Mixed messages of mortgage market

Dominic Thomas

March 2024 • 6 min read

Mixed message of mortgage market

I wonder if I’m exaggerating if I suggest that property is such a UK obsession that it is the political dividing point between the ‘haves’ and the ‘have nots’. Think about it – what policies are designed to protect and inflate the value of property and which are there to house people (irrespective of your political beliefs or persuasion)? The value of mortgage borrowing in the UK is now £1,657.6bn 1.1% lower than last year.

Anyway, the current Government is keen to reassure us that the UK is not really in a recession and talking about one merely leads us into one through negative talk. We know that the Chancellor considered offering guarantees to banks if they issued 99% mortgages, but this never made it into the final list of ideas, probably because most of us thought it was daft.

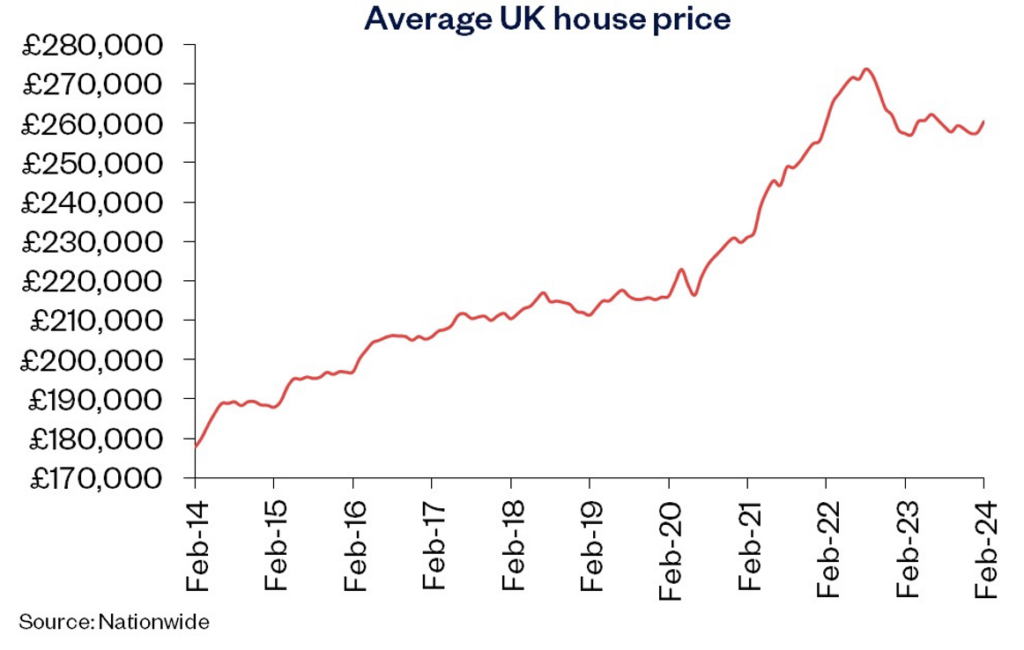

Meanwhile the UKs largest Building Society Nationwide (who have recently bought Virgin Money for £2.9bn) report that property prices have been rising, up 0.7% in February 2024. The average house price is now £260,420 up 1.2% over 12 months. This is in contrast to the figure that the Land Registry produce of £284,691 for December 2023.

As our office is currently based in SW20, the average price of all property in the area was £555,262 but for a detached house £1,604,983, or a semi at £884,485, a terraced house at £611,401 and a flat or maisonette at £390,792. You can search your location using the UK House Price Index here

On the other hand, reports from the Bank of England also show that mortgages in arrears (missed payments) now stands at around 13.2% of mortgages.

Comparing the last two quarters of 2023 (Q3 and Q4) isn’t really ‘fair’ as we all know that most house buying and selling is done in the summer months (Q3) not over the Michaelmas term. So in that context, the Bank reports that new mortgage commitments is down 21.2% comparing Q4 in 2023 with 2022. The value of advances is down 33.8%. In Q4 2022 £81.6bn of loans were agreed, a year later it is £54bn.

The number of First Time Buyers continues to decline, from 351,000 in 2019 to 287,000 in 2023. Affordability is the key phrase in lending these days and rising rates have evidently placed pressure on borrowers, stretching their mortgage over greater lengths to make the monthly repayments more ‘affordable’. I imagine most of us are familiar with a 25-year mortgage, but 1 in 5 (20%) first time buyers takes on a 35 year mortgage, double the number a year earlier.

“It was the same in our day”… no it was not.

