Where are you from originally?

Today, this may sound like a loaded question, so let me explain. The UK has a plethora of international tax agreements. Financial planning is always set in a context – it can be done in almost any country and is a growing profession in northern Europe, India and China. A financial planner needs to understand where you are deemed resident and where you are deemed domiciled as this has considerable impact on any planning in the present, but also in the event of your death.

Global Death Duties

The world seems smaller because of our ability to communicate and travel much more easily, within a few hours, you could be… well, the other side of the world. Britain’s multi-cultural history might be reasonably easy to plot, but how about your own? If you aren’t here to correctly explain the where, when and why… who has the accurate details?

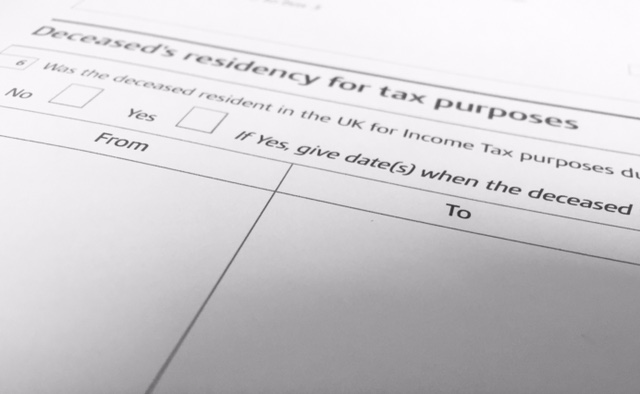

IHT401

The form IHT401 asks for a full history (take a look by clicking the link). The information requested covers some of what you may think is obvious (where you are from, your nationality etc) but also details about your education and employment. If you were not born in Britain, even if you have lived here since before you could walk, this is a form that you should prepare for your Executors. It has implications for where you are taxed and how much tax your estate will pay in the event of your death

Do yourself and your estate a favour..

The information requested by HMRC is probably easy for you to put together reasonably quickly, so can I urge you to do so. It will always be much harder for someone else to collate and verify your history, so make it easy for them to do so – by getting it done yourself.

This is more than a casual glance at LinkedIn with information of your career to date (assuming that your online CV is accurate). Naturally any Executor will need to check the information, so make this easy for them to find – provide it in a safe place or even in advance to each of them.

To my mind it makes sense for a financial planner to hold this same information about you as well – because investments that you make need to be set in the context of potential global taxes and of course ensure that the advice is suitable, appropriate and rather obviously – legal!

So, if you weren’t born in the UK – please take a moment to download the IHT401 form and fill it in, saving it to your records and if you are a client and haven’t done so already, send me a copy. Don’t put it off any longer.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk