TODAY’S BLOG

HELPING FIRST TIME BUYERS

You may be aware that buying your first home is and has been fairly difficult, largely due to the inflated price of property and incomes that simply do not keep up at the same rate. Successive Governments have attempted to address this problem with initiatives, including adjusting stamp duty, capital gains tax and providing a type of ISA which has +25% tax relief as a bonus if used for a deposit on a property. This began with the Help to Buy ISA in 2015 to be replaced by the Lifetime ISA or LISA (the tinkering seems endless and neurotic). The Help to Buy ISA is only available to those who opened one before December 2019 and will cease completely from December 2029.

I won’t go into all the detail here about the differences and appropriateness, suffice to say that a LISA has a £4,000 tax year contribution cap of the standard £20,000 allowance.

HMRC’s latest quarterly statistics on Help to Buy ISAs have been released. These cover the period from 1 December 2015 to 31 December 2021.

The statistics show that since the launch of the Help to Buy ISA, 480,494 property completions have been supported by the scheme and 630,264 bonuses have been paid through the scheme (totalling £714 million) with an average bonus value of £1,132. It may not surprise you to learn that 2021 saw the highest number of purchases to date.

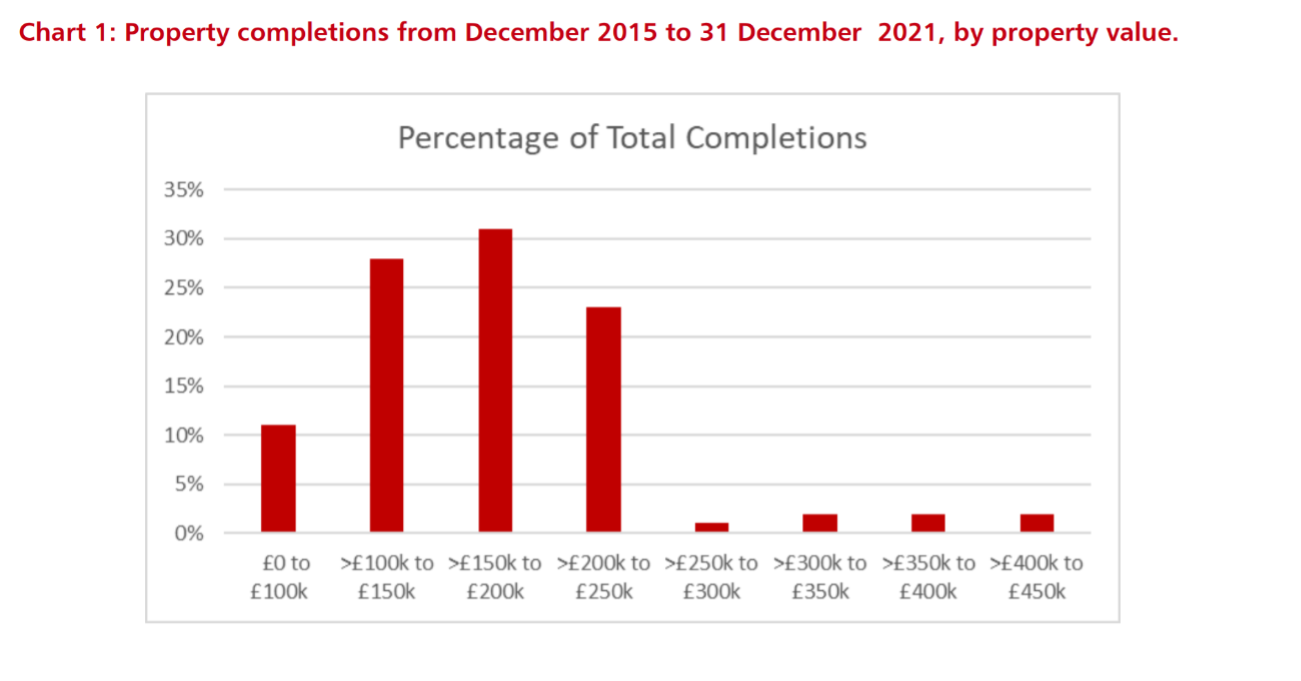

The table below shows the number of property completions supported by the scheme broken down by property value:

The highest number of property completions with the support of the scheme is in the North West (13%) and Yorkshire and the Humber (10%), with the lowest numbers in the North East, Northern Ireland and Wales. London buyers accounted for 8% of all completions but with a much higher average price of £330,661 – double the price paid in most of the UK.

The statistics also show:

- The mean value of a property purchased through the scheme is £175,849 compared to an average first-time buyer house price of £228,627 and a national average house price of £274,712.

- 65.3% of first-time buyers who have been supported by the scheme were between the ages of 25 to 34.

- The median age of a first-time buyer in the scheme is 28 compared to a national first-time buyer median age of 30.

It would be unfair to suggest that the scheme isn’t working that well, but in practice taxpayer money is funding private property purchases, which are predominantly helping those living in areas of already cheap (by comparison) homes. Personally I am not convinced by the system. It does very little to really control the problem of soaring property prices, if anything it may add to it …

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084