YOU ARE ALREADY READY – WIMBLEDON AND WINNERS

TODAY’S BLOG

YOU ARE ALREADY READY – WIMBLEDON AND WINNERS

I was watching the local tennis tournament in Wimbledon and for some reason a comment by the BBC commentator, John Inverdale struck a chord. It wasn’t a particularly unusual comment and nothing new, but for some reason it resonated, and I think he was spot on.

He said (and I may paraphrase)

“I was at Roehampton last week for the qualifying, I was interviewing one of the players that got through and asked: at match point, one point away from qualifying, what were you thinking? the answer was I wished I was anywhere but there… which is very different from a Champion who revels in such moments.

If you didn’t know who they were, you wouldn’t be able to tell the difference between most players, but it’s at the key moments, when the match is tantalisingly poised… invariably it’s the It’s the champion that’s been there more often who comes through.”

Apologies to Mr. Inverdale if I haven’t transcribed that perfectly. Anyway, if I understood correctly, he was really stating that winners seem to win more frequently because they are better in the tense moments. Something that I suspect we might all agree on.

YOU’VE GOT THIS…

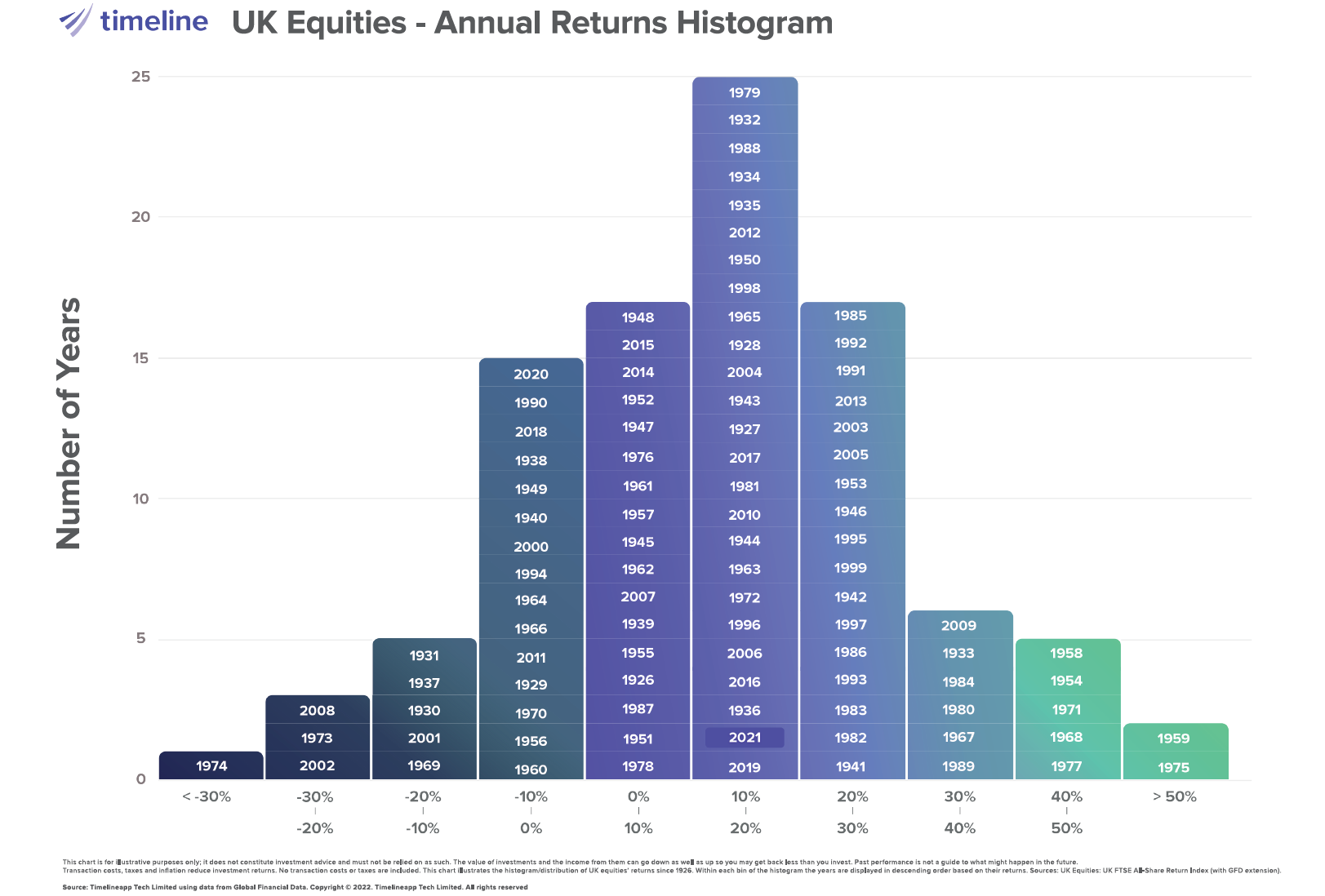

It reminded me of a chart that I have been using with clients recently. We know that markets have been difficult or “volatile” this year. The histogram I have been discussing is this one.

In simple terms it shows the calendar year returns of the UK stock market from 1926 to 2021. Everything right of 0% (column 5) ending the year positively, to the left (the first four columns) – negatively. The good news is that since 1926 there have been rather more years of positive returns (72/96) or 75% of all years.

I’ve been considering how we all handle stock market crashes and I think its right to remind ourselves of the awful investing years that we have lived through… depending on when you became an investor (most of you would not have been investors (aged 18) before 1955). So it seems reasonable to point out that you have lived through more than your fair share of bad investment years… you’d have to be at least 67 to have been an adult investor in 1973 and 1974, two of the worst years, but I suspect most have experienced 1990, 1994, 2000, 2001, 2002, 2008, 2011, 2018, 2020. Returning to the tennis analogy, these were the tense, big moments. You held your nerve and survived. You are still here; you and your portfolio have survived.

The way media and arguably regulation presents investment is to focus on the negative years. We can agree and acknowledge that “bad years” for investors come around regularly – 1 in 4 is a negative year. We are all adults and know this. Whatever is thrown at us over the coming months you have the genuine life experience to fall back on. You have been here before. Hold fast and play the long game, progressing through your own journey to the final.

If you are concerned about your portfolio please get in touch with me. If you know someone that is, why not suggest that they get in touch too. The greats all have coaches, but talent is what you possess already. A coach seeks to maximise yours.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084