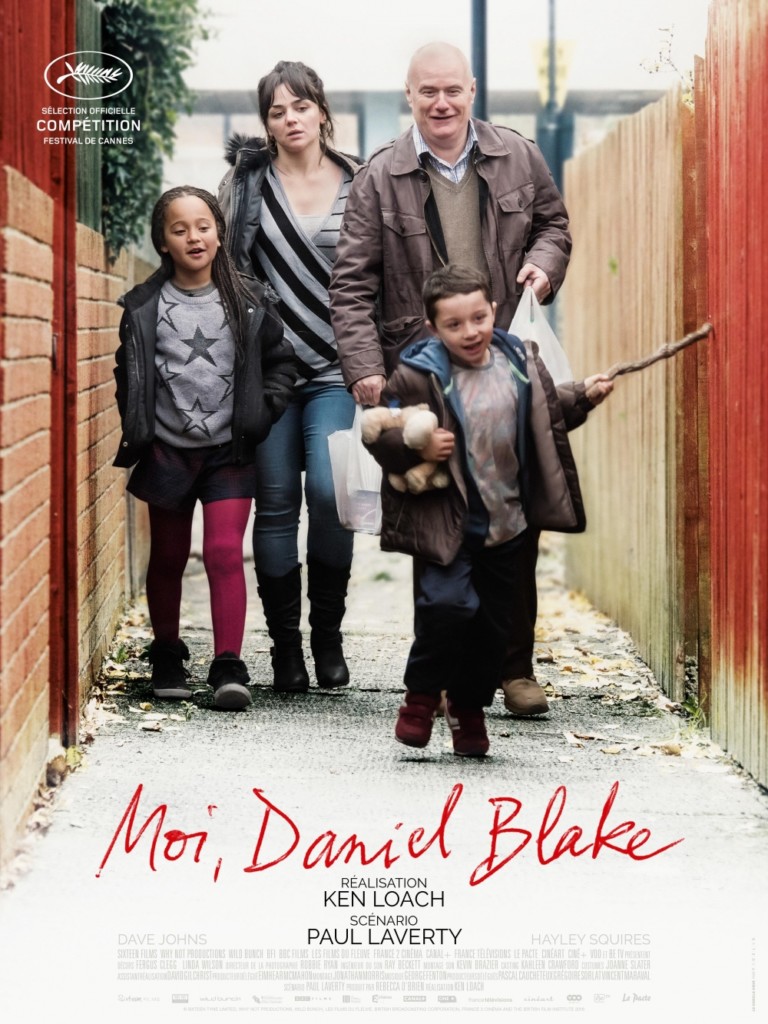

I, Daniel Blake

I, Daniel Blake

The new Ken Loach movie “ I, Daniel Blake” has created something of a ruckus. It would seem that if you hold entrenched political views, then probably you would learn nothing new. If you are a little more willing to be informed or at the very least, challenged, then this film has something to offer.

You might wonder why a financial planner is writing about a story, essentially about poverty and the UK benefits system. After all, our clients don’t draw benefits and are clearly not poor, by most normal definitions. My reasoning is that human dignity is simply a human issue for us all, and of course should disaster strike, any one of us could be left at the mercy of the State system – one that we all contribute towards and reflects our wider collective values.

