“Where you stand depends on where you sit.”

“Where you stand depends on where you sit.”

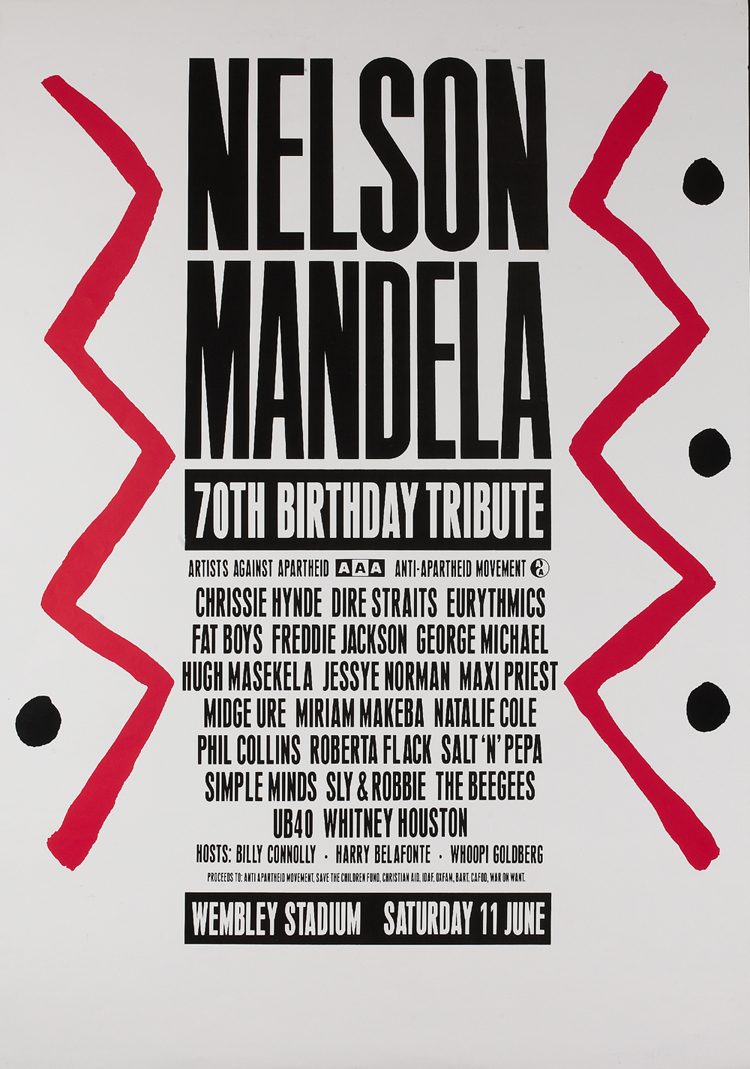

It was the tail end of the 1980’s, I was a student and still dating a young woman that had begun to challenge many of my assumptions and attitudes, I was still struggling to figure out who I was (and in truth, I’m still working on this). I was into the music of bands like U2 and Simple Minds, who seemed to be rather more than entertainers, writing about injustice and political geo-hot spots. U2 in particular had introduced me to Martin Luther King in a way that I cannot put into words – but captured by the song “Pride in the name of love”. We had already had Live Aid and made aware of the problems of famine. I was a young man with dreams of changing the world and fighting injustice. I was familiar with the work of groups like Amnesty International, Greenpeace, Christian Aid and racism was very much something that I opposed. We had a cause. So the opportunity to attend my first Wembley gig to remind the world that Nelson Mandela was still in prison and now 70 years old seemed like an opportunity not to miss. So on a summer’s day in June 1988 my girlfriend, her brother and I queued early to get a good spot towards the front of the Wembley stage. The crowd was enormous. Everyone seemed to want the world to change for the better.

“It always seems impossible until it’s done.”

Within 2 years, Mandela was free. Still at University this gave hope to a generation (perhaps several) that change was possible and perhaps, things could change more quickly with the right pressure and frankly justice as the guide. There was a sense that South Africa was changing and if a country could change, surely anything could change. I was young and naïve of course. In reality the hardest part was the process of change. Whilst we all may have hoped for a peaceful transition, it was Mandela and De Klerk that enabled this to happen, but the grace and wisdom that Mandela displayed with the truth and reconciliation commission was probably the biggest miracle.

“A good head and good heart are always a formidable combination. But when you add to that a literate tongue or pen, then you have something very special.”

The media is and will be full of tributes to Nelson Mandela who, as you know, died yesterday. There will be lots of jumping on the band-wagon I’m sure and of course Mandela was an ordinary man in many ways with his faults. However it is certainly the case that he has served his country and indeed all of us, by showing that change is possible, without war, but with passion and reason. That justice can prevail and forgiveness is possible. I very much doubt that I would have been as gracious and forgiving to my persecutors, heck, I struggle to keep my cool watching the news or driving in slow traffic… which reminds me of a U2 song God Part 2 about … well, I’ll leave that for you to decide..“I don’t believe in death row, skid row or the gangs, don’t believe in the Uzi, it just went off in my hand, I… I believe in love”.

“I am not an optimist, but a great believer of hope”

I know that Mandela was also extra-ordinary and someone to hold in very high esteem indeed. He was an inspirational figure and the world needs more like him. However, acknowledging our faults does not prevent us from being extra-ordinary. Indeed it is conquering our failings and facing our fears that provide the opportunity for us to be truly extra-ordinary.

“I am not a saint, unless you think of a saint as a sinner who keeps on trying.”

I hope that its ok with U2, who I have supported for many years to put a You-Tube video here. U2 have written a new song “Ordinary Love” for the new Mandela film – Mandela: Long Walk to Freedom.

Dominic Thomas: Solomons IFA