DIGITAL DEVELOPMENTS

TODAY’S BLOG

DIGITAL DEVELOPMENTS

Some of you are going to get fed up with me.

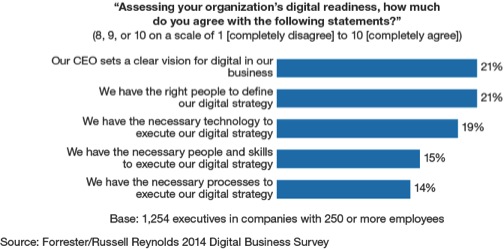

One of the many challenges of our times is the constant innovation of technology. A lot of this can seem utterly pointless, tech for tech’s sake, but sometimes it is a bit like witnessing the first washing machine when you have been slaving away with a board and scrubber at the river.

The pandemic has had a multiplication effect like nothing else I have known in the 3 decades or so that I have been doing this work. There have been huge improvements, but not as many or so significant as in the past 18 months.

It is not that these are unexpected, but rather that they are almost breath-taking when the very things you have yearned for, asked for, screamed for over the years are finally ready…. and work.

The problem being that most of you have got used to a system with us and I can assure you that most of the tools we have been using are or perhaps were market leading, some of these are going to be replaced. That is the pain – just as you get used to the appearance or workings of something we go and change it. Well hopefully we can minimise any pain. The only point of the changes is to improve what we do for you and seek better efficiencies for the business, meaning we can help more people just like you.

So stand by, things are about to change again.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084