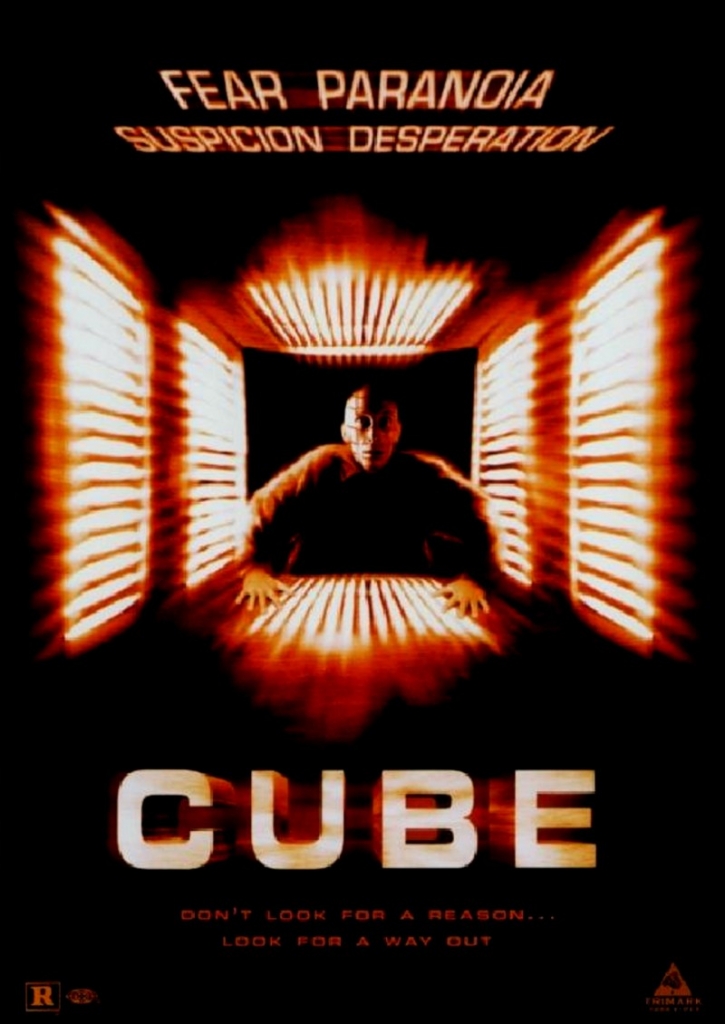

Daniel Blake is one of those typical, gritty, grim and grey British films, that in truth you probably have to be in the mood for. It isn’t “entertainment” and it isn’t a documentary. However in the days of food banks and some fairly vile tabloid newspapers, it’s a film that needs to be seen, rather like the truthfulness of your own finances.

Passive? moi?

Perhaps like you, I am occasionally found shouting at the TV or radio as something rattles my cage, yet it is not often that I do so in a cinema. Yet, that’s what I was doing within about 15 minutes, exasperated by the ludicrous treatment of someone by box-ticking automatons. I won’t ruin your experience of it by giving away the story, but it resonated with similar experiences that most of us will have had at some point when dealing with some organizations, particularly Governmental ones.

A curriculum vitae…

The story of Daniel, a carpenter in his late 50s or perhaps early 60s suffers a heart attack, signed off work by those professionally qualified to do so (his doctors) and then assessed by a “professional health worker” (as if) that he is not sick enough to be off work… and so the story ensues with an exploration into the penalty system introduced by a man who was actually found to mislead within his CV (according to BBC News night) one Mr. Iain Duncan-Smith.

You cannot be serious..

I know many of you are medical professionals – proper ones, not deemed so by a job title that reflects the ability to read a questionnaire containing medical terminology. So I am sure that some of you will have had experience of being confronted by those less qualified, purporting to know better…. which these days seems to be most people in political office.

Clearly none of us want a society where it is easier and more rewarding to “do nothing” than to provide something of value to others. We don’t want to encourage a culture of benefit vultures or tourists. However this is loaded with political sentiment and bias. One might make the case that a rich businessman that pays no taxes is also a benefit scrounger, not “paying their way” for all the things that the rest of us mere mortals believe important for the wider society.

It seems to me that “the system” simply isn’t very good and attempts to make it work rather better because of bile generated from supposed “journalists” have failed spectacularly.

There’s something very wrong with this isn’t there?

My own former MP was at a hustings and said he was “proud that we have a food bank here” which is hardly something to be proud of, merely reflecting the failure of our “first world” social system and is actually a reflection that the local people believe that this is very wrong, and respond to a very real, very human problem.

Planning upon uncertainty

As for your financial plan… well at the heart of this is the ability to do your sums. To live within your means… which is a lot easier when you are healthy and let’s be honest, wealthy (by comparison). However when health becomes an issue, you have probably ensured that you have savings and insurance to cover certain eventualities (well if you took my advice you did). So it will always appear easier to cope than it is in practice, because you and I are fortunate enough to have enough to plan and think ahead, even thinking about the bleak, improbable and perhaps unlikely. Part of my job is to reduce reliance on the State system by creating independence of it, self-sufficiency. This is not the same as being disconnected or unconcerned, which is the general line taken by those who have chosen to “critique” the film for being an extreme example….

Ok, there will always be some people that want to do nothing and expect something, but I struggle to believe that is how most of us behave. Most want a better life, not a benefits life. When I talk of lifestyle financial planning I am not advocating one of selfish disconnection, but of self-direction.

Anyway, wherever you are on the political spectrum (and I find myself finding some merit in most arguments from all sides) here is the trailer for a truly valuable film.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk