The Budget 2016

The Budget 2016

There’s nothing like the Budget to divide people along political lines, I shall refrain from making political statements. All Chancellors perform a merry dance taking from one pocket to give to another, the current Chancellor is no exception (indeed there are none).

Lifetime ISA & Pensions

The stand out issues are that there has been no attack on pension tax relief, as leaked following leaked rumours that it would be. However a new Lifetime ISA looks a lot like a pension – with an effective tax relief of 20% but maintaining the ability to access the money before retirement (before 55). This is much like Individual Retirement Accounts in the US and something that many have called for over the years. The problem is simply that a pension has the advantage of being a long-term lock away pot, there for your retirement. Enabling people to access funds earlier is designed to help homebuyers. On the surface this is a good thing, in practice access to money does not deal with the problem of over-priced housing, if anything it is likely to make things worse (think about it).

That said the ISA allowance is going to rise to £20,000 – which is good news for investors seeking tax-free growth. If I were a cynic I might suggest that these two issues are connected – the prospect of a lifetime allowance for ISAs could be introduced for all. So reading between the lines, the direction of travel seems to be to have 20% tax relief, accessible funds, but restrictions on the value of the pot…. we shall see in the fullness of time.

The Chancellor also appears to have tidied up some of the older tax rules about inherited pensions. When somone dies before 75 with a pension in drawdown, there is no tax to pay by the beneficiaries, after 75 the proceeds are taxed at the recipients marginal rate of tax (which could be 0% or up to 45%).

Pension Advice

The Money Advice Service (funded by levies on financial advisers and pension companies) is to be scrapped, it isn’t working and the name itself is misleading (it’s not advice, but information). I along with many others was peeved about the advertising which suggested a return to the lie that financial advice is free – it never has been and never will be. Given that this was paid for by levy, it felt rather like the biting the hand that feeds. In any event, go-faster stripe paint at the ready… there will be changes (hmm… plenty of opportunity to get some consultants in to test new names, design a logo that will inevitably be less than satisfactory).

Employers that pay for pension advice to employees can currently claim £150 per head without it becoming a benefit in kind (and taxable on the employee) this is being raised to £500 per head. I wonder what might happen…

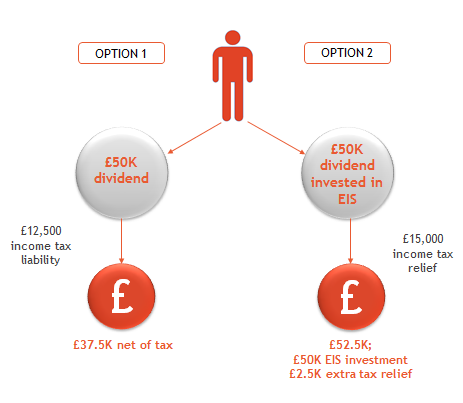

Capital Gains Tax

The rate of tax payable on capital gains is to be reduced to 10% and 20% (from 18% and 28%) and further suggests a more streamlined approach to taxation, where income taxes and other taxes seem to be at similar rates. I would welcome this as it moves towards a more genuine tax simplification and reduces the number of tax rates, making life easier for planning effectively. The new CGT rates come into effect from 6th April 2016… which will help those lucky enough to nurse some investment gains of late.

Personal Tax

The personal allowance is increasing to £11,000 from 6th April and to £11,500 from 6th April 2017. The amount of income you can earn before the 40% tax rate begins has also been raised. This will not help anyone earning more than £100,000 at which point the personal allowance begins to reduce by £1 for every £2 of income over £100,000.

Small Businesses

Corporation tax is due to fall further, this is a tax tool designed to help encourage enterprise and I think we all welcome actions to stop businesses legally evading tax through transfer pricing etc – the Starbucks or Google loophole looks like one that may be closing…. we shall see.

Small businesses also look set to benefit from rates being cut – which of course is very welcome, its a very odd tax. Business owners do not get to vote for their local authority unlike council taxpayers and many find the costs punitive. Most will be receiving demands this month for the next year and be very pleased at the prospect of a reduction in 12 months time (if I have correctly understood when it will be introduced).

Other stuff… the Budget will be dissected in the media, you will possibly be bored with it already. Of course its important, but the issues invariably are about attempting to make the bad news look good and the good news look “absolutely fabulous” (all Chancellors, all parties). These things tend to come out in the wash… can you remember the Budget from 2011 or 2012? probably not…

Solomons APP

All the changes will hopefully be updated on our APP by the end of the evening. Do let me know how you are getting on with the APP – its full of useful calculators and tools… but only if you use them. Its free to download and use – so do tell others. Don’t forget it works on iphone, ipad and Android.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk