TODAY’S BLOG

THE TROUBLE WITH ISAS

HMRC have published their data about ISAs to the end of the 2018/19 tax year. Their data is reliable or should be because you will recall that each ISA requires your unique National Insurance number. As a result, it is possible to provide accurate data about income, age, gender, and employment.

The deeply disturbing news is that the vast bulk of ISAs are cash ISAs. Cash ISAs are glorified deposit accounts, cash is not a sensible long-term investment strategy, it is a perfect short-term spending strategy. As cash rates have declined from not very much to virtually nothing over the last 20 years, Cash ISAs have basically failed to keep pace with inflation.

“BUT CASH ISAs ARE LOW RISK”

“But Cash ISAs are low risk” you cry, well… what you really mean is that the value doesn’t go up and down (volatility) your assertion would be right, but when you factor inflation into the actual real world, then Cash ISAs are pretty much basically always guaranteed to go down. The risk you run is one of running out of money and the power of your pound shrinks.

There may of course be good reasons for holding Cash ISAs, but based on income range, people over £30,000 generally have more stocks and shares ISAs than Cash ISAs – though its still a fairly close-run thing.

“BUT AT LEAST CASH ISAs ARE TAX FREE”

Cash ISAs are tax free, that is certainly true. What that means is that the interest paid to you on your deposit is tax free. All good… well, it was. Since 6 April 2016 there has been a personal savings allowance. Basic Rate (20%) taxpayers are able to earn interest of £1,000 without it being taxed. Higher Rate taxpayers have a £500 allowance and Additional Rate – well, of course we know that it is politically expedient to be seen to punish anyone earning £150,000 or more, so no tax-free savings for you!

WHY LOCK INTO A DEPRECIATING ASSET?

Taking a basic rate taxpayer with interest rates at something like 1.5% at best, then you would need more than £66,000 in your cash ISA before any tax would be applied to the interest. At 1% it would require £100,000. Higher rate taxpayers simply halve the numbers. As for the tax that would be applied on interest above that – well no more than a round of drinks for most people.

A quick trawl of Cash ISA rates today (30/06/2020) and the very best rate I can find is 1.25% if you want to lock your cash up for 7 years… why anyone would do this is beyond me. Then there is the aggravation of regularly looking for a better rate and the hassle of moving your really rather duff Cash ISA into a different one. Life is too short for this nonsense isn’t it?

Similarly, junior ISAs – why bother holding cash for a child for 18 years and missing out on investment growth over nearly 2 decades. It is madness. Investors and savers really must understand what risk really means.

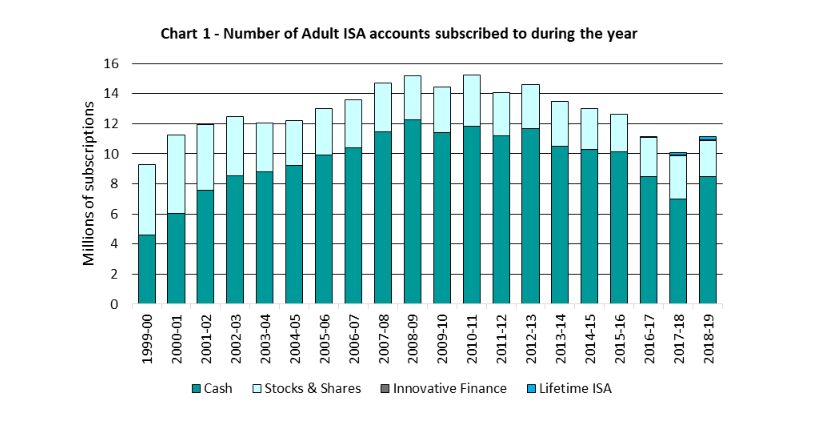

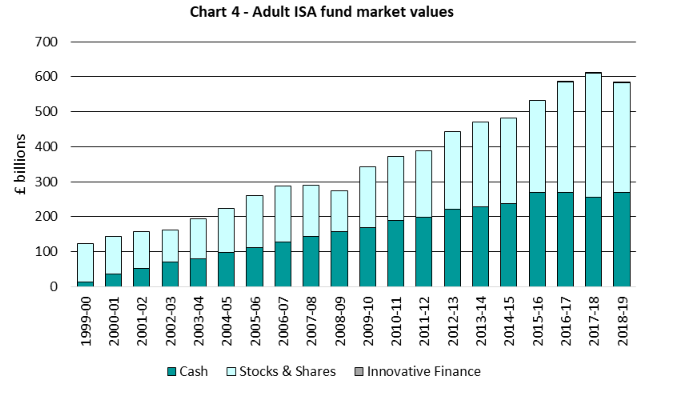

The value of ISAs to the end of the data was £584billion, of which cash ISAs account for 46% yet make up 76% of all ISAs. The chart below (from the HMRC bulletin – so labelled Chart 4) shows the fluctuating but growing value of shares in ISAs. Remember all are being added to each tax year, but the vast majority of the money each year goes into Cash ISAs.

CONFESSIONS OF A CASH ADDICT

OK – so you have some cash ISAs. I am not saying you shouldn’t have them, but only do so if you intend to spend the money fairly soon (within 3-5 years tops). Otherwise you are missing out on a lot of growth and the ability to keep the power of your £ working for you. If you would like a review, do some of the legwork, compile a list of your Cash ISAs, the balances, the Banks or Building Societies that they are with and the current rate of interest you earn. If there is a fixed rate, confirm when that ends. Then send me the information.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084