Financial Planning and Elvis

Financial Planning and Elvis

It is undoubtedly true that Elvis is one of the most famous singers in history. His fans continue to enjoy his music long after his death (one of the greatest legacies of art) and his music continues to be reworked and performed. We all know of the claims of vast numbers of Elvis impersonators.

Elvis rose from a very modest background and to some extent epitomized the American dream. At the time of his early death (age 42 in 1977), it is said that he had about $5million in the bank (around $20.5m by today’s measures). Of course there was also property, notably his recently renovated with 1970’s glitz Graceland; Elvis could also spend… as has been well documented.

Thankfully he had a Will of which there were just three beneficiaries, his father Vernon, grandmother Minnie Mae and his daughter Lisa Marie. His father was the Executor. Thanks to a good relationship with his ex-wife Priscilla, who whilst not being a beneficiary, became the sole Executor following the deaths of Vernon (1979) and Minnie Mae (1980).

A little less conversation ?…

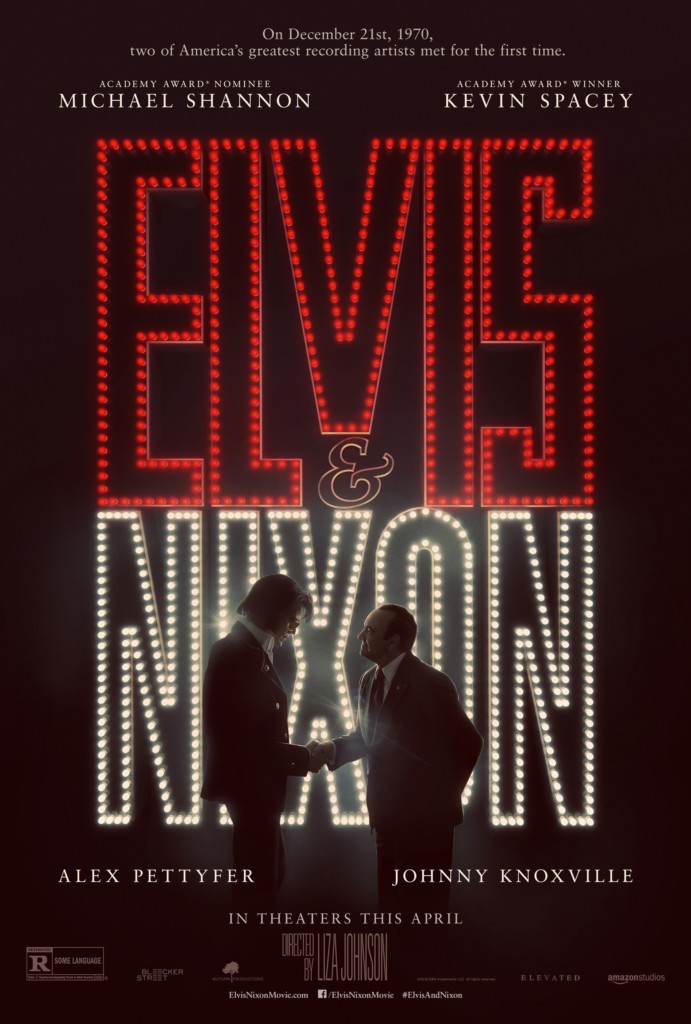

Priscilla was presumably one of the few people that said “no” to Elvis. A recent film (Elvis and Nixon) reflected (how accurately it is unclear – “based on true events”) some of the excesses and delusions that Elvis suffered. In this story he asks Nixon to make him a spy or Federal Agent. It would appear that his persuasive powers and charm secured him such a status, however nominal.

What has this got to do with financial planning? Well, Elvis is perhaps a more extreme example, but his experience is common to celebrities, who are often surrounded by people who rarely, if ever, appear to question, challenge or oppose some of the decisions being made. We can all think of examples of albums, books, performances or appearances, where the celebrity in question really should have said “no” and it appears that nobody else, those closest, said as much. I very much doubt that being a celebrity is all its cracked up to be, in fact I’m fairly sure it is a lonely and rather uncomfortable status. Yet we are all prone to blindness. We all wrestle with denial of reality.

I believe that a great financial planner, does not simply help you to secure your future, but also acts as a reality check, someone to challenge your assumptions and plans without envy or malice. Without this, presumably only friends and family have such proximity to be able to serve a similar purpose, but is that really likely? Or even fair? You may be surprised to learn how often I am with couples who at some point in our meeting say “you never told me that… I didn’t know you wanted to do that… this is the first time I have heard you express that”.

Of course others may be able to provide some form of counsel, I’d suggest that was healthy, but a financial planner, has a unique collection of hard and soft “facts” about you to provide a far better opportunity for you to grapple with the building a future based upon who you really are and who you wish to be. We all have talents, but sometimes our abilities in one area of our lives fool us into thinking we can handle others that appear “easy”. This is not the sole preserve of celebrity. We all have versions of ourselves, but an honest reflection without judgement is a value that may well be priceless.

As for the movie, well if it is true, its unbelievable… (but I enjoyed it) so here’s the trailer.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk