The Best Laid Plans Might Involve An Alternative Or Two

The Best Laid Plans Might Involve An Alternative Or Two

Yesterdays stock market falls are very unwelcome news, but perhaps it will cajole the politicians and bureaucrats into action to address the problems within global economies. As a part of my role, I seek out a range of investment opportunities, besides those simply of shares. Shares (or equities) are obviously volatile but have a proven long-term track record, however there are other forms of investing that can be helpful to those looking to diversify beyond the available cash, bonds, property and equity funds. One such opportunity might be to consider investing in the film industry.

Most people will be aware that there are many films that don’t make it to the big screen – a serious number. This may have little to do with the quality of the film (think of all the dire blockbusters that you have seen over the years) yet every once in a while a “small film” finds massive commercial success. In recent years, from a British perspective this might have included “Slumdog Millionaire” and “The Kings Speech“. These are generally unexpected and very welcome successes. Most of the time, films do not find such international success.

That said, success is a term that can be rather misleading. As an investor what one really wants to achieve is a positive return on capital. Investing in film needs to be done carefully, largely due to the way that films are financed, not the way they are edited. Commercial and financial success hang upon the way a film is distributed and in 2011 this includes DVD, rental, pay-per-view, download and cinema release as well as the possibility of merchandising.

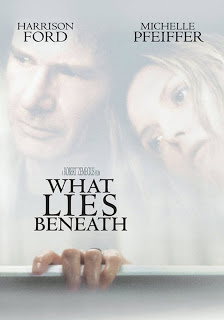

Last night I was doing some research on your behalf at a private screening of “Best Laid Plans” which is produced by Molifilms, whose MD, Mark Foligno also executive produced “The Kings Speech“. The film is one of several that are part of a financing investing opportunity for those with a minimum of £25,000. This would be an investment in an Enterprise Investment Scheme and therefore would qualify for tax relief on the investment of up to 30% (this was increased from 20% in the last Budget but not yet finalised). So a £25,000 investment ought to see £7,500 returned to the investor in tax relief (a net investment of £19,250). In addition, provided the shares are held in the company for 3 years there is no capital gains to pay. Sounding better still. Of course how the EIS is structured, the underlying financing and management of the business (Mark Foligno who has a strong pedigree with considerable success) are all vital elements in assessing whether this is a good investment, let alone an appropriate one.

As for the film itself, it is a pithy, dark tale of a life of grime and crime in Nottingham. In many ways not unlike “One Flew Over The Cuckoos Nest” with one of the main characters having significant learning difficulties – the gentle giant who is taken advantage of my some fairly unsavoury characters. Unlikely to have box office “success” but a movie that many will probably see. The lead actor, Stephen Graham, who recently appeared in “Tinker Tailor Soldier Spy” is particularly good. It is not everyone’s cup of tea, it’s a raw life urban Brit flick.

As an investment – well I’m still conducting my “due diligence” but if this sort of investment appeals to you, then you could have a look at the prospectus yourself, or call me once I have completed my research. This article is in no way advice, merely commentary on the diversity of investments available and the sort of things I get up to seeking out opportunities for clients.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk