Investing: Greece is the word

Greece is the Word

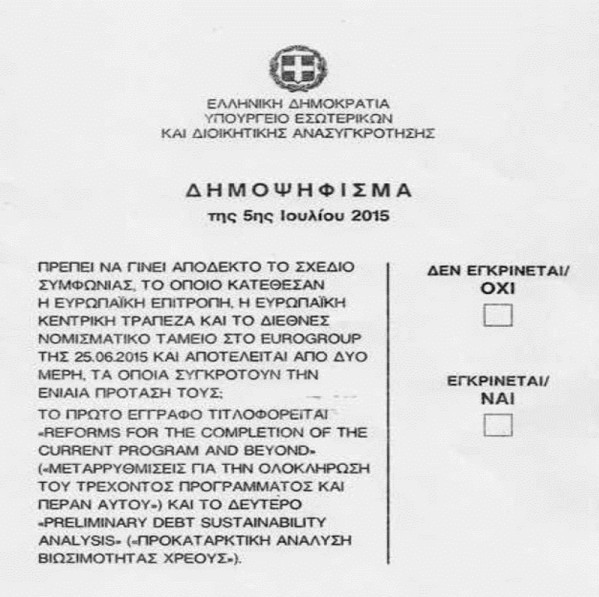

The world’s markets and media financial pages have been consumed by a single issue in recent weeks—the stand-off between debt-laden Greece and its international lenders over the conditions of any further bailout. For investors everywhere, both of the large institutional kind and individual participants, the story has been fast-paced and difficult to keep up with. More importantly, the speculation about possible outcomes has been intense.

Of course, no-one knows the eventual outcome or whether there will even be a definitive conclusion. After all, this is a story that has been percolating now for six years, since Greece’s credit rating was downgraded by three leading agencies amid fears the government would default on its debt.

Since then, the Greek situation has faded in and out of public attention as rescue packages came and went and as widespread social and political unrest gripped a nation known as the birthplace of democracy.

But there are a few points to keep in mind. Despite the blanket media coverage of Greece, this is a tiny economy, ranking 51st in the world by GDP in purchasing power parity terms (which takes into account the relative cost of local goods).

On this measure, Greece is a smaller economy than Qatar, Peru or Kazakhstan, none of which currently feature prominently in world news pages. Its economy is about half the size of Ohio in the USA or New South Wales in Australia and about a tenth of the size of the UK. Even within Europe, it is tiny, representing only about 2% of the GDP of the 19-nation Euro Zone.

Size is everything

As a proportion of global share markets, Greece is also a minnow. As of early July 2015, it represented about 0.32% of the MSCI Emerging Markets index and just 0.03% of the MSCI All Country World Index.

And while its total debt is large in nominal terms and relative to its GDP at about 180%, this still represents only about a quarter of 1% of world debt markets.

Of course, what worries investors is not so much Greece itself but the wider ramifications of the debt crisis for its European bank lenders, for the future of the single European currency and for the global financial system.

Yet, many of these concerns are already reflected in market prices, such as in Greek government bonds, the spreads of peripheral Euro Zone bonds, regional equity markets and the single European currency itself.

While no-one knows what will happen next, we can look at measures of market volatility as a rough guide to collective expectations. A commonly cited measure is the Chicago Board Options Exchange’s volatility index, sometimes known as the ‘fear’ index. This has recently spiked to around 18 from 12 in mid-June. But keep in mind the index was up around 80 during the peak of the financial crisis in 2008.

Of course, the human misery and dislocation suffered by the Greek people through this crisis should not be downplayed, neither should the financial risks. But from an investment perspective, there is still little individual investors can do beyond the usual prescription.

Perpective

That prescription is to remain disciplined and broadly diversified across countries and asset classes and to be mindful that markets accommodate new information instantaneously. So the risk in changing one’s portfolio in response to fast-breaking news is that you end up acting on events that are already built into security prices.

In summary, the events in Greece are clearly worrisome, but Greece is a very small economy and a tiny proportion of the global markets. Events are moving quickly and prices are adjusting as news breaks and investor expectations adjust.

For the individual investor, the best approach remains diversifying across many countries and asset classes, remaining focused on your own goals and, most of all, listening to your chosen advisor, who understands your situation best.

Jim Parker

Vice President, Dimensional

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk