The Annual Spending Plan

The Annual Spending Plan

As we prepare for the end of the tax year in a few weeks’ time, we are also preparing your annual spending plans. On Wednesday clients should have received a new copy for you to update us with your plans for the year ahead.

If you would like to simply update your details from last year, we can provide a copy, which we will send to you securely. We are now using the Citrix ShareFile system which is encrypted and doesn’t require you to use a password. You can also return documents to us that way too (which makes life a little easier if you can save pdfs or create them). Alternatively we could send you an excel version of the same information. Just let us know.

A plan is not an account

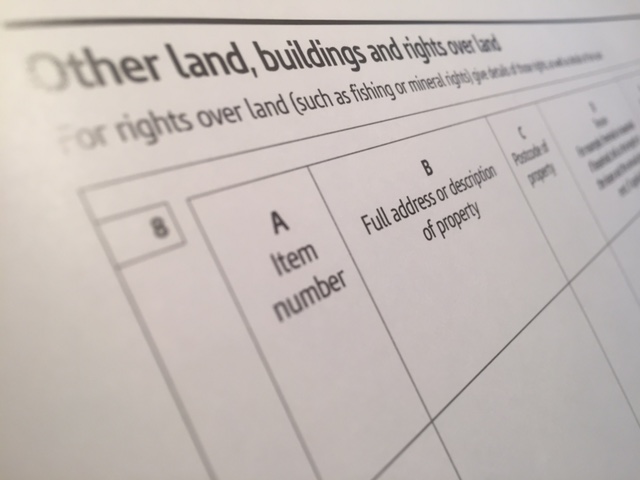

We are all aware that despite the official figures showing inflation of roughly “nada”. Most of us need to keep an eye on where our money is going. Your financial plan is based upon your lifestyle. There are a couple of obvious sources of information about your lifestyle, things that tend to be more accurate than our own memory – your bank account and your diary. These tell us how we spend our time and money.

So whatever life stage you are at, it’s time to review your spending plan. Note that this is a plan, not an account.

The big-ticket item… in your plan?

I don’t follow American football, but I did see an “interview” with a Bronco’s fan at the Superbowl last weekend. He was asked how much he spent… he replied “Twenty-one”… then when asked how much on the whole trip, he said,

“thirty thousand – I spent twenty-one thousand on four tickets, but with the tailgate package it was thirty thousand…. Don’t tell my wife”.

I’m guessing that by now she has seen the video on NBC…. Well at least the Broncos won…. I’m not entirely sure that the interviewee knows the difference between hundreds and thousands though (a problem in financial planning and life generally!). When I looked up the price of a ticket the tailgate package is considerably less, so either he paid a fortune to a ticket tout or missed the day they did hundred, tens and units…

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk