Markets are High, the End is Nigh

Markets are High, the End is Nigh

I have no idea why radio and TV stations broadcast the level of the FTSE with every news bulletin. It’s as though they are screaming “the end is nigh”. Think about it for a moment, what purpose does it serve? The only people that can do anything about their investments are traders – who had the information already. To my mind the only reason I can think of is so that you and I panic. The markets are high, so we panic with the good news fearing that is must be coming to an end. Alternatively, they have fallen, so the anxiety and fear is by how much and how far.

So What?

A better question might be…. So what? How does this affect me at all? Well the truth is that your investments will almost certainly be impacted, but then that’s the point of investing. The issue is really does the rise or fall play any significant part on your financial well-being. This is where proper financial planning comes in. We know that investments fall in value. We allow for it. We also know and believe that the point of investing is so that they rise, otherwise we wouldn’t bother would we!

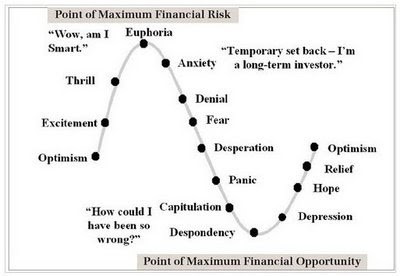

A picture paints a thousand words

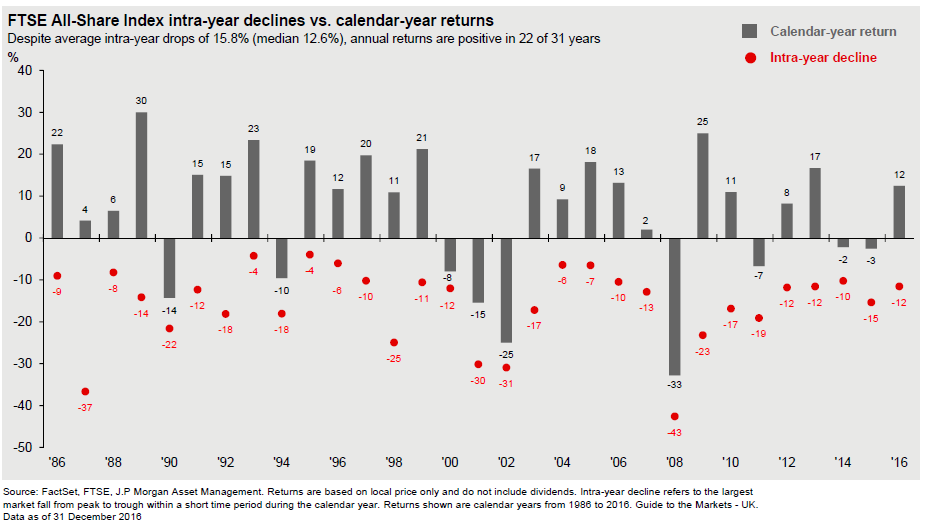

So, I thought that I would share with you an interesting graph. This shows the returns of the FTSE All-Share over the last 30 years from 1986-2016 (31 years). The grey columns show the calendar year returns. You will observe that 22 or the 31 are positive, 9 are negative. In other words, 70% of the time, calendar year returns have been positive. However, when the negative years occur, those years can see large falls, note the worst being -33% in 2008 (the credit crunch, supposedly the worst financial collapse in generations).

Let’s get Negative

Now observe the red dots. These represent the largest fall in each year. All falls must be negative to be a fall. So, every year has one. Note how these are pretty “bad” yet don’t really seem that bad when you consider the actual return over the year (grey column). Its noteworthy that the average fall in a year is -15.8% – the median (if you line up all the results, the one in the middle) is -12.6%. So, in short you should expect a fall every year of around this sort of amount. It should not be a surprise.

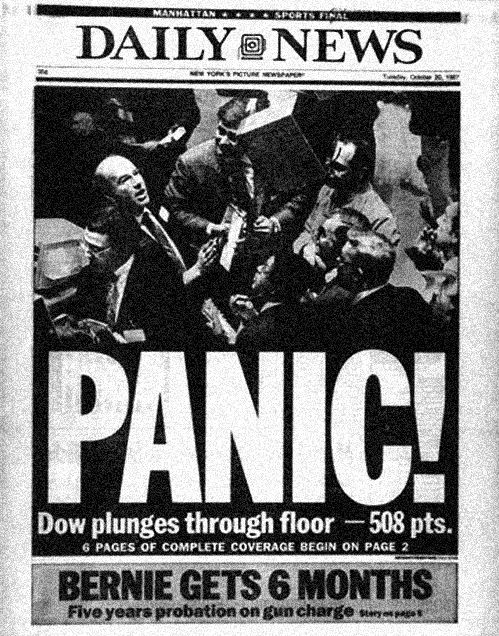

You probably remember the crash of October 1987… just after the hurricane that Michael Fish didn’t expect. Remember the headlines of millions wiped off the markets. True, it (the FTSE All Share) fell -37% however over the year it showed a return of +4%. Which do you remember? I’m guessing the crash… which you would certainly remember if you got in a panic and sold your holdings (when they were down)… selling in a panic or a crisis is the surest way to actually have one, but remembering your long-term financial goals and why on earth you are investing anyway is vital. That’s what we and any other decent financial planner will help with, when the crowd and the media and the market are telling you to panic, do something!… do not.

Diversify to Dampen

However, very few people have all their investments in the FTSE All Share or indeed entirely in shares (equities) most will have a portfolio that has some in low risk holdings as well, ideally the portfolio will be globally diversified across nations and asset classes. This will dampen the effects of both the rises and the falls of the markets.

The Only Timing that Matters

Trying to time the best moment to enter or exit the market is impossible to do with any repeatable success. However clearly you and your planner need to mindful (aware) of when you want to withdraw money. It’s all very well a favourable long-term average return, (or even a calendar year one) but what about when it’s a really bad year and you need the money out? Again, the truth is that any decent planner will help assess this advance. In practice it is unlikely that you would need all of your investments at the same time, but it can happen, particularly if you decide to use your entire pension fund to buy an annuity (income for life). This is why we spend a lot of time getting to understand our clients, your goals, values and aspirations – importantly when you need the money, so that that we can plan appropriately, perhaps reducing investment risk or holding more cash than you might need. Context is everything and a plan is vital. So get in touch to ensure that your investments are structured properly – for you, not for the media.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk