Traitors and behaviours…

Jemima Thomas

Jan 2023 • 5 min read

Traitors and behaviours…

I love binge-watching a TV series and a good murder mystery is my favourite, so naturally it’s no surprise I tuned into the BBC’s latest reality TV series, The Traitors. Two months on, and the show has been streamed more than 28 million times on BBC iPlayer. To say it has been a success is an understatement, and there is now a US version (yes I have also eaten my way through this too!), which has also been a brilliant watch.

The basic ‘plot’ is that 22 strangers are moved into a castle in the Scottish Highlands to complete a series of challenges and missions together as a team, to add to a pot of money that they might win at the end of the game. The game consists of three secretly-assigned ‘traitors’ and the rest being ‘faithfuls’. The goal of the game is for the faithfuls to collectively reach the final, where they’ll be able to split the winnings. However, if a traitor (or traitors) manage to reach the final, they get to take the pot of money for themselves. Throughout the game, the three traitors are secretly lurking, sabotaging the efforts of the others and picking off contestants one by one. Each evening, contestants gather around a table to ‘banish’ someone they suspect of treachery. It’s the ultimate game of detection, backstabbing and trust, the faithfuls must root out the traitors amongst their ranks to win; or risk losing everything.

On paper I’m not sure this sounds quite as thrilling as it was to watch play out, but I can assure you (if you haven’t already watched) that it’s incredibly gripping and shocking to see the lengths to which people will go to defend themselves under pressure. With everyone feeling confused, sketchy (or not!) behaviours become magnified and analysed, and emotions quickly run high as the days pass. It’s safe to say that they all seem to become a little mad as a result of not knowing who to trust. Morals are thrown all over the place, and each person quickly becomes defensive (and sometimes aggressive) in order to convince other team members that they are in fact a faithful.

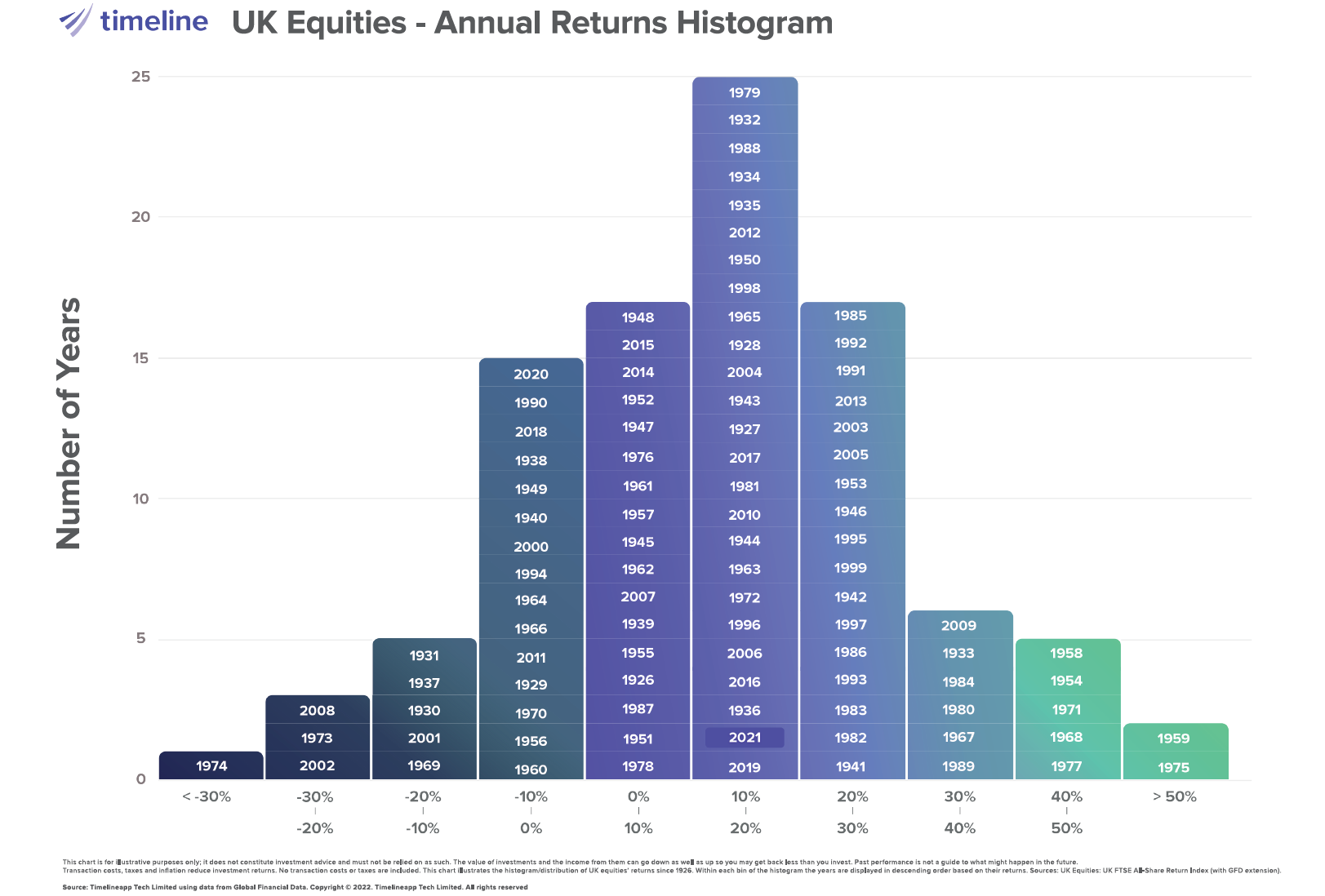

I’m very aware that trust and money are two of the most important aspects of financial planning. You have to trust that although the stock market will dip, it will inevitably rise again (albeit very slowly at times), you have to trust that your money is in the safest hands, and that your long term goals will be possible. Our behaviour around how we manage our feelings on this is vital.

This brings me to the book I was reading a few months back, Psychology of Money by Morgan Housel. It’s a brilliant easy read on how money isn’t necessarily ‘what you know’, but ‘how you behave’. Housel says “behaviour is hard to teach, even to really smart people”. He shares a number of short stories exploring the strange ways people think about money, and how people tend to make financial decisions as a result of their background, marketing, and intuitive knee-jerk decisions.

We have a few copies of Morgan’s book available, so do contact us if you would like to receive a copy and we will send one out to you. I highly recommend watching Traitors (and the US version if you enjoy the UK one!) and to set some time aside to read Morgan’s book if you can.