When will the penny drop?

When will the penny drop?

I regularly meet people that have bought a variety of financial products from their Bank or Building Society. For some reason, some seem to think that a Bank is particularly trustworthy and I never really understand why this is the case. I wonder if it has something to do with the appearance that other types of savings account are just “better rates” than a current account and its all free of charge. Whether it is appreciated or not; an account with a Bank is a product, which generates revenue for the seller.

Santander fined £12.4m for bad investment advice

The news that Santander has been fined £12.4m by the regulator doesn’t surprise many financial advisers. I have had to explain what it is that people have, invariably not what they thought. What annoys me is that this continues to go on and however much training Banks supposedly do, the problems persist. It takes the regulator considerable time to build a body of evidence to have a clear case and the fines to Banks are inconsequential.

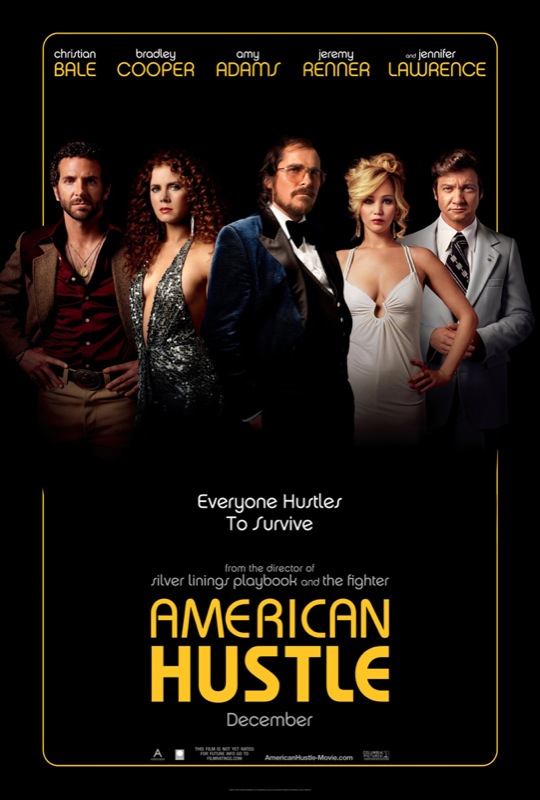

Would Jensen, Rory and Jessica approve?… I doubt it

The advantage that Banks have is their huge marketing and PR budgets, let alone high street presence. Paying very likeable celebrities or stars to appear in adverts tends to create a warm, trusting feeling towards the brand itself. The reality is that of course there is little or no real connection between the star and the business and any feelings are frankly misplaced based upon the overwhelming evidence.

Get commercially real, Banking 1-2-3

The biggest delusion is the notion of free banking. Nothing is free; it’s paid for by someone. If all Banks charged for providing proper administration of day to day cash management, and this more honest, transparent approach was continued into other elements of their business, I would be very happy. Banking is a business, an important one, as we all need it. I am not knocking the core business of banking, but why they are allowed to offer financial advice on anything other than lending and deposit taking is beyond me. This is its core business, not arranging investments that are dressed up to look like deposit accounts. If Government and Regulators are serious about addressing the savings gap, it should not use Banks and frankly should ban any advertising that contains anyone vaguely famous. The wrong financial products can do a lot of harm, we warn people about smoking or drinking, but the penny really hasn’t dropped about the risks of Bank products.

Dominic Thomas: Solomons IFA