Anything to do with investments and those that provide and shape them

The Robin Hood Banker?

|

| 1991: Robin Hood Prince of Thieves |

Call us today or visit our website for more information and to arrange a meeting

Anything to do with investments and those that provide and shape them

|

| 1991: Robin Hood Prince of Thieves |

I wonder how many of us watched the final of the European Football Championship. The final was a footballing spectacle, with Spain beating a very good Italian side 4-0. The sports psychologists will have something to say about the score-line, but this was a world cup winning team perhaps at its best.

The pundit “experts” were left gob-smacked by the sublime passing and control that the Spanish side seemed to have in abundance. I had every sympathy with the Italians, who despite playing with 10 men for a large part of the second half, held on nobly. However one wonders if the result would have been much different if they had fielded 15 players – and Italy are good!

I have a confession, I’m not madly into football as some are. However, I do like to see good goals, team spirit and tenacity. I don’t like all the silly falling over and cries of “foul play”. I enjoy the drama of sport, but when sport becomes predominantly about winning it loses its purpose.

I know that these days it is simply a business, but something of sport is lost when winning is the only objective, which is why finals are usually so dull. One of the pundits was so in awe of the performance that he said that “football has just been reinvented”.

This made me wonder whether the collapse of faith in the Banking sector and generally within financial services is perhaps a good thing. There is certainly a need to reinvent a better way of managing risk and oversight of it.

There is also the enormous need for good financial planning which will help determine what level of risk needs to be taken on an individual level. The competition within the sector is in all the wrong things – performance and returns. A reliable, honourable and dare I say it, beautiful banking or financial services system is all about the why and how – not the what. It is time for a collective rethink.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

|

| 1957: Something of Value – Brooks |

|

| 1964: Mary Poppins – Stevenson |

|

| 1936: A Face in the Fog – Robert Hill |

|

| 1945: House of Fear – Roy William Neill |

|

| 1981: Raiders of the Lost Ark – Spielberg |

|

| 2006: Notes on a Scandal – Richard Eyre |

|

| 2008: Chaos Theory – Marcos Siega |

|

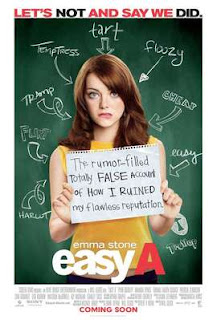

| 2010: Easy A – Will Gluck |