The UK General Election

Over the long run, the market has provided substantial returns regardless of who lives at Number 10. This is not a piece that I wrote, but it is worth sharing as it makes a very useful point. Think and act long term.

Next month’s snap election is the first national vote in the UK since the EU referendum. While the election’s outcome and overall impact are unknown, there is no shortage of speculation about how the election will impact the stock market. Below, we explain why investors would be well-served avoiding the temptation to make significant changes to a long-term investment plan based upon these sorts of predictions.

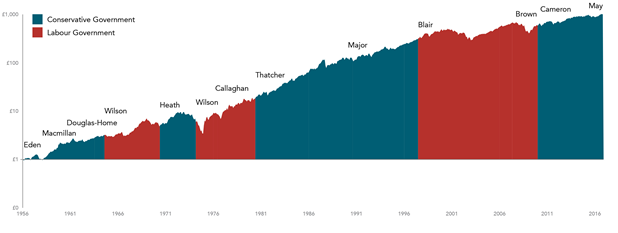

Here’s a chart to consider – Growth of £1 invested into the Dimensional UK Market Index between January 1956 – December 2016…. some 60 years, which is rather like investing at 30 and living until 90.

Note smallprint:

For illustrative purposes only. Past performance is not a guarantee of future results. Index is not available for direct investment, therefore, their performance does not reflect the expenses associated with the management of an actual fund. Dimensional indices use CRSP and Compustat data. See “Index Descriptions” in the appendix for descriptions of index data.

In plain English – this is really an example to demonstrate the wisdom of long-term thinking (and investing) rather than the constant short-term anxiety and to be blunt “mucking about”.

Investing is not meant to be gambling

Trying to outguess the market is often a losing game. Current market prices offer an up-to-the-minute snapshot of the aggregate expectations of market participants— including expectations about the outcome and impact of elections. While unanticipated future events (genuine surprises) may trigger price changes in the future, the nature of these events cannot be known by investors today. As a result, it is difficult, if not impossible, to systematically benefit from trying to identify mispriced securities. So it is unlikely that investors can gain an edge by attempting to predict what will happen to the stock market after a general election.

The focus of this election is Britain’s exit from the EU. But, as is often the case, predictions about the outcome and its effect on the stock market focus on which party will be “better for the market” over the long run. Exhibit 1 shows the growth of £ 1 invested in the UK market over more than 60 years and 12 prime ministers (from Anthony Eden to Theresa May).

Markets and 10 Downing Street

This exhibit does not suggest an obvious pattern of long-term stock market performance based upon which party has the majority in the Commons. What it shows is that over the long run, the market has provided substantial returns regardless of who lives at Number 10.

Equity markets can help investors grow their assets, but investing is a long-term endeavour. Trying to make investment decisions based upon the outcome of elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely result from random luck. At worst, such a strategy can lead to costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, in order to pursue investment returns.

INDEX DESCRIPTIONS

Dimensional UK Market Index: Compiled by Dimensional from Bloomberg securities data. Market capitalisation-weighted index of all securities in the United Kingdom. Exclusions: REITs and investment companies. The index has been retroactively calculated by Dimensional and did not exist prior to April 2008.

Investments involve risks. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Past performance is not a guarantee of future results. There is no guarantee strategies will be successful. The information in this material is provided for background information only. It does not constitute investment advice, recommendation or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk