THE GLOBAL MARKETS

TODAY’S BLOG

THE GLOBAL MARKETS

There is little chance that you have escaped the news or the reality that the global stock markets have been very turbulent. The charts are either setting new records or getting pretty close to them. So, by way of an update I thought that I should remind you of some of the basic investment principles that we believe and are applied to your portfolio.

Firstly, we cannot control the markets. Let us simply acknowledge the reality that the prices of assets around the world are not things that any of us control. Neither can we control Government policy. In truth there is very little that we can control, but when it comes to investing, it may as well be a secret, or so it seems.

YOUR BEHAVIOUR

I am not going to suggest that your feelings are things you can control, they are real and need to be acknowledged. However, they are not the basis for a good investment experience. When it comes to your portfolio, none of us are naturally programmed for optimal performance. So, whilst we note our feelings, we do not base our plans around them. We base our plans on the goals you have set and the basic, easy to say, hard to do, investment principles.

ASSUMPTIONS

As every “crash” happens, investors invariably tell themselves the same thing… “this time its different”. The truth is that unless you genuinely believe that capitalism, globally is dead, then nothing is different. Yes, there are things wrong with capitalism, but if its basic premise is to raise money so that companies and organisations can create and meet the needs of real people in different markets, that creates jobs, wealth and share profits and therefore prosperity. If you don’t believe that, then you really should not be investing in anything at all.

I am not pretending that there is not, or will not be some significant difficulties and hardship around the world as a result of the pandemic and crisis of confidence in markets, but it will return, it is a question of when, not if.

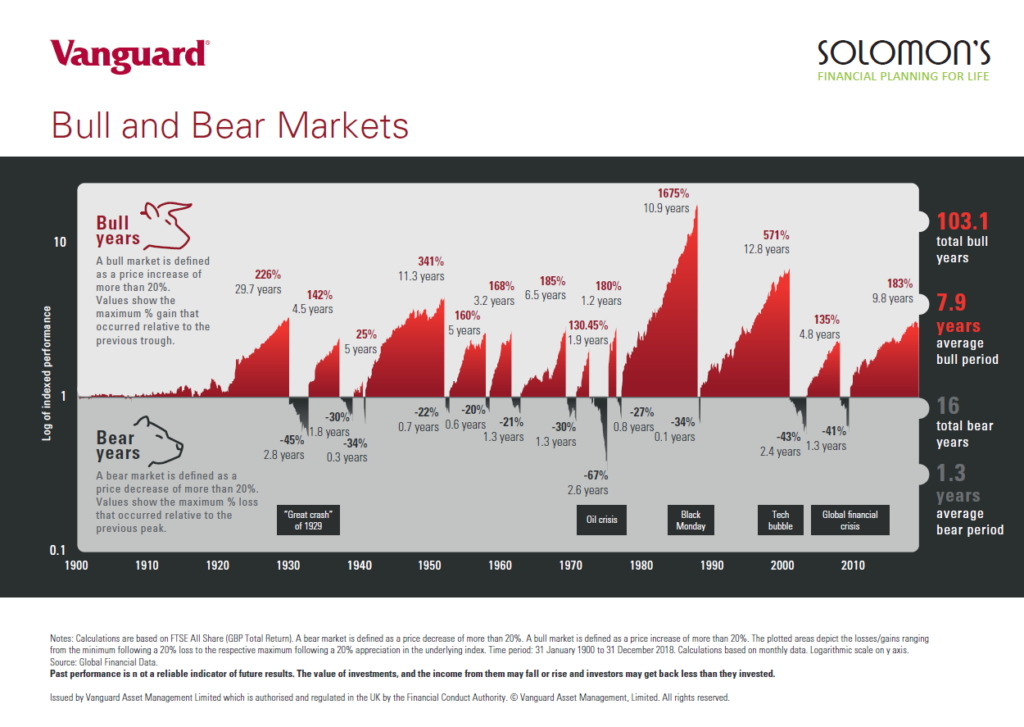

BULL and BEAR

This in mind, Vanguard produced a rather helpful chart this morning which I wanted to share with you. This shows the Bull and Bear runs of the FTSE AllShare Index. Note the falls and the durations of the respective “runs”. I have put the pdf of this below. This shows total returns, so includes the income (dividends) from shares. This takes a long-term view, since 1900. So before all of us were alive, through two world wars and unspeakable things that man does to man. Will we ever learn? Here is another opportunity for you as an investor to do so. Do not panic, this will pass.

In the office we have a sculpture by Linda Hoyle of a bull and bear that I commissioned (sounds fancy, but it wasn’t). This is in our reception and is a reminder that both are ever present, battling for the upper hand. There is opportunity in both. You can find Linda’s work here.

Download the pdf: Solomon’s Bull and Bear Markets

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084