EVERYONE KNOWS, BUT NOTHING IS SAID

TODAY’S BLOG

EVERYONE KNOWS, BUT NOTHING IS SAID

I wonder if you have played Scruples. I haven’t done so for many years, I remember it as one of those ice-breaker/get-to-know-you games that occasionally got wheeled out at a student party. How truthful and how flexible with the truth are we with one another? Perhaps there has been an episode or incident in your life ,or that of a friend, where everyone seems to know something is awry, but nothing is said. To some this is friendship, to others it is dishonesty.

Money is one of those very divisive topics, aside from income and discussions about fairness, how we all spend it and use it tends to be something that is often hidden. We see some degree of opinion exposed in the media, largely chastising both the very wealthy for their luxury spending and those that are poorer – spending money on “non-essentials”. To say that it is a loaded and often heated topic would be an understatement.

A Financial Plan based on reality

The problem for you and I is that in order to provide any meaningful financial plan, you have to declare your real-world spending, so that I can build a plan to enable you to continue to maintain your lifestyle, but also attempt to help more of your own money stick to you. What good is it if I build a plan to deliver an income of £30,000 a year when £45,000 is actually needed. This is a precarious aspect of the adviser/client relationship. In the nearly 3 decades that I have been advising clients, I have very rarely met anyone that hasn’t struggled with completing a spending plan. I have been told the experience is difficult, it raises issues of where has the money gone and what have I to show for it?

The intention is not to expose, embarrass or shame, simply to understand and see things for what they are, without value judgement. I cannot see how I can do a proper job for my clients without understanding how much money they have and need each month to support their lifestyle. Honesty about where we are now is vital in order to enable us to reach the future together. Financial denial is no different from any other form of denial. It can feel comforting, but there are consequences to failing to face realities.

Family Secrets

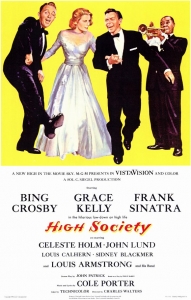

I was reminded if this as I was watching “All My Sons” by Arthur Miller (1947). A powerful play that I had seen before in 2010. The play is based on a true story. The main characters all know a discomforting truth which is shameful. The neighbourhood also all know of this, perhaps discussing in private, but otherwise ignoring the proverbial elephant in the room. Whilst a son, a missing in action pilot, acts as the delusion in which others share, it is merely representative of a deeper, darker truth, that a great injustice has been done. In many senses exposing this discomforting truth is a patriotic and righteous act. In reality Miller, was called before the House of Un-American Activities (hard to comprehend this today) on 21 June 1956 to explain himself for writing the play, which casts a wary eye over the American Dream.

To have the future you want, we need to understand your goals and the reality of your situation. Everyone is entitled to dream, but my job is to build a path to the future, not prop up ladders to castles in the sky.

If you don’t know the play I will not spoil it for you, but at the heart is the sense of blood money – or at least money earned deceitfully.

“Chris, I want you to use what I made for you … I mean, with joy, Chris, without shame … with joy…. Because sometimes I think you’re … ashamed of the money…. Because it’s good money, there’s nothing wrong with the money.”

It doesn’t have to be like this…

I’m not implying that clients earn their money deceitfully! – I’ve only had one instance where this was actually the case and we didn’t proceed… well you don’t want to upset a mercenary really do you! We all know that money is loaded with sentiment, assumptions and values – many learned from our families or social structures. Money doesn’t have to be divisive, secretive or delusional. We can talk about it honestly.

As for the play, currently it is being performed at the Old Vic and stars Bill Pullman and Sally Field until the 8th June. In my honest opinion, it is Colin Morgan as Chris Keller that delivers the strongest performance. One definitely to watch. Here is the trailer and click here for tickets.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084