Financial Scams – Be Warned

Financial Scams – Be Warned

Believe it or not July 2015 is financial scam month…. given all that is going on in relation to Greece, the ECB, IMF and European Union….not to mention FIFA, perhaps the timing is perfect. Anyway, there is a whole month being dedicated to warning you about financial scams. Sadly there are a lot.

Let me be very plain. A scam works because you are caught off-guard. It is not only the “foolish” that get scammed. Anyone is a potential target. As with most deceptive crime, emphasis is placed on appearing to help you, to warn you of impending problems and to then offer what seems like a logical or sensible solution – such as withdrawing all your money from your “compromised account”. One of the most despicable crimes is to then involve you in the entrapment of the fraudster…. when actually you are simply at a deeper level of the scam.

Your telephone number is a bit like a front door key. You answer the phone, the line is open. Invariably the fraudster passes themselves off as a Bank representative or a large well-known shop and they report that your card appears to have been compromised. If they are pretending to be your Bank, it is unlikely that they reveal which “Bank” they are calling from, simply allowing your mind to fill in the gaps. If they pretend to call from a shop, well frankly you aren’t likely to be that suspicious as you are being helped and advised that fraud was committed on your card in their shop.

Open Line

Your guard is down, because you think you are being helped, it doesn’t occur to you to ask the caller to confirm YOUR name or your bank account number. The caller with mind distracted asks you to check your card… the details, is there a number on the back to call the bank? yes… ok, call them. Goodbye. But actually the fraudster is still on the open line – even if you have hung up, the line is open (a problem that telecom companies have failed to address properly). You call back, but are essentially on the same call… answered by a colleague of the fraudster or even the same one, who then simply harvests your personal information to use… name, address, account information etc.

Another scam involves a fraudster posing a police officer, who suggests that they want to entrap the criminal. S/he suggests you withdraw as much as you can from your account and send it to them for assessment or tagging, perhaps sending a “secure” delivery car to your home to collect it from you. This is a scam, you won’t see the money ever again.

I know that these things seem “obvious” but in the heat of the moment, being caught off-guard and thinking you are being helped and could also help catch the fraudster, you are simply the next victim. Here is a link to a video from the BBC about this.

What you can do

Firstly if someone calls you offering to solve a problem with your banking or IT , challenge them with the sort of questions that your Bank asks you when you phone them…. but go full hog. Do not give them your details but ask them to tell you your details (which they are highly unlikely to have). Go further by asking them to confirm the last 5 payments that you made, the amounts, dates and sources. The fraudster will quickly give up and hang up.

I have had a fraud call centre call me warning that my computers at home had a virus. I knew this was bogus, but quickly appreciated how easy it is to be duped. Normally in those circumstances they ask you to download something to your computer… which is essentially a trojan horse, tracking your banking, which of course can lie dormant for some time, so you forget all about the call and think you were helped by someone pretending to be from BT or whoever.

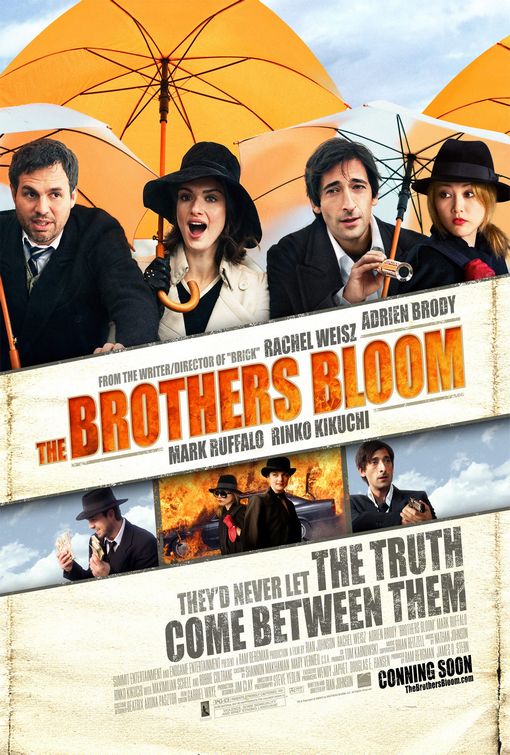

The 2008 film The Brothers Bloom is well worth watching to remind yourself at how skillful confidence tricksters can be and how little regard they have for the “relationships” that they create.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk