Wrong Place at the Wrong Time

Wrong Place at the Wrong Time

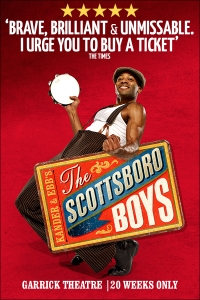

A timely new (2010) musical “Scottsboro Boys” has returned to London, currently playing at The Garrick off Leicester Square. It is the story of 9 black men… well youths really, aged 13-19. Who were in the wrong place (Alabama) at the wrong time (25 March 1931). You may know the story, which is also reminiscent of the Harper Lee novel “To Kill a Mocking Bird”. I didn’t know this particular story, but sadly it is all too familiar… a lynching and swift carriage of gross injustice. It is a depressing tale about stupidity, bigotry and racism in a world that one would hope was consigned to history, but is clearly alive and fuelled by the same misplaced and misinformed fears.

As you might imagine, its a provocative piece, which has some interesting ideas. T he juxtaposition of black men playing white men (and women) in a parody of Minstrel Shows, further revealing how misguided and disrespectful such things were/are and culminating in a particularly disturbing “blacked up” segment. The creators draw on ideas from Cabaret and Chicago, using song and dance harmonies to hide but reveal the discord. A criticism I would have is that the show isn’t very energetic, rather “sedate” but then perhaps this is quite deliberate, given the restrictions of prison and a hot box… and the final scene of powerful protest.

he juxtaposition of black men playing white men (and women) in a parody of Minstrel Shows, further revealing how misguided and disrespectful such things were/are and culminating in a particularly disturbing “blacked up” segment. The creators draw on ideas from Cabaret and Chicago, using song and dance harmonies to hide but reveal the discord. A criticism I would have is that the show isn’t very energetic, rather “sedate” but then perhaps this is quite deliberate, given the restrictions of prison and a hot box… and the final scene of powerful protest.

The Truth Will Set You Free

This is not a hopeful story, in fact it wasn’t until 2013 that the Governor of Alabama, Robert Bentley signed the Scottsboro Boys Act, which exonerated all nine of them. Today America, the “land of the free” is still a tinderbox with unresolved racial issues and it is little wonder that so many are concerned about what seems to be systemic racism, where it would still appear that white lives are worth more than black lives. Whilst it is now nearly 84 years since the original incident, I am left to reflect on a phrase that I use daily – tempus fugit. Time flies… well, whilst it certainly seems to, I guess in practice, it will be a matter of perspective. Whilst I enjoy freedom, without too much genuine concern that it could be curtailed, for those that live with daily prejudice and injustice, I doubt that time moves quickly at all… and if the current state of global politics is anything to measure, it would seem that attitudes certainly do not change quickly. A lifetime of injustice must make time “feel” rather different. A museum, which often acts like a time travelling device, is a reminder of the past, to their credit Alabama have opened a museum to this history. The hope that I take from this is that it takes a brave community to be honest about its past…as it does for us all. Truth is something that I uphold as a virtue and something I bring to my work with clients, but perhaps the greater truth is that truth sometimes takes a very long time to be exposed, sometimes too long is far too late and may not, in fact set you free.

Scottsboro Boys runs until 21 February 2015 at The Garrick, London.

Dominic Thomas