TODAY’S BLOG

SHOULD I INVEST NOW?

The global stock markets have fallen further and look likely to remain volatile for some time. Whilst there are lots of good reasons to be concerned, we also believe that markets will recover. Every time there is a “crash” we hear people say that this time it is different… but it never is different, it’s the same problems reframed in a different way, for a new crisis. The problem is essentially the same. Fear.

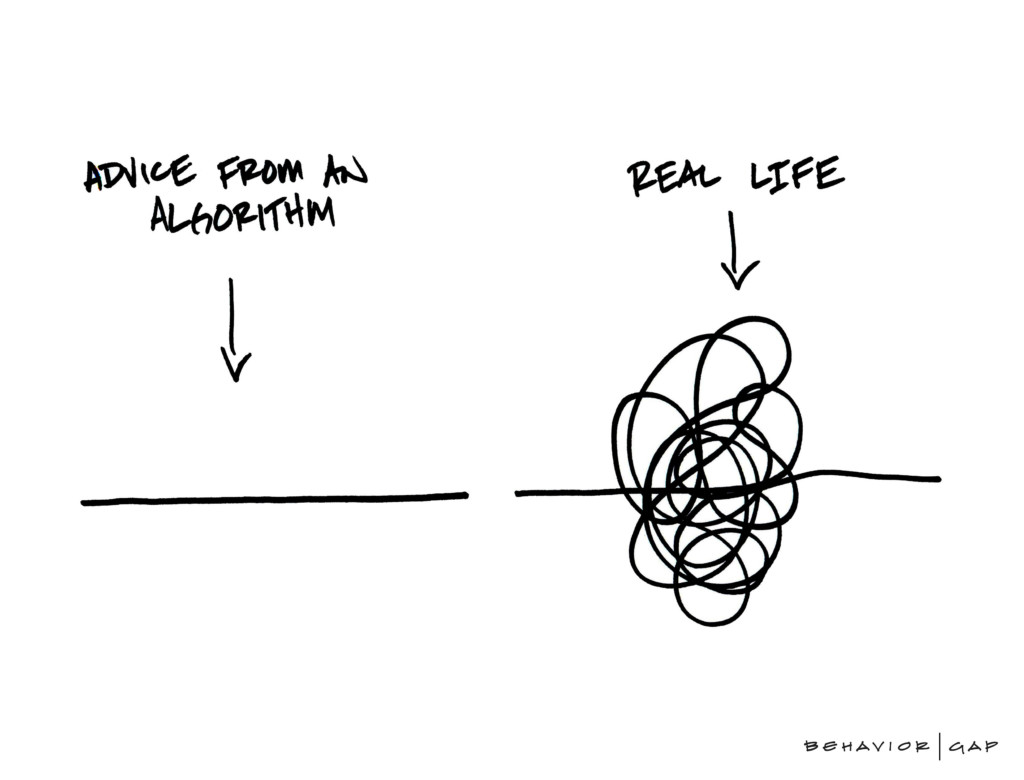

If you believe that over the long-term businesses listed on stock markets deliver jobs, security and wealth then there is no reason to believe anything will change when you have a long-term mindset. Remember that commercial innovation always happens, some companies go bust as they are unable to adapt, new ones step in, technology evolves, everyone moves forwards. If you are investing for days or weeks, then frankly that isn’t investing its speculation and I wouldn’t advise anyone to do that. Investing is designed for long term wealth creation.

TIMING THE BOUNCE BACK

Trying to time an investment for the exact bottom of the market is impossible (well it would be luck). The truth is that the markets may fall further, we don’t know. However, we expect them to recover – much like the overwhelming vast majority of people will recover from coronavirus. It may take weeks, months or even years, but it will recover. That it not to say that life may be more difficult in the short term and require patience and assistance.

So to my mind, this is a good time to invest due to low market valuations. However, as always I would remind you that I advise everyone (including businesses) to hold somewhere between 3-12 months of typical spending in reserve for an emergency. This is that time. If you have this and have reviewed your numbers, including perhaps making some minor reductions to spending, then if this still fits your plan for your life, then there are good reasons to invest.

The one concern I have is the practicalities of getting investments done in time for the tax year end, primarily due to a reduced workforce and lots of demand. So I would encourage anyone wanting to make tax year specific investments to do so as quickly as possible.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084