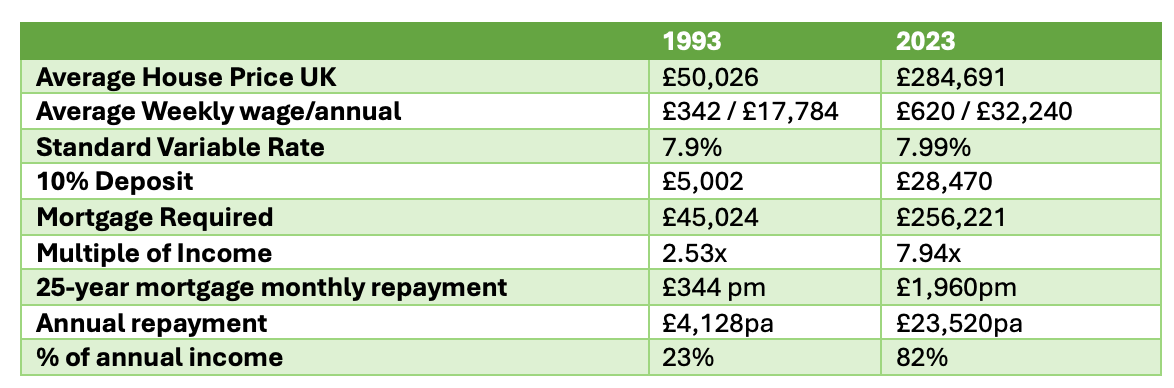

You will likely have heard or thought that everyone struggles at first with a mortgage and their finances. That’s true, but it’s worse for young people these days, much worse. Admittedly everyone is different, there are enormous regional variances, but if we go with averages for the UK, here are some facts that may convince you that buying a coffee and avocado on toast really isn’t the issue. The system is broken and it is deliberately set up to favour property owners here in the UK. Most law is based around the notion of property ownership.

As is evident from the above, clearly it is not possible for someone wanting the average mortgage with the average income to afford the monthly repayments on a 25 year loan, so lenders have responded by offering longer durations. This does not address the problem, it merely keeps the system going and keeps young people in debt until they are definitely not young! Of course better mortgage rates can be found (true in both periods) and of course property prices differ as noted in my local example of an average flat in Merton being more expensive than the average UK home.

If you factor in other costs that young people have which you and I did not have in 1993, it would include student loans and auto-enrolment pensions. The latter being a very good thing, the former being a State-wide fleecing (my opinion).

Yet, I suspect that you and I are likely to presume that these same young people will be happy to do all those jobs that keep civilized life ticking along, from emptying the bins, caring for the elderly and unwell to policing our streets and running the country. I imagine that they may not be quite so enthusiastic to keep doing the work and the paying of taxes to support it.

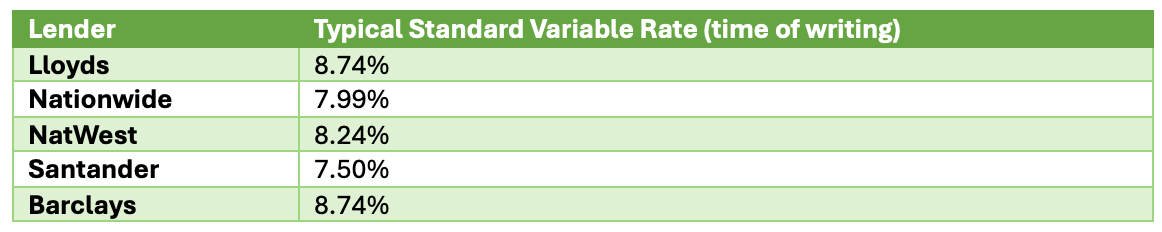

Remortgages, which you would think should be increasing as people shop around for better rates are actually in decline from 849,000 in 2021 to 538,000 in 2023. The table below makes me wonder why on earth people are not remortgaging. I do hope that it isn’t a sense of fear. To provide a reminder let’s consider mortgages and houses in December 1993. The average property price was £54,026 (Land Registry) and the standard variable mortgage rate was about 7.9%. The average salary in 1993 was £17,784 in December 2023 it was £32,240.

Perhaps your energy costs are starting to subside, if you have a mortgage or pay rent, I am sure you will have been aware of the increases in your monthly costs, at least if you have had to renegotiate terms. Variable rates are considerably higher than they were a few years ago. There is a fair chance your mortgage is with Lloyds, Nationwide, NatWest, Santander or Barclays who account for 64% of the entire mortgage market. The top nine lenders in 2022 (out of 79) affirm Pareto’s law of having 80% of the market from 20% of the players (or less).

Anyway, in terms of your financial planning, we don’t arrange mortgages, but advise you speak to Martin and his team at London Money (see our professional contacts page). You may be concerned about your children or grandchildren getting onto the property ladder or perhaps downsizing to release equity at some point. Please ensure that you keep us up to date with any changes in your thinking about how you intend to use property in relation to your planning.

Reference: Bank of England: Mortgage and Lender Administrators Statistics 2023 Q4 (LINK HERE)

Reference: UK Finance: Household Finance Review, latest data Q4 2023 (LINK HERE)

Reference: UK Land Registry: UK House Price Index (LINK HERE)