Lost pensions

Dominic Thomas

July 2023 • 8 min read

Lost pensions

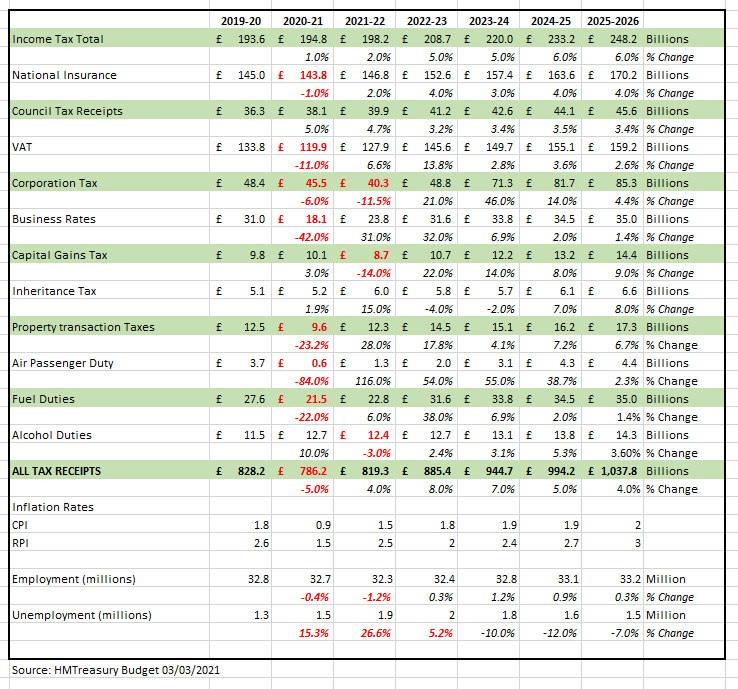

The world of pensions is ever changing, a phrase that three decades ago I thought could never be uttered with a straight face, such was my naivety. The last three decades have seen a vast amount of change which has left most of us attempting to follow a paper trail of who took over who, a bit of head scratching, trying to remember who took over Clerical Medical or Friends Provident, Sun Life, Equity and Law, Norwich Union and hundreds of others.

KNOW YOUR EAGLE STAR FROM YOUR COMMERCIAL UNION

Today, the pension provider landscape looks nothing like it did. Indeed, traditional pension companies have largely disappeared or sold their legacy of pension funds to someone else. This has often not been a spectacular success, with constant promises that you (and we) are important, but evidently not important enough to answer the phone before a change of Chancellor.

1 IN 4 PEOPLE HAVE LOST A PENSION

Add in the regular movement of investors as their careers unfold and you have such a mess that not even an angry teenager’s bedroom would surpass. A recent survey (warning with them all about extracting data from a small sample to 66m people, but that said..) showed that 1 in 4 people believe that they have a missing or lost pension. I’m a little surprised it isn’t a higher proportion.

There are a multitude of small pots of pension benefits, sometimes pennies but sometimes thousands of pounds. Many of you may remember “contracting out of SERPS” in the late 1980s or early 90’s… some of these pensions have had several decades of growth and worth a princely sum. It is certainly worth checking.

PROCRASTINATION WILL COST YOU INCOME

Too regularly good intentions to “sort out my pensions” is deferred until a better time. I understand this very normal reality but it carries a cost. A lot of old pensions are very expensive by today’s standards and those charges are eating away at returns. Then of course, there is the issue of the returns themselves – are the funds appropriate, suitable to your long-term ambitions?

The good news is that even the Government have a service for lost pensions. You can find the link in our conveniently entitled “useful links” page – Lost Policy Finder. Of course, if you already have the details and they are sitting in a drawer somewhere, send us a copy so that we can assess it for you, don’t leave it until you take your retirement more seriously, we want to help you avoid using the phrase “if only I had got this to you earlier”.

GETTING READY FOR RETIREMENT… THE SOONER THE BETTER

As a not very aside, side note…. Do also have a go at our “Retirement Ready?” quiz if you are yet to retire, and please SHARE this information with people you care about, helping everyone to become more financially informed as well as financially independent, is one of our reasons for being here.