research data) they have a decent platform with a reasonable range of funds. Their new charges aren’t that competitive and whilst they provide extensive fund information (most now do) as the HL spokesman said on air, there is the belief that they provide “the best funds at the best prices”. Whilst I can understand this statement, it rather betrays the belief that selecting “the best” fund is easy to do. It isn’t. This is a convenient belief, I might suggest delusion and one that DIY investors also suffer (hence a marketing match made in cyberspace).

Here’s the big one

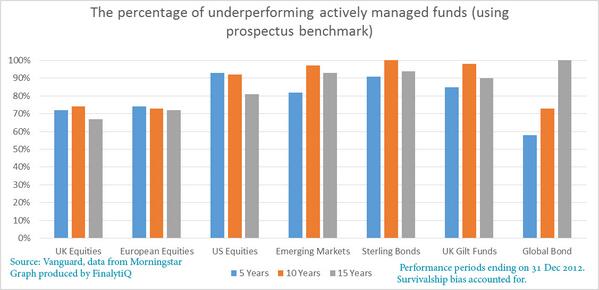

Ok, here’s the big issue that the financial services industry generally doesn’t want to acknowledge, but when you read the next statement, and reflect on it, you know it is true. Here it is. It is not possible to consistently outperform the market without taking additional risk to the market. You might want to re-read that. Now there are some that that do outperform, but do so over the very short-term. Given that most fund managers do not manage their fund for very long, (a cynic might suggest that they quit whilst ahead) looking at the longer term performance of winners is equally unhelpful. Suffice to say a very small percentage outperform the market over 20 years… and the proportion that do is about the same as random chance. Its also depends on when you buy into a fund and don’t forget that hundreds of awful funds are closed and if had been included, would demonstrate that an even smaller proportion outperform over the long-term. Here is a chart a friend of mine shared recently.

Experience isn’t priceless, but it is highly valuable

As for the platform, well on one hand it is an administrative system. They are not all equally as good as each other, they all have different charging structures and functionality. A key issue for me is “does it work?” and you’d be surprised at how many fail the test. Theory is one thing, reality is another. A good financial adviser will review the platform you use, sometimes it is better to move, sometimes it isn’t. Whilst it is important (always) to challenge the way things are to improve, the assertion that there is “one way” of doing things, that “cheapest is best” or that similar products are in fact “all the same”, is simply not accurate. Experience isn’t priceless, but it is highly valuable.

Profit or profiteering?

However, let us not ignore some obvious facts, there are vested interests. Financial advisers (myself included) are not charities, we are businesses. Platforms are businesses, Fund Managers are businesses. All need to make a profit to continue to exist, the real question is what level is reasonable and fair – which is almost impossible to answer to everyone’s satisfaction. Moneybox challenged the 71.5% profit margin that HL make.

Dominic Thomas: Solomons IFA