Picking Winners – Financial Myths

Picking Winners – Financial Myths

Most of the financial services industry thrives on inertia and misplaced trust. The investing world can be broadly broken down into two categories – active or passive management of money. The terms are not helpful but can broadly be best described as active management is where Fund Managers attempt to outperform the market by use of skill, philosophy and information. Passive management basically says this is possible, but impossible to do with any repeatable success, so invest into the entire market (or index) to obtain the market return.

There are skills, systems and processes needed within passive management if truth be told, particularly when an index is forced to alter its constituents (much like the end of season promotions and relegations). However, costs are generally much lower – unless you are unfortunate enough to own a Virgin Money Index tracker. Generally active funds are more expensive – considerably. This it is argued, is due to better performance.

Anyhow, research from American Dimensional Fund Advisers, who rather pride themselves of academic research and evidence, recently concluded their study of US funds available to US investors. OK, its America not the UK, but given that the US is roughly 8 times the size of the UK stock market, let’s use it as a better sample.

The Unvarnished Truth

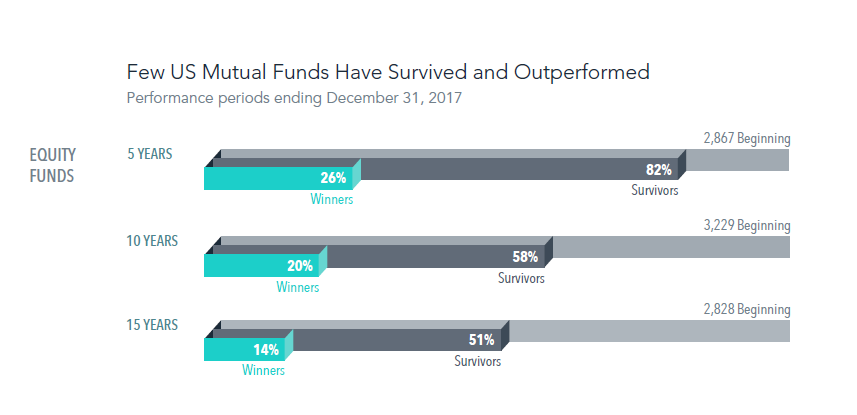

The evidence looked at equity funds and Fixed Interest Funds over 5, 10 and 15 years (2002-2017). Given that most people are investing for their lifetime, though behave as though they do so for about 12 months, these are sensible starting timeframes for such research. For the sake of brevity, I will discuss their equity fund findings (the results were much the same for both asset classes).

Of all the funds available, only 14% to 26% outperformed their Morningstar category index. The longer the time frame the lower the number that outperformed. So, in simple terms about 1 in 4 outperform over 5 years, 1 in 5 over 10 years and about 1 in 7 over 15 years.

Survival of the Fittest

However, even if it was as simple as simply picking funds on that basis, you are more likely to have picked a fund that closed. Over 5 years 18% of the funds did not survive (about 1 in 5). At 10 years this rose to 42% failing to survive (1 in 4). At 15 years, well just 51% of the funds you could have chosen from survived. That’s 1 in 2.

Top of the Pops Investing

As many advisers and most online sites promote and select “top performing funds” it may interest you to know that a Fund Managers historic performance does not ensure a decent future performance. The data revealed that top quartile performance for consecutive 3-year periods occurred on average between 17% and 33% of the time. In short, not many sustained even a short-run, or strong track records failed to persist. Coldplay and Atomic Kitten both had good years in 2002 (when the data range begins). Who remains “successful”?

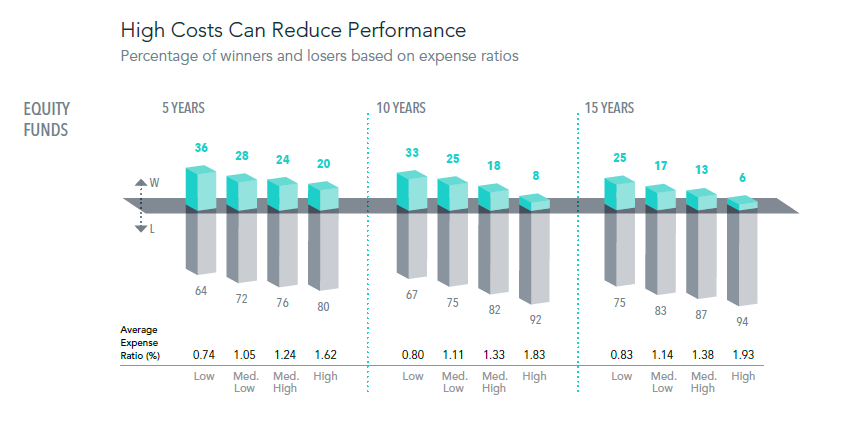

As stated, an often-cited argument is that active funds cost more because they perform better (we have established that some do – 14% of them over 15 years). Higher costs mean better results, right? Well not according to the evidence. Those with high charges (fund manager costs) with an average expense ratio (AER) of 1.93% almost entirely underperformed (94% of them). Those with the lowest costs (AER of 0.83%) delivered better results, with 25% of them outperforming.

The research also found that trading costs also impacted results (unsurprisingly). Some Fund Managers changed their portfolios almost entirely, the more they did and the longer the timeframe, the fewer that beat their benchmark. Yet this is typically claimed to be their true skill. Only 9% of high turnover funds beat their index over 15 years.

Hey Big Spender…

I have been in this game for quite some time, but it doesn’t need much experience to learn that those with more money have more money to spend…. On their version of reality (marketing) which is why many advisers, Product Providers and media swallow the myth that active management costs more because it delivers more. It can, but only in a very small number of cases and the chances of selecting such funds is virtually non-existent when most look at 3-year top quartile performance data.

There is another way, a better, cheaper way. We call it low-cost investment techniques rather than passive investing, because there is nothing passive about it. High costs and excessive turnover are likely to contribute to underperformance. You can avoid this completely, if you want to.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk