Grace Extended for Confessing to HMRC

|

| 1937: True Confession – Ruggles |

Call us today or visit our website for more information and to arrange a meeting

|

| 1937: True Confession – Ruggles |

|

| 1957: House of Numbers – Rouse |

|

| 1954: An Inspector Calls – Hamilton |

|

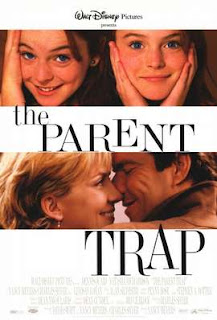

| 1998: The Parent Trap – Nancy Meyers |

|

| 1955: Rebel without a Cause – Ray |

Yesterday I blogged that the “Taxman Cometh” who prosecuted a man for unpaid taxes (and undeclared income). Today there is news that HMRC make deals with some big businesses regarding the payment of taxes – with MPs fairly cross that the taxman is not cometh enough! and rather too cosy with some of the big businesses in the UK to the tune of £25bn – one notable company being Goldman Sachs. Certainly it is very tempting to believe that HMRC are not being tough enough on large companies, however the story has two sides. Personally I doubt very much that HMRC are lenient, the real issue is the UK and global corporate tax system that enables both individuals and companies to create and register companies around the world, in more “favourable” tax regimes. The rules of corporate taxation are complex and frankly this is the realm of the big Accountancy firms that exist to reduce taxes for big business. There is an obvious correlation between the two. The existence of different tax regimes and rules that permit their use make such tax avoidance legal, yet clearly morally questionable. HMRC are unable to collect taxes that are legitimately avoided.

|

| 1941: Ladies in Retirement – Vidor |