Is Your Bank Account In Trouble? How Does It Measure Up?

Today the FSA have warned Banks offering current accounts with “added extras”. You are probably familiar with the sort of thing – travel insurance, accidental death cover, discounted tickets, gadget insurance as so on. Apparently whilst well aware that many of the features may be very good value and help you on your life journey, the FSA are concerned that some people are not able to claim on the “free cover” and some rarely or never use any of the features, therefore question the merit of providing the add-ons as “standard features”.

The FSA is moving to ensure that three key steps are put in the path of eager Bank staff.

- The Bank should check to ensure that the customer is eligible to claim under the cover that they are being offered, based upon the information provided.

- Provide customers with an annual eligibility statement, reminding them of the cover and acting as prompt to see if circumstances have change that might invalidate the cover.

- If a Bank staff member/sales adviser is recommending the product, they must establish that it is suitable.

This has a potential mis-selling scandal for the usual suspects (again) as in reality Bank staff are partly remunerated based upon the products that they sell – you may not think of it as a sale or purchase, but the Bank does. Hence the FSA are “concerned” particularly as they estimate that 20% of us now have these types of accounts. You may have gathered that I become rather like Victor Meldrew when I see adverts from Banks offering x,y and z all of which have nothing to do with banking, frankly because I believe that it is precisely this reason why Banks lost their way – failing to understand or remember what their main purpose is for customers, rather than simply seeking to add yet another money spinning idea and income stream to keep shareholders appropriately misinformed that “all is well”. I still don’t understand why nationalised banks advertise in a way that competes with one another, perhaps a marketing expert could let me know the rational – beyond retaining the facade of “brand”.

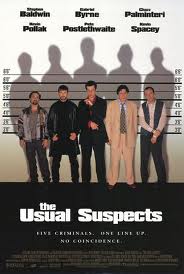

Perhaps you have a Silver, Gold, Platinum, Black or Red (and so on) account that provides a long list of features you don’t really need. Then again, maybe you are making dramatic savings on other insurance products. Do let me know – though I do wonder if, much like the film “The Usual Suspects” (with Gabriel Byrne and Kevin Spacey) everyone ends up losing except the one that got away…

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk