NFT – NEW FAIRYTALE

TODAY’S BLOG

NFT – NEW FAIRYTALE

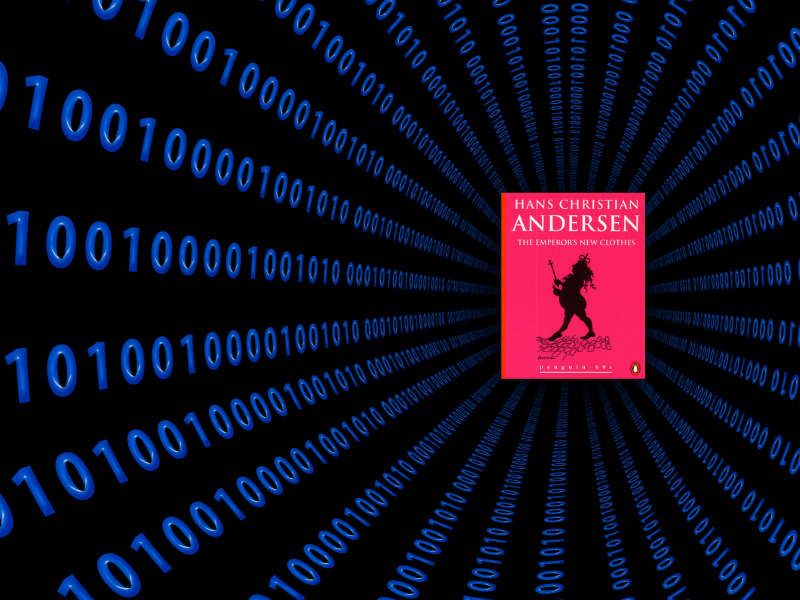

Perhaps you haven’t heard about NFTs, if not give yourself a pat on the back. However, it’s possible that you have seen something online or had a younger person mention it to you and perhaps it left you a little perplexed. I am not a fan. To me this is yet another of “The Emperors’ New Clothes”. I am concerned that a lot of people will say goodbye to their hard earned savings for fear of missing out and not understanding investing, in a culture that appears to tell us not to invest in the stock markets. Give me a moment and I will try to explain why.

One of the main reasons for people being scammed is due to a fear and lack of understanding about the stock markets. The market volatility is regularly reported by what passes as news, keeping you informed about the latest FTSE100 movement. “Billions were wiped off the markets today” is a phrase that regularly rolls off news presenters’ tongues, yet rare is the day (have I ever?) when we hear the “billions wiped on”. We are all kept in a state of anxiety about impending doom and it is quite deliberate. It gets your attention.

SO WHAT… HOW DOES THIS ENCOURAGE SCAMS?

Well, fearing the investment of your money in the most regulated, scrutinised exchange, where data is published and reviewed every day of the year and has been for decades, it seems that the volatility and the anecdotal “I lost money” or “my dad lost money” triggers the big red panic button that most of us have. So many turn to alternative forms of investing in the mistaken belief that they are less ‘risky’ (in fact some seem to be a ‘sure thing’). Oh, and for good measure, we humans are impatient, we love a happy ending and have a tendency to ignore the hard work that went into creating one (if it even is an ending). Or to put it another way, to approve of and want successful investments once they have happened.

INVESTING IN REAL COMPANIES

When you invest money into the stock market or funds of equities (as is more likely) you buy shares in companies that trade internationally. They do so by making or providing goods and services that we want, need or require. As markets are generally competitive, they strive to improve what they do to ensure their own sustainability. Where companies often go wrong is cutting corners to reduce costs and increase profit rather than improving what they do and communicating this properly. On occasion, you may have an objection to the company, or its sector or the people that lead it. So you can (we can) screen out some of these based on ethical, environmental, social or governance standards. At the same time, you know that ‘cheap’ is unlikely to be high quality, but you also know that we don’t all need our weekly shopping from Harrods. There is a range; a spectrum. Sometimes we pay more for things because of the feelings that it evokes, sometimes we do so because we instinctively know it to be better.

Your investment appreciates in time as the company you invest in grows. You also receive a share of the profits made (dividends). Quite how much and how well these companies ‘perform’ is largely down to how well they run and… luck. By luck I mean – the right place at the right time, for example being a PPE manufacturer and a pandemic arrives.

You get your money back when you sell your investment. In the interim, you’ve hopefully had some dividends and an improvement in the value of the share. If you hold a handful of companies and one or two fail (such as the Kodaks of the world) then you have a proper loss. If you hold thousands, perhaps an entire market, then the impact of any failure is significantly reduced.

INVESTING IS NOT GAMBLING

Placing a sporting bet or a stake in a casino, you are hoping for a win, or something close to that to get your money back, plus the incentive to make the bet in the first instance. You may get back nothing – which is far more likely. That’s gambling – the risk of complete loss. For some people this is a small bit of fun (I can think of many better things, but I won’t judge), for others it becomes an addictive habit that can destroy families.

When you consider investment in proper companies (shares in them) over time, going back to the start of your lifetime, there is only one direction of travel for the combined value of your investments. Upwards. Yes there are bumps along the way (volatility) but you own real assets (companies) making and providing real products and services.

THE NEW CLOTHES

The digital world and our obsession with it, has given some people the idea that a digital image is worth something. These NFTs (Non-Fungible Tokens) are in my opinion the equivalent of the Emperor’s new clothes. The value is talked up by nefarious online forums and chatrooms and ‘traded’. I would not touch them with the proverbial barge pole. If in the event I am wrong about this in say three decades time, that’s fine with me as I will be holding assets that provide regular income from actual profits from making real products and services. I can and will happily live with that and until proven otherwise, I will not aid anyone into deliberate folly.

HMRC’s NFT SEIZURE IS A WARNING TO ‘INVESTORS’ AND TAX CHEATS

The UK tax authorities have confirmed their first ever seizure of a non-fungible token (NFT) following a probe into an alleged £1.4million VAT fraud. Her Majesty’s Revenue & Customs (HMRC) said it had confiscated three NFTs, along with £5,000 in other crypto-assets, and arrested three people as part of a fraud investigation concerning around 250 sham companies. It claims the three suspects, who have not been publicly named, used a variety of ‘sophisticated methods’ to try and conceal their identities, such as false invoices, pre-paid unregistered mobile phones and virtual private networks.

NFTs are tokens representing the ownership of a digital asset, which could be an artwork, an image, music, or even a tweet that have their own unique signature and cannot be exchanged for another asset of the same type. But there has been increasing worries that these digital tokens, as well as cryptocurrencies, are being used by criminals to hide their illicit financial gains. Nick Sharp, the Deputy Director of Economic Crime at the HMRC, said: “Our first seizure of a Non-Fungible Token serves as a warning to anyone who thinks they can use crypto-assets to hide money from HMRC.”

Understand the real risk and buy real assets. You have been warned.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084