Make Time Count – There’s A Drag To Being Older

|

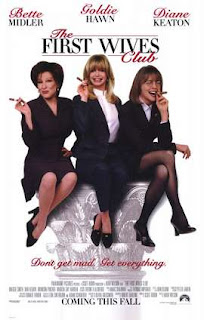

| 2010: Beginners – Mike Mills |

Some people view financial planners as a bit of a killjoy, to be avoided, why? Because we have a habit of reminding people of their mortality, something that we all know, but live as though it’s an issue that can be thought about at some point in the future.

Good financial planning involves facing some home truths and more recently I have asked clients the very blunt question, “when do you plan to die?” of course none of us know when this might be. The purpose of the question is to start to help form a broad guide for when this might be. Actuaries seem to be suggesting that of babies born in 2012 in Britain, around a third of them will live beyond 100. Of course I’m not expecting to be around to find out if they were right.

So what do we use as a guide? Well your family background for starters, perhaps you might frame your financial plan with the assumption that you outlive your parents by a few years, not always possible, but one approach. Another is to take the latest ONS national statistics, which are historical, but to 2010. If you are male and now 65 the average life expectancy is another 18 years (83) or 20.62 (85.62) if you are female. So you may wish to assume +/- 5 years for this. An interesting element of this is called “mortality drag” so skip forward to age 75 and men have another 11 years to live (86) on average, or 12.82 (87.82) for women. You can see that they appear to live longer than the projection for those aged 65. There really is statistical evidence to assert that the older you are, the longer you will live. Strange, I know, but true. The point is that we need to start somewhere with our assumption for a plan so that we can ensure your money doesn’t run out first. Another important point is to remind yourself that time is running out, so make it count whilst you can.

We are a boutique firm of financial planners. We create financial plans designed to achieve a desired lifestyle. We will craft and implement your plan that will provide you with the greatest chance of accomplishing your unique goals based upon the values that you hold. Financial products are little more than the tools to achieve your required results

Call us today or visit our website for more information and to arrange a meeting

Call us today or visit our website for more information and to arrange a meeting