Public Sector Pensions – Goalposts Moving Again

|

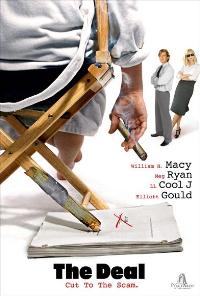

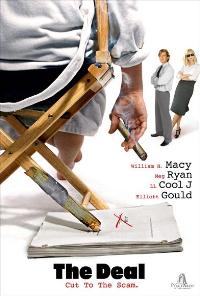

| 2008: The Deal – Schachter |

Call us today or visit our website for more information and to arrange a meeting

|

| 2008: The Deal – Schachter |

|

| 1963: The Man With The X-Ray Eyes |

|

| 2008: Eagle Eye – Caruso |

|

| 2011: Anonymous – Emmerich |

|

| 1943: Old Acquaintance – Sherman |

|

| 2005: Tennis Anyone? – Logue |

|

| 2012: The Bourne Legacy – Gilroy |

|

| 1949: Death of a Salesman – Miller |

|

| 1997: The Borrowers – Hewitt |

We have a unique system, which we call the DomTom system, (it’s a little tongue in cheek). Our approach does to financial services what SatNav did to maps and it is nothing short of revolutionary. Our approach connects your values and motivations to identify the route to reach your desired outcome, which for most people is a specific lifestyle. The best SatNav systems update regularly, helping you to avoid congestion and recalculates the route based on the latest information.

Your Financial Plan needs to adapt its approach as circumstances alter, but if done properly, the principles behind your plan will not alter, because they reflect your personal values.

A great financial plan is a “living” document, something that requires updating and monitoring. It is true to say that “life is a journey” but we believe you need to know where you want to go and how to best get there. You can select the speed and whether you take the scenic or quick route, our job is also to monitor what lies ahead. Our approach provides you with the truth about your financial position.

We believe that you can only make two mistakes along the road to truth, not going all the way, and not starting.