Don’t leave it to the last minute

Dominic Thomas

April 2023 • 3 min read

Don’t leave it to the last minute

One of the things we take seriously here at Solomon’s is finding ways to improve what we do for our clients and how we do it.

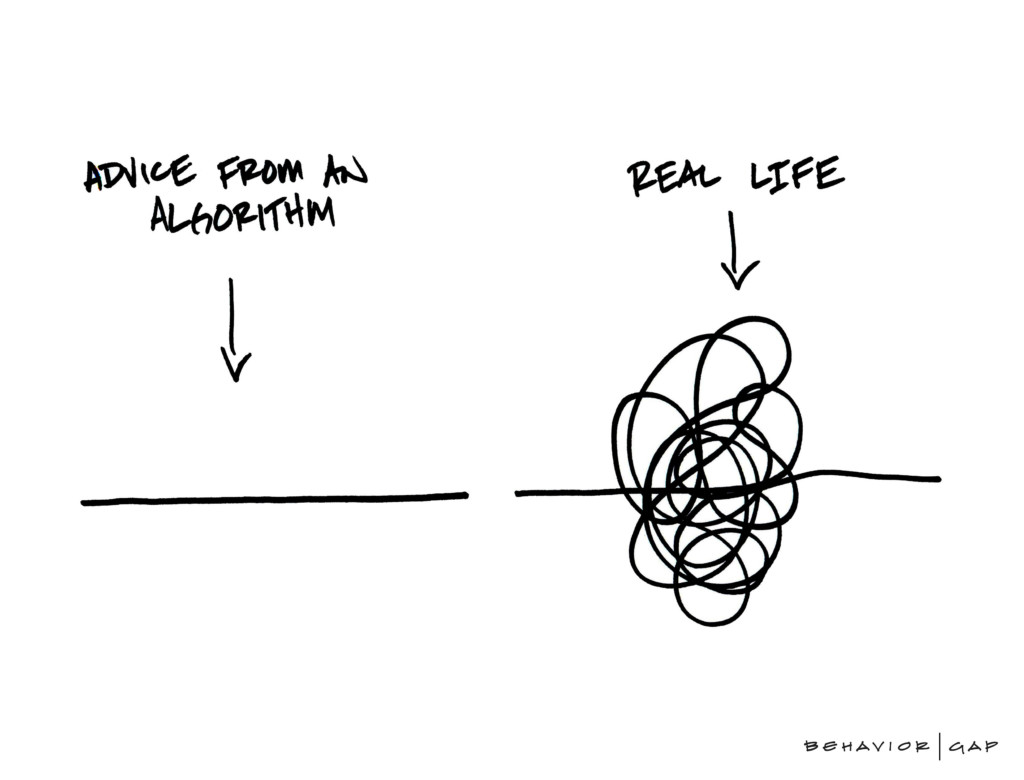

The tax year end period in the last few years has been very busy indeed with a number of transactions being processed very close to the deadline of 5th April. The team here (once again) stepped up marvellously this year and we all worked incredibly hard to ensure good outcomes for all – but we would like to try and ensure that we don’t have a similar ‘last minute rush’ next year!

So what’s the answer? Possible solutions rely fairly heavily on our clients joining with us in our endeavours. I have been encouraging clients for many years to set up monthly Direct Debit payments to ISAs and pensions (where appropriate) and many of our clients are now doing this (and reaping the benefits of pound cost averaging – see our video here!). I would be happy to discuss this with you if you haven’t already had ‘that conversation’ with me. The alternative (for clients who are able and would prefer to make their contributions in lump sum payments) is to make sure that you do this as early in the tax year as possible (you can invest from the 6th April onwards).