Business Owners and EIS

This item is aimed at business owners and how an EIS might be of use.

Many business owners are growing increasingly frustrated about the tax associated with extracting profit from their companies. Often referred to as “double taxation”, a company owner must first face corporation tax on profits made by their business and again when they decide to pay themselves a dividend/salary. It can at times, feel like you are working for HMRC.

An Enterprise Investment Scheme (EIS) can be used to extract profit from a business tax efficiently. EIS was introduced by the UK Government in 1994 in order to induce investment into UK smaller companies. In order to make investing in smaller companies more attractive, compensating the additional risks, there are a number of tax reliefs available through EIS investments (providing you hold your investment for at least three years).

| Income Tax Relief | CGT deferral | IHT relief |

|---|---|---|

| Reduction in income tax liabilities amounting to 30% of the total investment | Facility to defer paying CGT on all, or part, of a chargeable gain by investing the gain into EIS qualifying shares | EIS companies qualify for Business Property Relief (BPR) |

| Relief can be applied to the current or previous tax year | Investors can defer CGT by using EIS up to 12 months before crystallising gains or up to 36 months afterwards | As long as shares have been held for 2 of the last 5 years and are held at time of death and remain BPR qualifying, the value of the EIS investment will count as part of your estate but will have a nil value for IHT purposes |

| The maximum amount of income tax that can be claimed is £300,000 for the current tax year and £300,000 for the previous tax year | ||

| Relief cannot exceed the amount which reduces an investor’s income tax liability to nil |

Business Owner – Double Tax

Mr Williams, normally a higher rate tax payer, owns a small business. He pays himself a £10,600 salary per year in order to stay within his personal allowance; no income tax is paid on this amount. In addition to this salary he pays himself a dividend each year which attracts an income tax liability. However, he is still frustrated with the amount of tax paid on the dividends.

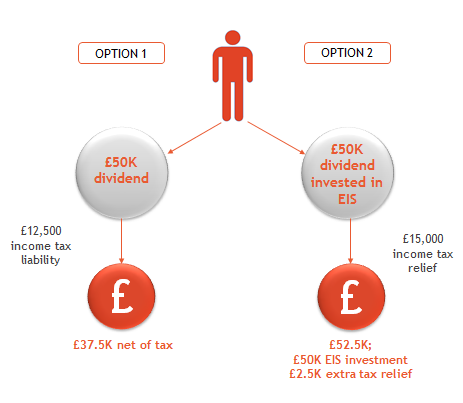

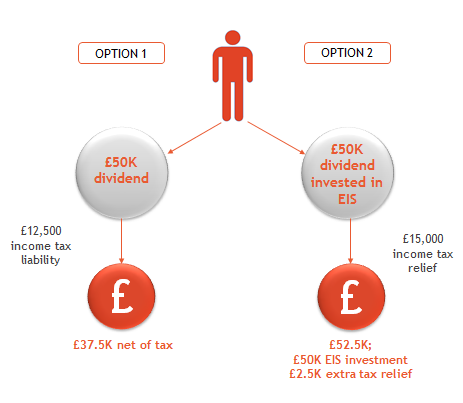

If Mr Williams pays himself a £50,000 dividend, he will owe 25% (£12,500) in income tax on this (once we take the tax credits into account). This will leave him with £37,500 of net funds in his account after paying the tax.

If Mr Williams invested £50,000 into an EIS, he will be entitled to 30% income tax relief (£15,000). This tax rebate can be used to wipe out the £12,500 due on the dividend. It also leaves him with an extra £2,500 of income tax relief to set against other income tax he has paid across the current and/or previous tax year.

He is left with a £50,000 EIS investment, which he can liquidate once he has held the investment for three years. Providing the EIS investment has, at least, preserved its value Mr Williams has saved £15,000 in tax as a result of this investment.

Any growth within his EIS investment is tax free, as per the EIS rules.

My example, implies that Mr Williams has adequate resources elsewhere, so that he can invest £50,000 rather than it being needed for income. The word or note of caution, is that an EIS is obviously an investment and at the higher end of the risk spectrum (though running your own business obviously carries risk). Whilst investing in smaller companies often involves higher levels of risk and worse levels of liquidity, many investment companies offer EIS investments that target capital preservation. These investments involve companies with long-term, index-linked and stable cash flows.

Want to know more? – get in touch.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk