Wishes, forecasts & worries

Wishes, forecasts & worries

Here is another great piece I came across by David Booth, Founder of Dimensional Investors. David is one of the genuine sage’s of investing and I have great respect for him and his business. So I thought I’d share this piece which is timely.

When I was growing up, our local newspaper, the Kansas City Star, was full of news and had one page for opinion. After decades of cable news and nonstop digital postings, I see more opinions these days than news. That’s not a bad thing. But when it comes to investing, it’s crucial to remember the difference between news and opinion, and how they are sometimes used to forecast the future.

Any time the government releases new data on unemployment or inflation or interest rate changes, people start claiming they can forecast the future. That’s not necessarily a bad thing either. But most of what I hear people say isn’t what I would call “forecasting.”

Forecasting is when you have a high degree of confidence in an outcome based on well-proven models. The weather forecast for a few days from now is a lot better than anything I read in the Kansas City Star about investing. The weather forecast is pretty darn accurate. I’d sure call that kind of forecast the right use of the word. That’s different from someone issuing a “forecast” for when the Dow will hit a certain number. Or when inflation will reach a certain level. Or which five stocks will rise the most over the next year.

So when people say they forecast that something will be at this level at that time, I don’t call that a forecast.

That’s a wish.

And when people forecast that something will go down at a certain time?

That’s a worry.

DON’T BASE YOUR PLAN ON WISHFUL THINKING

Do you really want to invest your hard-earned savings—the money you’ll need for your kids’ college or your own retirement—based on someone’s hunch or wish?

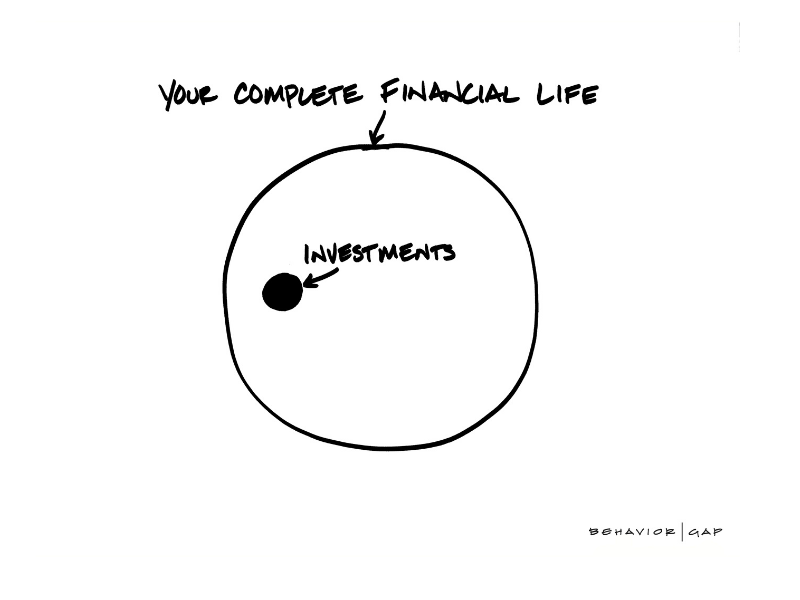

The good news is you can have a good experience without having to do any forecasting—I believe you just need to be a long-term investor with a truly diversified portfolio.

Over the last 100 years or so, the average return of the market has been about 10% a year.1 I won’t call it a forecast, but my best guess is that over the next 100 years the average annual return will be about 10%. Of course, there may be large fluctuations, just like we have experienced for the last 100 years (and like we have experienced in the last six months).

Instead of forecasting, focus on the power of what I think has been behind the stock returns of the last 100 years: human ingenuity. Millions of people at thousands of companies working to improve their product, enhance their service, and lower their costs—and all adapting in real time to a changing world. We witnessed the power of human ingenuity over the course of the pandemic. I’m seeing it again as companies adjust to deal with inflation.

The world has changed in so many ways since I was a kid reading the Kansas City Star. I still occasionally read it on my phone now. (It makes me chuckle when I imagine trying to explain to my grandparents that I read the newspaper on the phone.) While I expect the world to keep changing—I’m not forecasting when or how—I am confident that human ingenuity will be a constant. Whether in good times or bad, that’s reason to be optimistic.

DAVID BOOTH

DIMENSIONAL Executive Chairman and Founder

Footnotes

1 In US dollars. S&P 500 Index annual returns 1926–2021. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment, therefore their performance does not reflect the expenses associated with the management of an actual portfolio.

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk