What IS an ISA?

Daniel Liddicott

Sept 2023 • 12 min read

What is an ISA?

An Individual Savings Account (ISA) is a tax-efficient account available to residents of the United Kingdom. The main perk of an ISA is that any interest, dividends or capital gains you earn within the account are exempt from income tax and capital gains tax (CGT). This means that the money you make from your investments stays ‘in your pocket’, helping it grow faster over time.

Types of ISAs:

There are several types of ISAs, each designed for specific savings goals and risk tolerances:

- Cash ISA: This is similar to a regular savings account, where you deposit cash, and it earns interest over time. It’s a low-risk option ideal for short-term savings goals

- Stocks and Shares ISA: If you’re willing to invest with a long term mindset, a Stocks and Shares ISA allows you to invest in stocks, bonds, and other financial instruments. Over the long term, this can offer better returns than a Cash ISA

- Lifetime ISA (LISA): Aimed at helping you save for your first home or retirement, the Lifetime ISA provides a government bonus on your contributions. You must be between the ages of 18 and 39 to open a Lifetime ISA. There are some restrictions on withdrawals, so it’s essential to understand the terms

- Junior ISA (JISA): If you’re under 18, a Junior ISA is designed for you. Parents or guardians can open one on your behalf, and it can be converted into an adult ISA when you turn 18

A simple breakdown of how ISAs work:

- Choose your ISA type: Determine your savings goal and risk tolerance. For short-term goals or risk-averse investors, a Cash ISA might be best. If you’re looking to grow your wealth over the long term, consider talking to us about a Stocks and Shares ISA

- Open an ISA account: You can open an ISA account through banks, building societies, investment platforms (if you use a financial adviser), or even online. It’s a straightforward process, requiring some personal information

- Contribute: You can make deposits into your ISA account of up to £20,000 each tax year. Keep in mind that Junior ISAs have a lower limit of £9,000 each tax year. These are separate allowances, so depositing £9,000 into your child’s JISA does not count towards your own ISA allowance of £20,000.

You can contribute up to £4,000 per tax year into a Lifetime ISA, which will use up some of your ISA annual allowance. This means that you could contribute a further £16,000 to another adult ISA. The 25% bonus that you receive from the Government on your Lifetime ISA contributions do not use up your ISA annual allowance, meaning that you could have £21,000 added to your ISAs in this way each tax year (£4,000 to your Lifetime ISA + £1,000 Government bonus + £16,000 contribution to other adult ISA).

If you have a child who is 16 or 17 years old, they are entitled to both a Junior ISA and an adult ISA, meaning that they are also entitled to BOTH of the annual allowances that come with them. This means that the amount that can be saved into ISAs on behalf of these teenagers can increase from £9,000 per year to £29,000 per year. Note that the adult ISA during this transition period must be a cash ISA. Once they turn 18 years old, however, their annual allowance will revert back to the standard £20,000 per tax year – so there are only two years in which to take advantage.

- Invest: If you opt for a Stocks and Shares ISA, you can start investing your money in a diversified portfolio of assets. Remember, investing carries risks, and it’s crucial to do your research or seek advice

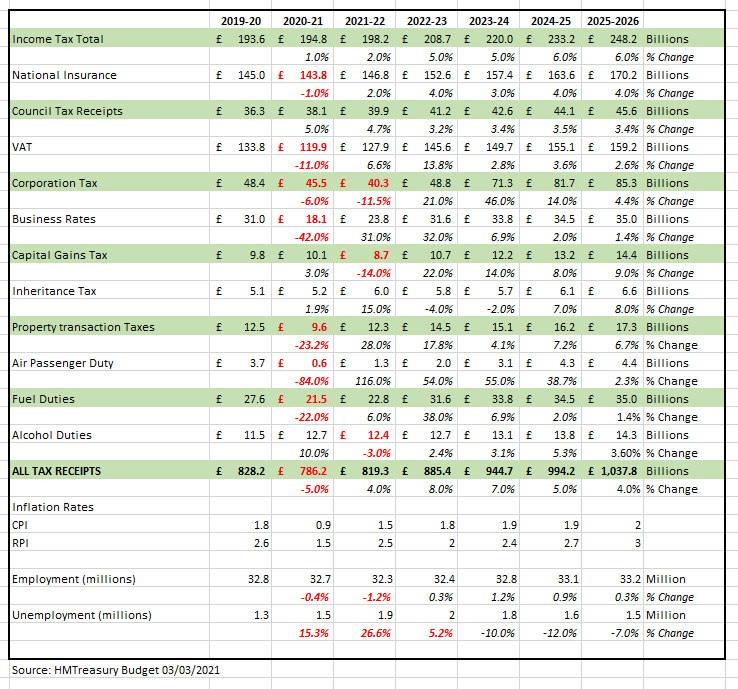

- Earn Tax-Efficient Returns: Any interest, dividends, or capital gains you earn within your ISA account remain exempt from CGT and income tax. This is a significant advantage that can help your wealth grow faster. You might easily fall into the trap of thinking that ISAs are tax-free, but that isn’t the case. ISAs are subject to inheritance tax (IHT)

- Monitor and Manage: Keep an eye on your ISA’s performance and ensure you stay on track with your savings goals (or use a financial adviser to do this for you). As you get older, your priorities may change. People often shift in their approach towards certain things for a variety of reasons. This could manifest itself as a change in attitude to investment risk, for example; or taking a decision which requires capital such as purchasing a property.

General tips

- Start Early: The earlier you start saving or investing, the more time your money has to grow due to the historical long-term nature of markets.

- Government Bonuses: If you opt for a Lifetime ISA, you can benefit from government contributions. You can deposit up to a maximum of £4,000 into a LISA each tax year and the government will contribute 25% of what you deposit. You can do this each year until you reach the age of 50. The funds within a Lifetime ISA can only be accessed without penalty for the purchase of a first home (maximum value of £450,000) or once the account holder has passed 60 years of age. Should you wish to dip into this ISA for any other reason, you will be charged 25% on the withdrawal – and you don’t just lose the amount of bonus you receive:

Example:

£4,000 contribution + £1,000 bonus = £5,000

£5,000 withdrawal – £1,250 (25% penalty) = £3,750

Result = a loss of £250 (6.25% loss on the original £4,000 contribution)

Conclusion

Understanding ISAs is an important step towards securing your financial future. Whether you’re saving for a car, a house, or your dream holiday, ISAs offer a tax-efficient way to grow your money over time. Remember to research your options, set clear savings goals, and consider seeking financial advice if you’re unsure about your investment choices. With the right approach and discipline, you can use ISAs to build a solid foundation for a prosperous financial future.