|

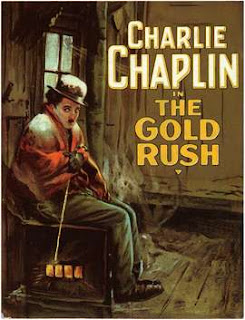

| 1925: The Gold Rush – Charlie Chaplin |

The financial pages are becoming awash with the news that Glencore is set to float on the London stock exchange. The floatation qualifies for fast-tracking and is expected to burst into the FTSE100 in early May. The company which is owned entirely by its managers and employees, had a turnover of $145bn in 2010. Its main activities are the production and marketing of commodities. Glencore are selling off something like 20% of their own shares. It is estimated that this “floatation” means that the company is worth in the region of $60bn. There’s about $11bn worth of the company up for grabs when it floats, that’s about £6.7bn making it the largest floatation in UK history.

Whatever you read over the coming days remember that a market exists to serve both buyers and sellers. The sale of £6.7bn of shares will make several of the key staff billionaires. A key question that is prompted then is “have commodity prices peaked? – hence the sell off?”

A word of caution – those that really made money in the American gold rush of the 1840’s were the ones selling the shovels. Remember that I’m not a stockbroker, so cannot and do not give advice about individual shares. So please do not call me to ask for an opinion on buying Glencore. What I can tell you is that it will end up in most portfolios by default due to fund managers simply having to hold the stock.

We are a boutique firm of financial planners. We create financial plans designed to achieve a desired lifestyle. We will craft and implement your plan that will provide you with the greatest chance of accomplishing your unique goals based upon the values that you hold. Financial products are little more than the tools to achieve your required results

Call us today or visit our website for more information and to arrange a meeting

Call us today or visit our website for more information and to arrange a meeting