Dominic Thomas

Jan 2024 • 7 min read

Last exit before…

As a minnow, I’m supposed to celebrate the move made by St James’s Place who are now promising to remove their exit fees whilst also reviewing their fee structure. Hefty exit penalties applied to their pensions and Investment Bonds in particular. According to their current, outgoing Chief Executive, the changes will come into effect in the second half of 2025.

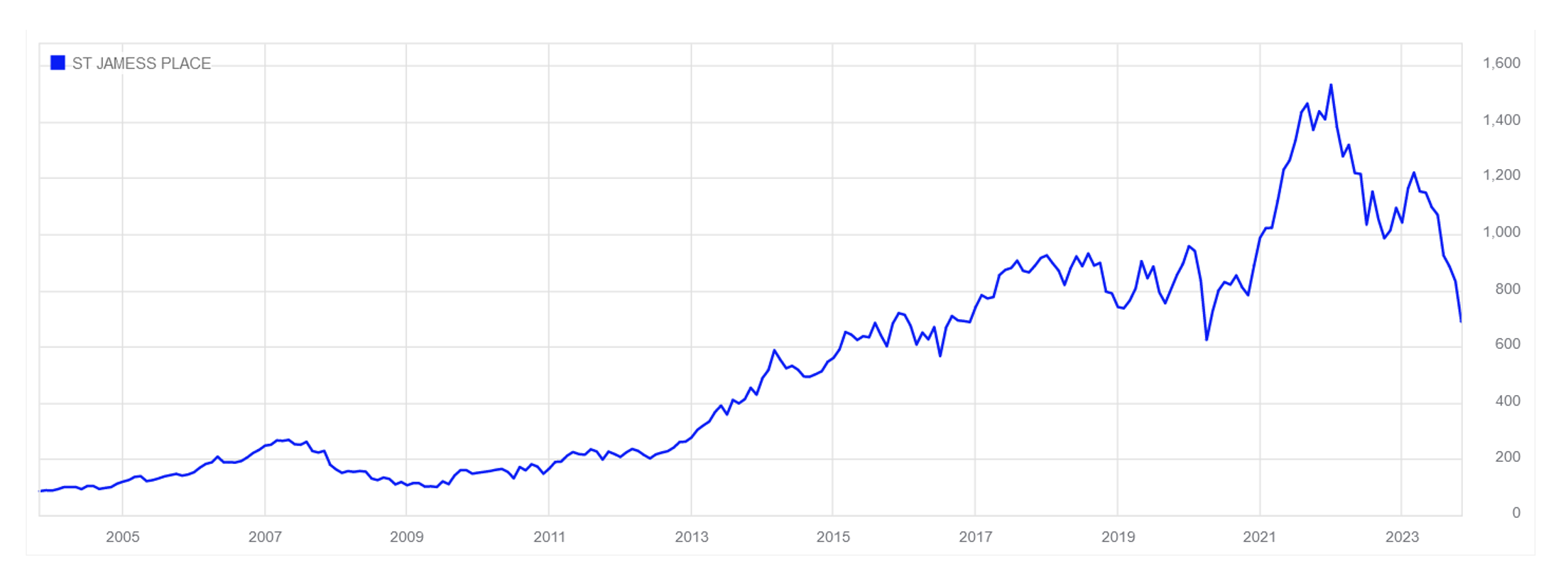

Some suggest that this is the regulator placing pressure on SJP. I might suggest that treating customers fairly (TCF) was introduced by the regulator in 2006, so one might conclude that it has taken them nearly two decades to comply. Then from 2013 fees or rather adviser remuneration had to be agreed with the client under what was known as RDR (Retail Distribution Review) and a banning of commission. The introduction of the new Consumer Duty rules in July 2023 together with some scathing pieces in mainstream media and a drop in their share price (halving since the end of July as investors appreciate that previous revenues may be ‘threatened’) all appear to have prompted appeasement. One might say that the penny finally dropped.

SJP are obviously a financially successful company, some very flattering marketing materials and beautiful offices, which would be the envy of most in the sector. Their advisers currently make up about 1 in 10 of all advisers. They are also a restricted firm, meaning that they sell a limited range of financial products and funds, unlike an independent firm who selects from the whole market.

SJP Share price (30/10-2003 -17/10/2023)

One thing is for certain, there is no denying that their 900,000 clients with around £168bn generally like what they do, despite expensive and rather poor performance of investment portfolios. The truth is that SJP are excellent at branding, and this extends to the advisers (who work and market themselves as ‘partners’) who they put in front of clients. They are well trained and very good at relationship selling (for the record – selling is a good and necessary skill and process). It’s rarely easy to move someone away from SJP by merely stating facts about price and performance.

As someone who believes that the UK needs better advice and more people in receipt of it (including politicians and their Parties), I don’t really have much of a problem with SJP other than until now it has been incredibly difficult to properly compare their charges (because they have been deliberately obfuscated – I don’t think there is another way to honestly view it). They are now set to address this which will almost certainly mean their profit margins are lower, but also that some, perhaps not many, of their clients will seek advice elsewhere.

My main gripe is that our sector needs to earn and demonstrate trust and fairness whilst having integrity. It has taken the regulator far too long to take seriously what the entire sector has known about SJP charges for decades … it’s not the amount, but the lack of clarity.

A POTTED HISTORY AND OTHER PEOPLE’S MONEY

St James’s Place was formed in 1991 but under the name of the Rothschild Assurance Group and began trading in 1992. The name changed formally in October 2000 not long after Halifax took a majority stake (60%) in the business. You may recall that Halifax merged with the Bank of Scotland forming HBOS in 2001. We had the credit crunch and despite Lloyds writing off £200m of US subprime debt in December 2007 and then seeing first half profits fall 70% in 2008, they stepped in to acquire HBOS, but traders were ripping them to shreds seeing the share price halve at one point. On October 13, 2008, Alistair Darling announced that the UK Government was bringing the banking system back from the brink, with a 43.4% stake in Lloyds. Just four months later Lloyds stunned the City announcing £11bn in losses at HBOS; and before the end of 2009, the Government stumped up a further £5.7bn for Lloyds. It wasn’t until the end of 2013 that Lloyds finally disposed of its holding in SJP just a few months before it moved from its FTSE250 listing into the illustrious FTSE100.

By way of comparison, I formed Solomon’s in 1999 and it remains independently owned and operating as an independent financial adviser. Since the outset, we removed commission from all protection products and implemented a level playing field of fees, meaning that there was no higher adviser fee for any particular investment product (Investment Bonds and Pensions normally paid advisers much more). There have never been exit penalties on anything we have arranged, except specific products such as VCT, EIS and SEIS, which is due to HMRC regulations regarding minimum durations to qualify for tax relief and nothing to do with advisers or indeed the product providers.

Clearly, we do not have 900,000 clients nor do we have £168bn under management. We have saved our clients an awful lot in costs for investments (cheaper than 99% of the sector), platforms, product selection, reduced losses and taxation. Hopefully our clients are also reassured that they have ample financial protection should the worst happen (we have seen how this has made substantial differences to those who have experienced such matters). In addition, having a clear financial plan that provides for your personal lifestyle choices rather than an assumption that you must want a yacht. Our clients are able to achieve high degree of peace of mind, whilst living in the reality of an uncertain, flawed and at times broken world.