THE BUDGET 3 MARCH 2021

TODAY’S BLOG

THE BUDGET 03 MARCH 2021

The House of Commons was unusually civil during the Chancellors Budget Statement largely because hardly anyone was there due to social distancing and making the task rather easy to identify who is behaving like a spoiled child. Normally the Speaker has a harder job. As for the Budget – well, it’s a good job I am not a betting man.

The Chancellor believes that support over the pandemic will run to £407bn in various forms. This needs to be repaid if future generations are not to be saddled with debt forever, thereby hampering how future Governments can help them.

I did warn that taxes would rise, I thought capital gains tax would be the most obvious tax to increase. It has not. The only actual increased tax rate is Corporation Tax, which impacts business owners running profitable businesses (with profits over £250,000). Corporation tax will rise from 19% to 25% – that’s an increase of 31%. It may surprise you to learn that only 10% of businesses claim to make profits over £250,000.

Almost everything else stayed the same – but staying the same really means changing. Of course, this knock-on effect means reduced profit to share out in the larger businesses (like those you invest in via a fund) so returns may be dampened – but then this is simply a UK issue and most of your equity holdings are not in the UK now (your portfolio is global).

THE SAME DOES NOT MEAN NO CHANGE

Pensions, Capital Gains, Inheritance tax all remain unchanged, which means that as incomes or the values of assets rise, the excess taxes begin to hurt rather more.

Those approaching retirement have the spectre of a 5-year freeze of the Lifetime Allowance at £1,073,100. Anything above this sees the excess taxed at 55% – so more likely. How much and how you can contribute to pensions is also frozen, as it is for ISAs and Junior ISAs. These are probably the “nice to have” problems if you are running a business that is struggling or have an income that has fallen dramatically due to the pandemic.

Your Personal allowance (income you can have at 0% tax rate) rises by £70 on 6th April to £12,570 but then stays at that level for 5 years. Higher rate and Additional Rate tiers also remain frozen. What this really means is that if your income rises due to inflation or promotion etc, you will pay more tax.

The most notable help to younger generations is the Apprentice Scheme and the re-opening of 95% mortgages by lenders, who have been given Government guarantees. There may be some window dressing here, a borrower will still be made to jump through a variety of hoops to prove that they can become an owner (or more accurately, a borrower) rather than a renter, with a 5% deposit. Those that have taken advantage of the reduce Stamp Duty ending in March, have a little longer to complete their purchase.

If you are asking me what I would have done differently, (you aren’t) well there is a very long list and most of it involves simplifying pensions and tax rates. Complexity enables some to thrive and others to become rather entangled. HMRC are due to have a whopping £180m spent on further technology to help ensure you report your taxes correctly with fairly dire consequences for those that do not. I do hope that the track and trace lot are not “awarded” the HMRC technology contract.

DETAIL IS A DEVIL

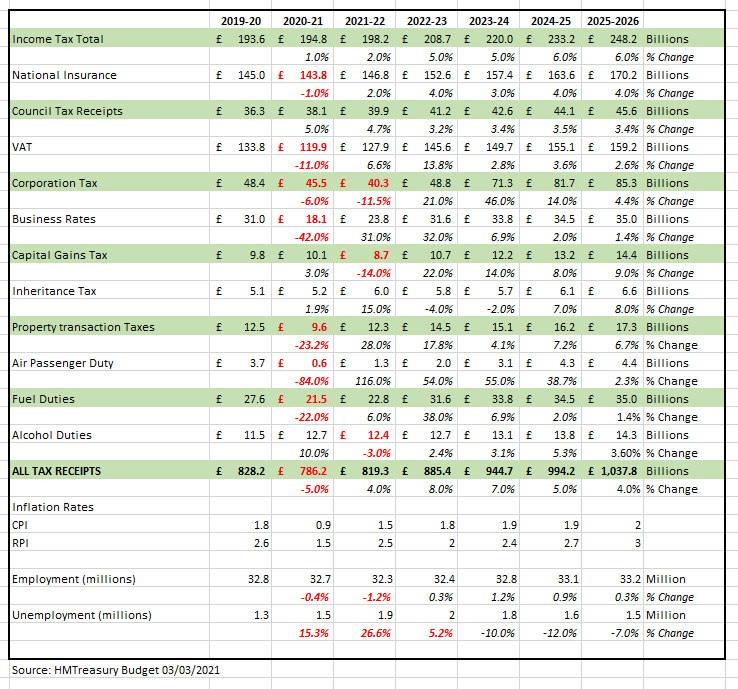

Politicians rely on our short-term memories, they must do otherwise so few would ever be re-elected. When you cut through the words it is best to look at the numbers. These are some key forecasts that I have pulled from the Budget Statement (which you can see here).

How you view life will likely influence how you select data from the table above (which is all lifted directly from the Budget) I have only shown the year on year changes as a percentage and drawn attention to some of the data (of which there is a lot!). Long story short, we will be paying more income tax. The Chancellor seems to be expecting unemployment to increase by 500,000 over the next 2 years before reducing, but still above current levels. Inheritance tax receipts peak in the coming tax year perhaps reflecting the consequences of the fatalities from the virus.

The property market looks predicted to return to normality shortly, but really picking up next year. Council tax looks likely to increase rather faster than inflation. Fuel duties will begin to rise, and oddly over the next 12 months, once hopefully this is over, duties from alcohol actually fall in 2021/22 (which I think is odd unless you have all been knocking back the booze over the last year or so more than normal with a plan to cut back). Air Passenger duty has rather obviously collapsed and will likely return to pre-pandemic levels in 4-5 years time, that’s quite a slow recovery.

Corporation tax will really bite in 3-4 years time. Business rates also begin to pick up, which when combined with loan repayments and more VAT, I imagine that some business owners may be looking at cost reductions. There may well be “pent up demand” and a good supply of labour, the Chancellor is understandably encouraging investment in growth, through new technology and digital business combined with Apprenticeships. It (business growth and development) is certainly what needs to happen, but whether it will remains to be seen.

Every Budget has lots of assumptions about the future, but you will be paying more tax, so use the allowances you can.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084