WAITING LONGER FOR YOUR PENSION

TODAY’S BLOG

WAITING LONGER FOR YOUR PENSION

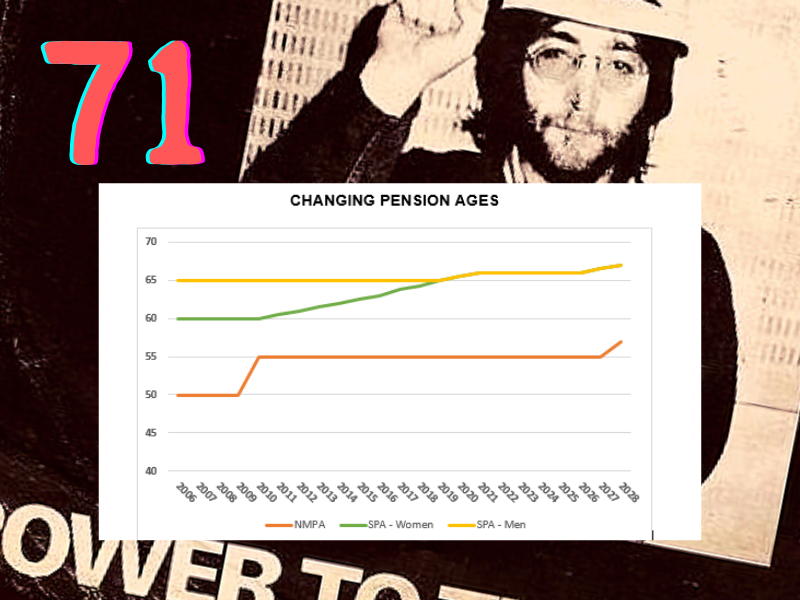

The start of the next increase to state pension age (SPA) is still nearly five years away, at which point it will be phased up to 67 by April 2028.In the meantime, the Government has confirmed a rise in pension age for private pension provision that was originally suggested in March 2014.

THE NORMAL MINIMUM PENSION AGE – NMPA

The increase is to be made to the normal minimum pension age (NMPA). This is the earliest age from which non-state pension benefits can be drawn, subject to very limited exceptions. The current NMPA is 55, set in 2010 as 10 years below the then male SPA of 65. The new NMPA from 2028 will be 57, 10 years below what by then will be the SPA for both sexes.

57 IS THE NEW 55

The Government has indicated that there will be exceptions to the higher NMPA covering:

- Members of the armed forces, police and fire services pension schemes, who will have a ‘protected pension age’ of 55;

- Anyone who has a protected pension age for scheme benefits arising from the last increase in NMPA; and

- Anyone who, on 11 February 2021, had a right under a pension scheme to draw benefits before age 57. In this context, the right has to be unqualified, i.e. there must be no requirement for consent from any other person, such as a trustee or employer. It will also apply on an individual scheme basis, so you might find some benefits can be drawn before 57, while others cannot because consent is required.

It would appear that if you have a personal pension established by the February cut-off date, you will generally meet the ‘unqualified right’ requirement, giving you a protected pension age of 55. However, some experts believe this could change when the necessary legislation emerges. When the previous NMPA increase was made, there was no such protection for personal pension owners.

Born between April 1971 and April 1973?

If you were born on 6 April 1973, you are potentially the worst hit by the change, unless you have benefits that are subject to a protected pension age. That is because you will reach your 55th birthday on the very day the NMPA increase to 57 takes effect – unlike the changes to SPA, there is no phasing in of the change. If you were born in the preceding two years, you will be in the odd position of being able to draw benefits at age 55 until 5 April 2028, but then need to wait until you reach age 57 before setting up any new drawings from you pension.

A realistic retirement age?

The idea of retiring at 57, yet alone 55 may sound appealing, but is it at all realistic? Consider these two factors for a start:

1. At age 57, the average man has 27 years of retirement ahead of him, while the average woman has 30, according to the Office for National Statistics. 1 in 4 of those men will live until age 92, the corresponding age for 25% of women is 94.

2. From 2028, there will be a gap of at least 10 years before your state pension starts. With the current state pension of £179.60 a week, that means an income hole to fill of at least £93,400 (plus inflationary increases).

A recent report showed that the average age of those ‘retiring’ in 2021 was 60. However, it also revealed:

- 37% had brought forward their retirement in the past year, with the three main reasons being pandemic related;

- 27% will work part time to support themselves in retirement;

- 37% were worried about not having enough money to last through retirement;

- Two thirds of retirees risked running out of money in retirement according to calculations by the report’s authors, even though the planned average total spend was a modest £21,000 a year.

ACTION

The change to a normal minimum pension age of 57 is largely irrelevant – few people can afford to retire so early – but it might affect you if you plan to draw some benefits early, e.g. to clear a mortgage.

Are you sure your planned retirement age is not going to leave you among those two thirds who might run out of money before they run out of life? Thats the main purpose of proper financial planning – to help ensure that your funds do not run our before you do. The sooner you know where you are, the quicker you can, if necessary, make the necessary adjustments.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084